- According to Cardano’s founder, BTC could hit $250K in 2025 or the next year.

- Bitcoin network activity has declined 22%, signaling weak demand in Q1.

Despite toiling below $100K amid macro uncertainty, Bitcoin [BTC] could more than double by the end of the year or 2026. In an interview with CNBC on the 9th of April, Cardano founder Charles Hoskinson projected,

“I think Bitcoin will be over $250,000 by the end of this year or next year.”

Hoskinson added that the target would be hit because of Fed rate cuts, new crypto regulations (stablecoins), and increased adoption. He downplayed the tariff wars and stated,

“The markets will stabilize a little bit, and they’ll get used to the new normal, and then the Fed will lower interest rates, and then you’ll have a lot of fast, cheap money, and then it’ll pour into crypto.”

Will BTC cross $200K?

In addition, Hoskinson forecasted that upcoming stablecoin regulation would allow even top global firms to accept them. Besides, he noted that the global conflicts will push more countries to adopt crypto for international settlements.

As a result, he estimated,

“The crypto market will stall for probably the next three to five months, and then you’ll have a huge wave of speculative interest come, probably in August or September, into the markets, and that’ll carry through probably another six to 12 months.”

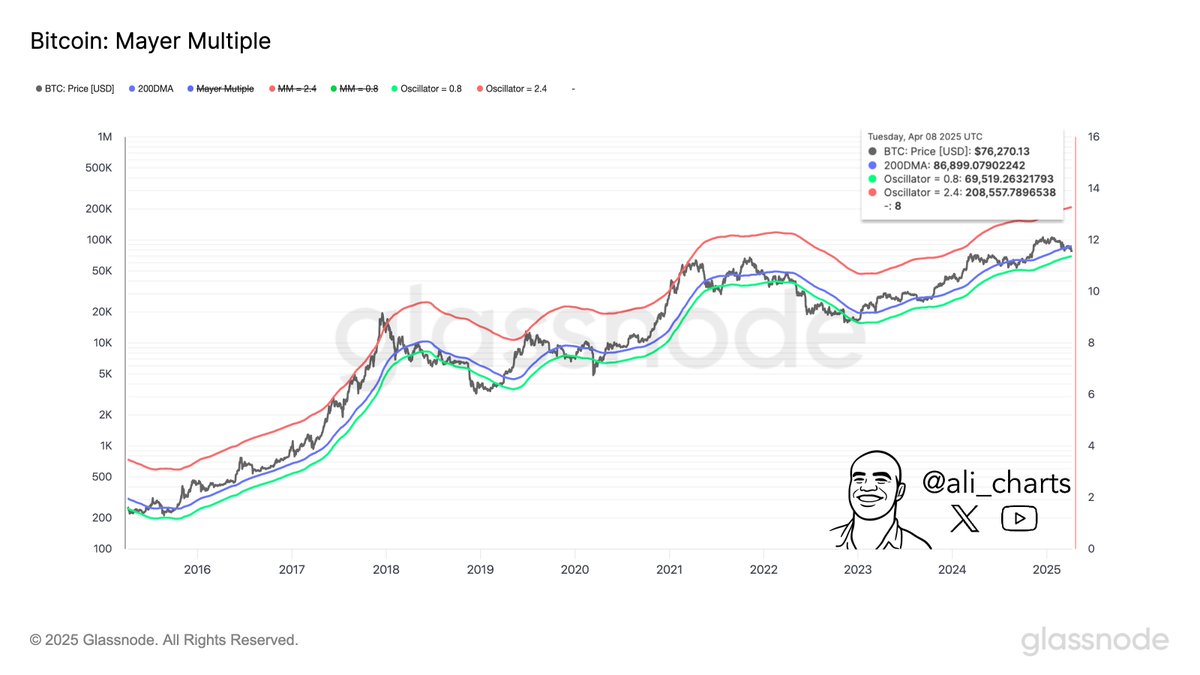

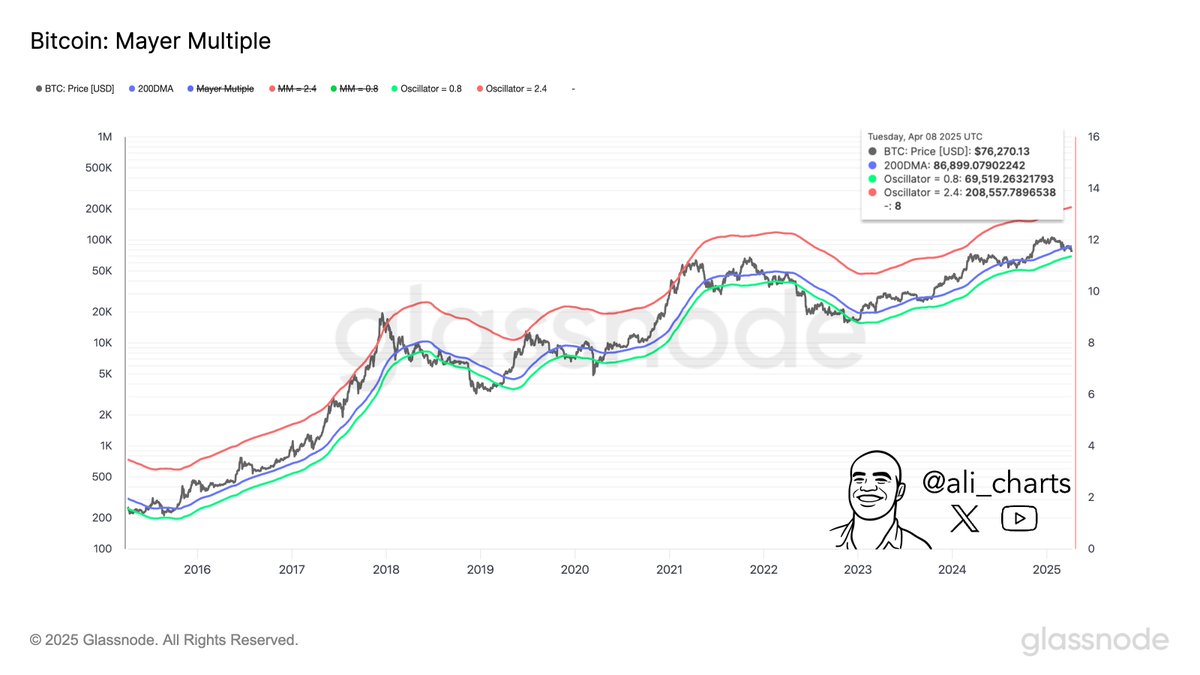

Surprisingly, the Mayer Multiple valuation model slightly aligned with his projection. The indicator showed that BTC could hit $208K if it rallies above $87K.

