- The significant drop in activity on the Bitcoin network could exert additional downward pressure on the cryptocurrency’s price.

- A key resistance level, where notable sell orders are concentrated, could further challenge Bitcoin’s ability to sustain its current value.

Bitcoin [BTC] has been trading within a tight range of $93,000 to $94,000 over the past few days, reflecting a lack of decisive market movement. While this stagnation might indicate market resilience, it also shows uncertainty about the next directional move.

In the past 24 hours, Bitcoin’s price has experienced a minor decline of 0.75%. However, trading volume surged by 68.66% to $29.41 billion, suggesting that selling pressure may intensify soon.

AMBCrypto analyzed broader market sentiment to assess whether this selling activity might increase.

Drop in network activity: Will BTC slide lower?

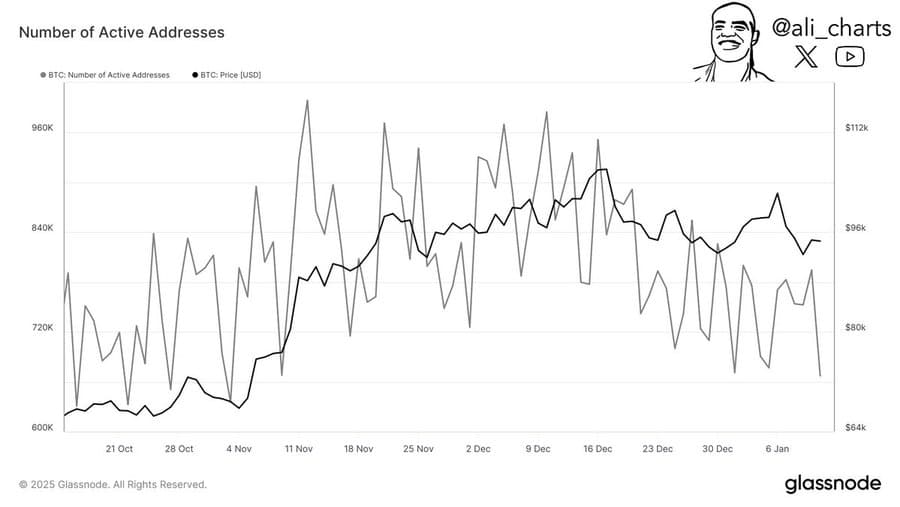

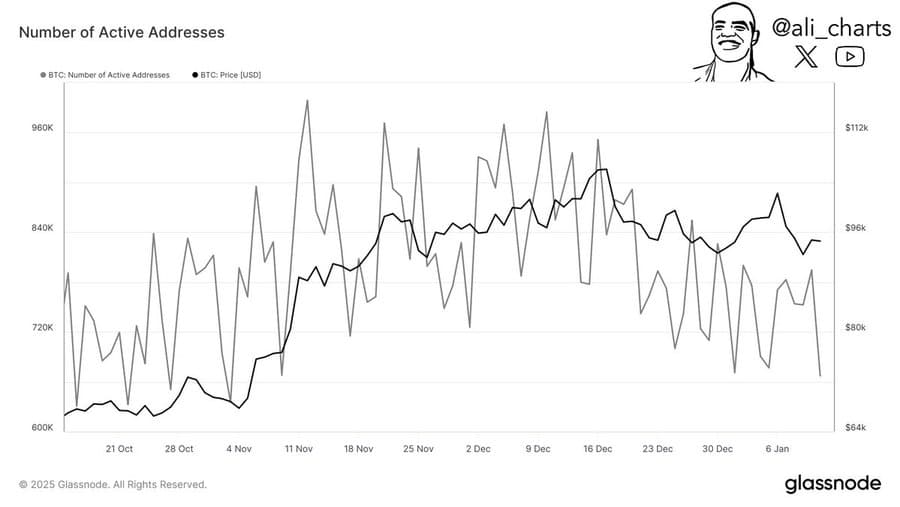

Bitcoin’s network activity has seen a significant decline over the past month, with the number of active addresses steadily decreasing.

Currently, the number of active addresses has dropped to 667,100—the lowest level recorded since November 2024.

Source: Glassnode

A decline in active addresses suggests reduced interaction with the Bitcoin network, potentially signaling lower transaction activity. This lack of engagement may indicate waning interest, which could contribute to a price drop.

However, it also suggests that the remaining active addresses might control a notable portion of the BTC supply. Increased buying activity from these addresses could potentially trigger a price rally.

Obstacle to future rally

If active addresses increase their buying activity for BTC, the asset could encounter a key supply zone as it trends higher, according to data from IntoTheBlock.

IntoTheBlock’s “In/Out of the Money Around Price” metric, which identifies supply and demand zones, shows that between $95,900 and $98,600, BTC could face selling pressure.

