- Whale transfers suggest long-term holding or OTC trades, not immediate sell-side pressure.

- Retail investors continue profit-taking, pushing Exchange Netflow into positive territory.

Over the past week, as Bitcoin [BTC] reclaimed $100k, whale activity has intensified from both the sell and buy sides.

In the past 24 hours alone, Whale Alert flagged a massive 2,000 BTC transfer worth approximately $206 million.

The destination? Unknown wallets with no exchange ties. Such a transfer that is not paired with exchanges could mean two major things.

First, the whale is moving funds to a personal or secure wallet for long-term holding that is often viewed as accumulation or intent to hold.

Second, it may indicate over-the-counter OTC transfers between private players or institutions and have no impact on prices.

Since this whale transfer is not paired with inflows to exchanges, it’s not an immediate bearish signal. Amidst this whale transfer is a surge in whale activity that has dominated the market over the past days.

Accumulation score flashes near-max levels

According to Glassnode, large wallets continued to lead accumulation, with those holding 1K–10K BTC accumulating a score of 0.9, almost 1, while sharks snapped up a 0.8 score.

Source: Glassnode

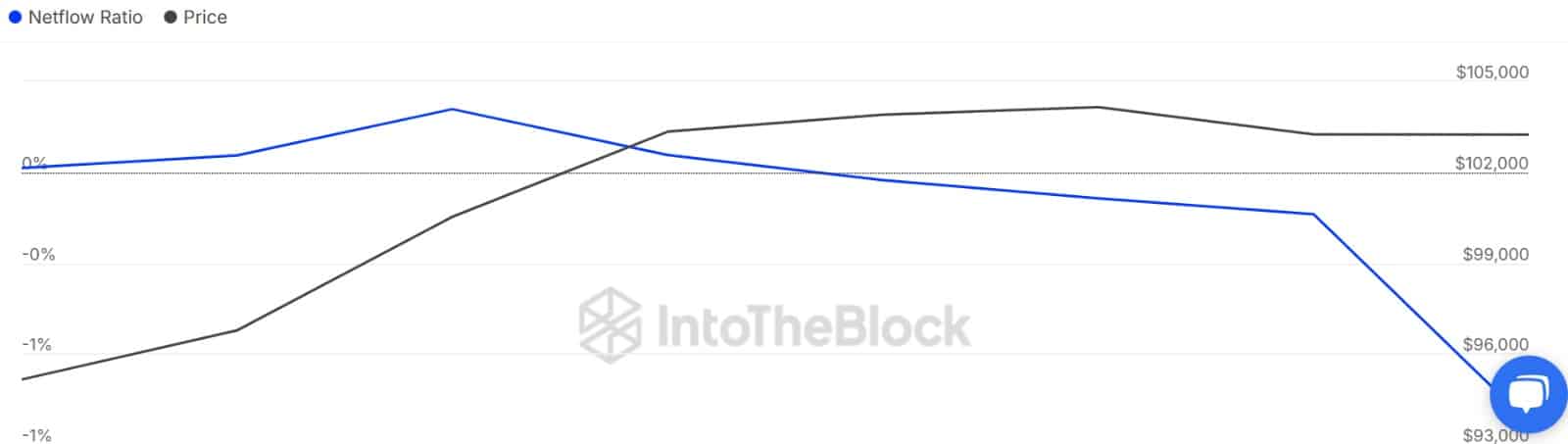

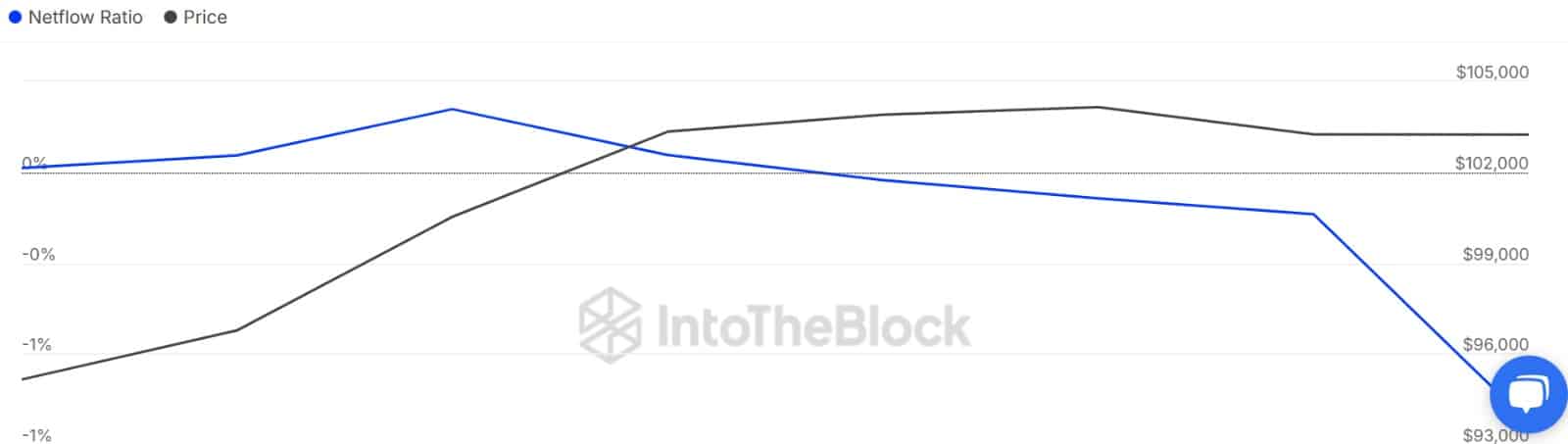

Meanwhile, whale exchange activity slowed.

For instance, ultra-large whales were at the neutral zone around 0.5. Therefore, Large Holders Netflow to Exchange Netflow Ratio continued to decline, reaching negative territory around -0.69.

Such a drop implied that whales were not sending BTC to exchanges instead, they were withdrawing extensively.

Source: IntoTheBlock

Retail exits could stall momentum

The rising whale activity, especially on the accumulation side, signals growing confidence in Bitcoin as they expect prices to rise further.

Historically, growing accumulation among large players has resulted in higher prices as demand drives prices up. If the continuation of the trend holds with whale accumulation, BTC is likely to reach higher levels.

On the flip side, smaller investors were selling into strength.

Wallets holding less than $10 in BTC continued to distribute, reflecting a high selling activity from small holders as they take profit.

The profit taking from retailers has resulted in a positive Exchange Netflow, especially since ultra large wallets are also selling, although at the neutral zone.

A positive netflow suggests a higher exchange of inflows than outflows.

Source: CryptoQuant

If retail selling persists, BTC could chop between $100K and $105K for a while.

But if smaller holders cool off and ultra whales flip from neutral to accumulation, Bitcoin could break above $108K in the near term.