Source: Glassnode

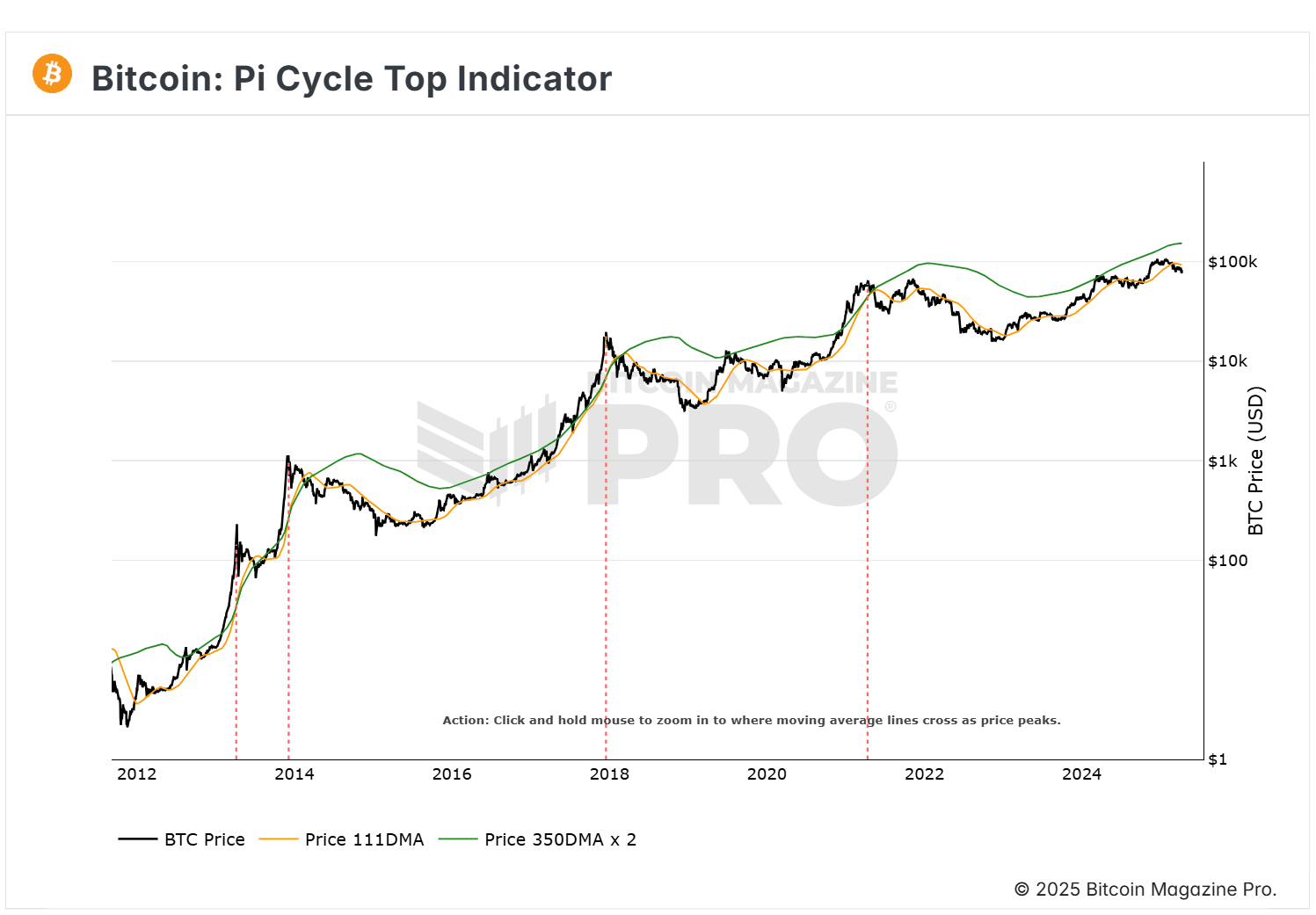

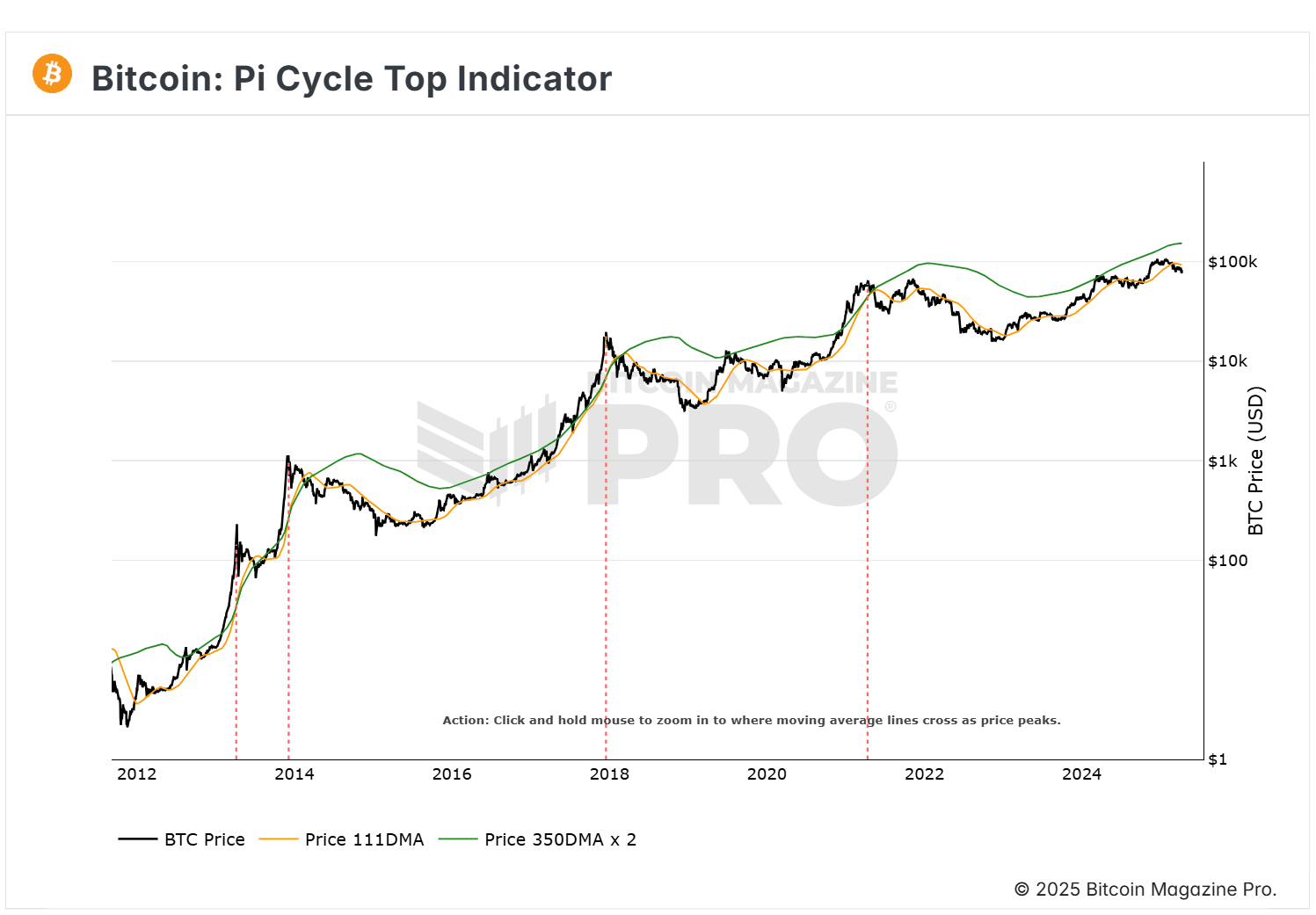

For the Pi Cycle top indicator, another valuation model, there was still more growth for BTC before it could top out this cycle. The indicator marked past cycle tops when the 111DMA crossed the adjusted 350-day Moving Average.

Source: BM Pro

Currently, the 350-Daily Moving Average(DMA) was valued above $150K, suggesting that BTC could surge above it before topping out.