At this level, approximately 1.46 million addresses hold potential sell orders for a total of 1.29 million BTC.

Source: IntoTheBlock

If BTC successfully crosses this supply zone, it could reclaim the $100,000 region. However, failure to break through would likely result in BTC dropping below the $90,000 mark, signaling further downside risk.

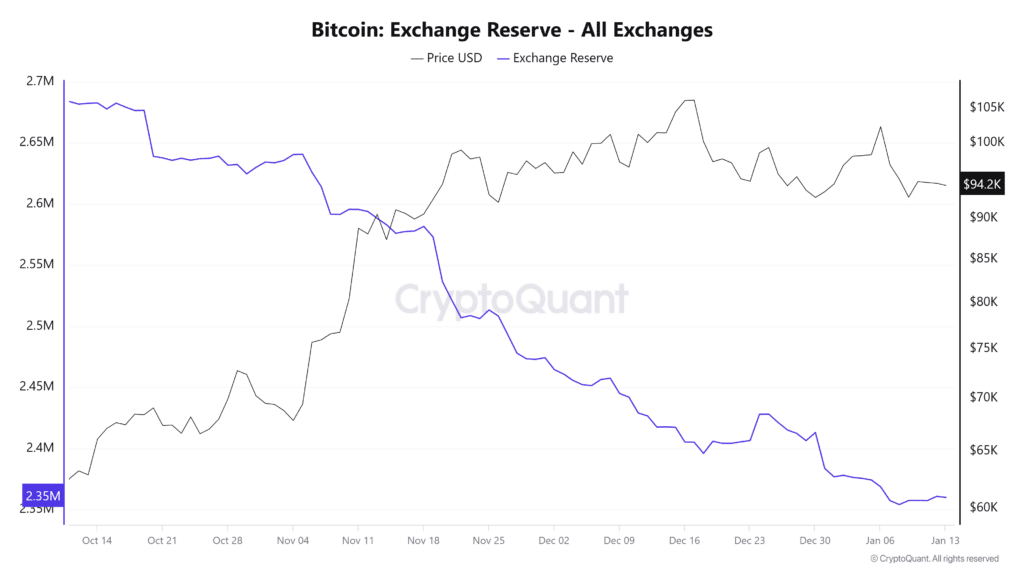

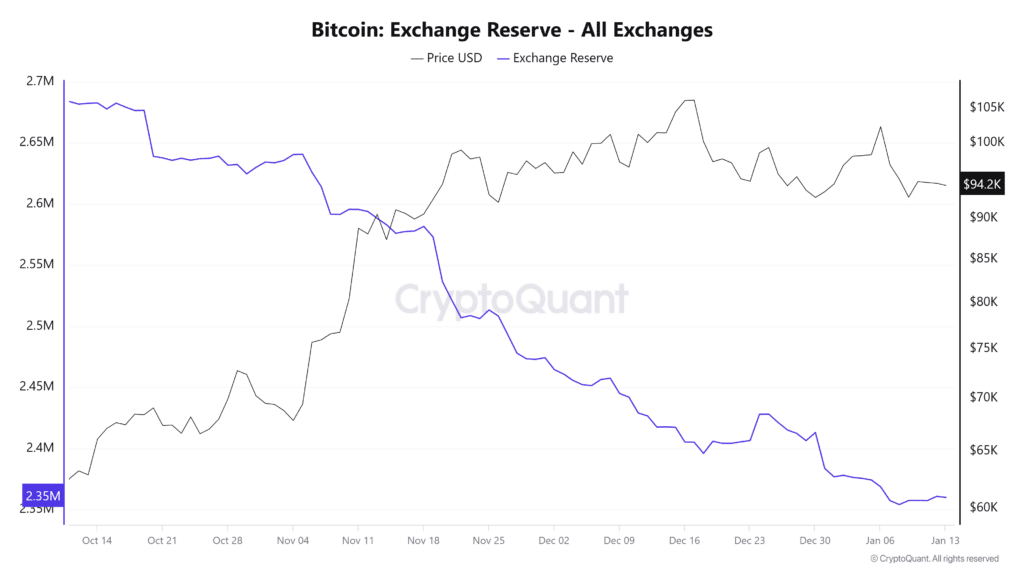

Increased supply puts BTC rally in doubt

According to CryptoQuant, BTC exchange reserves have been gradually increasing. This indicates a rise in the amount of BTC available on exchanges, leading to higher supply.

– Read Bitcoin (BTC) Price Prediction 2025-26

Since the 8th of January, BTC reserves on exchanges have grown from approximately 2,354,000 to 2,360,000. Typically, an increase in exchange reserves is a warning sign that the asset could face additional downward pressure from its current price level.

Source: CryptoQuant

If exchange reserves continue to rise, it could hinder BTC’s ability to rally from its current levels.