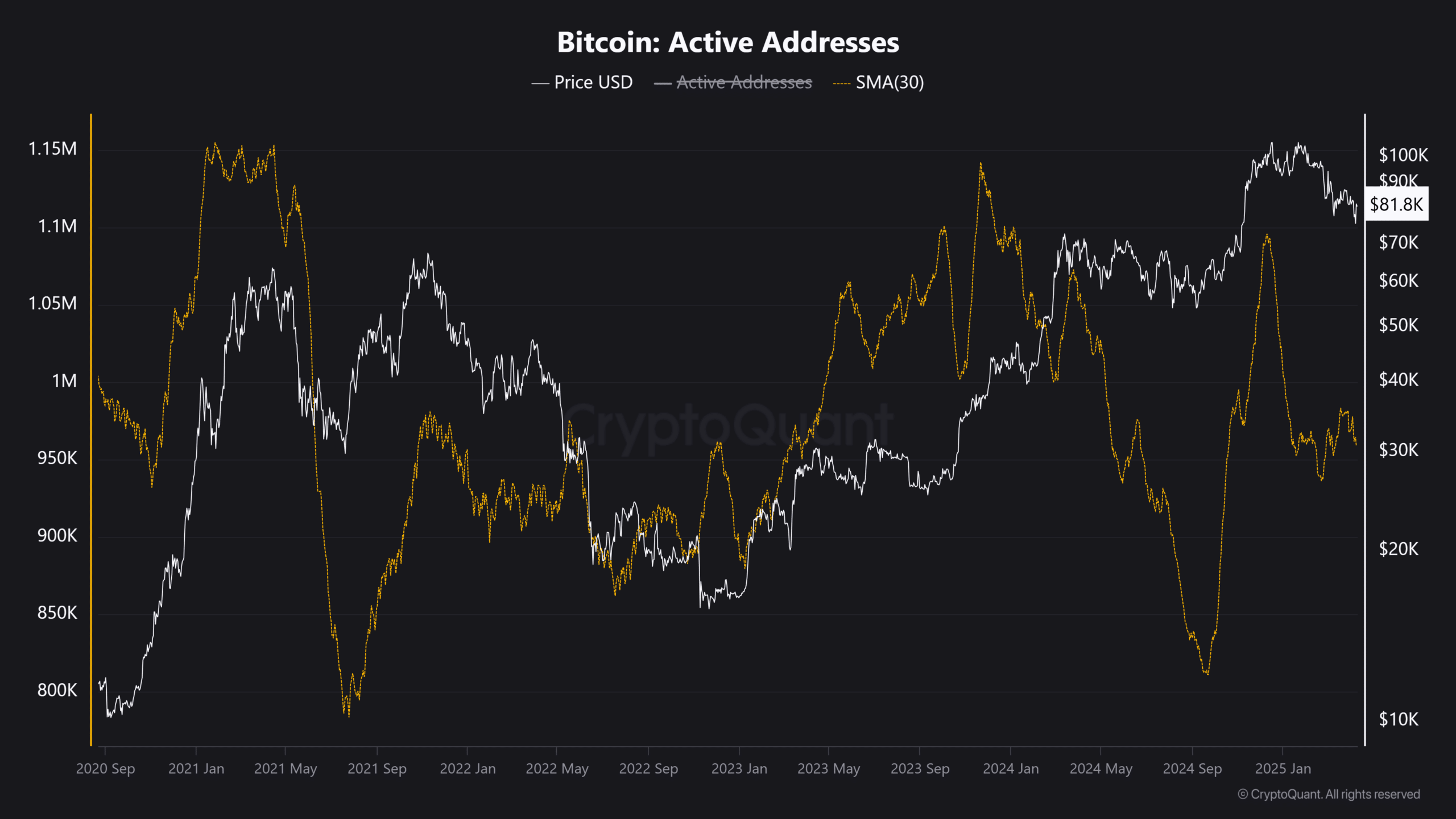

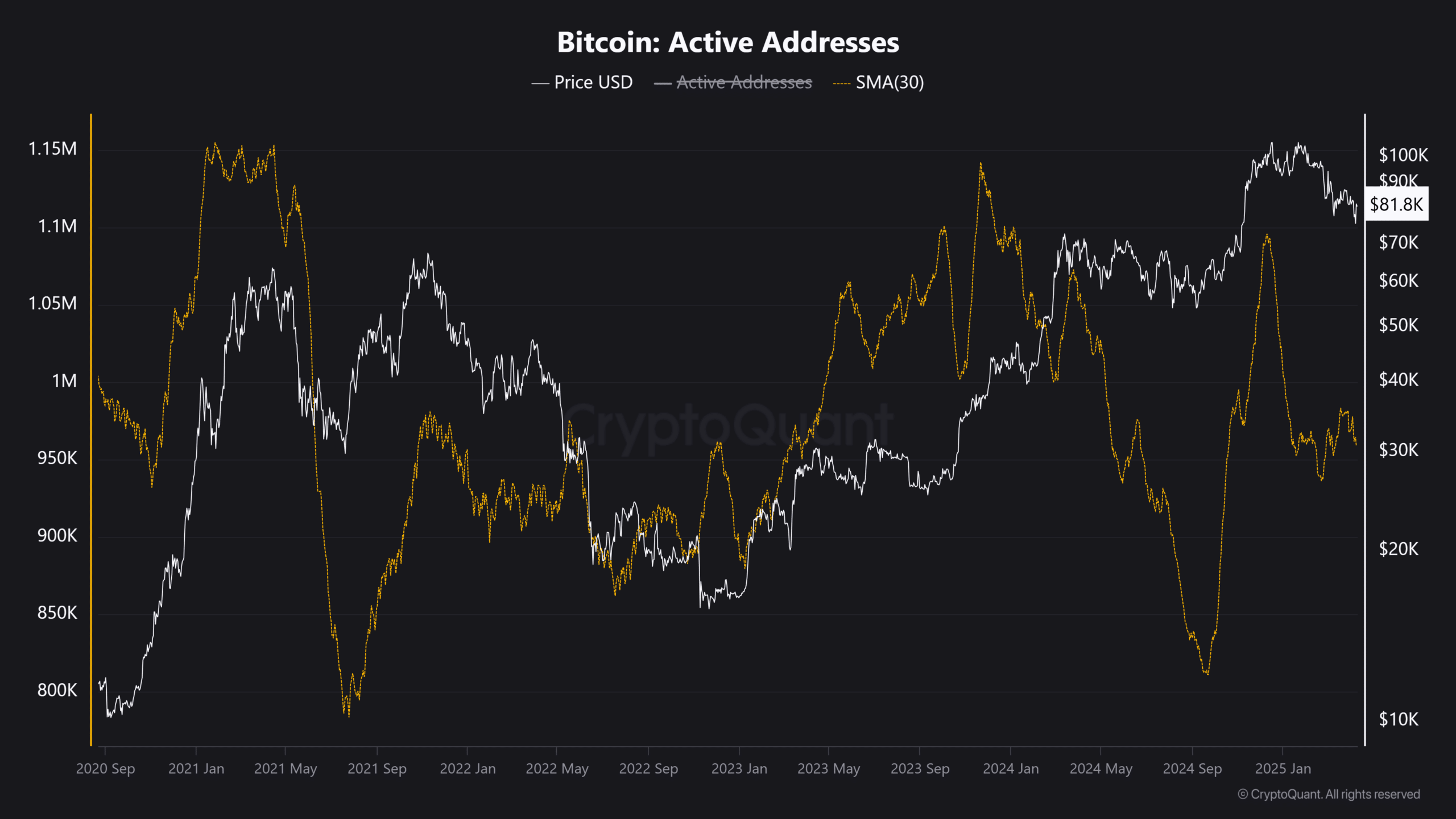

In the short term, however, the crypto could fluctuate near $80K amid declining network growth. According to CryptoQuant, Bitcoin network growth dropped 22% on a monthly average of active users.

It fell from 101K users to 78K, underscoring reduced network activity and interest from market players. For Hoskinson’s projection to be validated, network activity should increase to indicate a surge in demand.

Source: CryptoQuant