- Twitter and media sentiment turned negative, signaling a potential reset for Bitcoin’s market

- On-chain activity and miner confidence hinted at strong fundamentals despite market volatility

With Bitcoin [BTC] entering a new phase, recent analysis has revealed a shift in market sentiment. Both Twitter and mainstream media are turning negative for the first time since December 2024.

Now, while this doesn’t guarantee an immediate price drop, it does signal a broader market reset. As Bitcoin navigates this shift, the question remains – Where does it go from here?

Social Media – Shaping Bitcoin market sentiment

Market sentiment plays a crucial role in shaping Bitcoin’s price movements, and platforms like X have become key indicators of public perception. The sentiment expressed on social media can act as a powerful forecasting tool, influencing investor behavior.

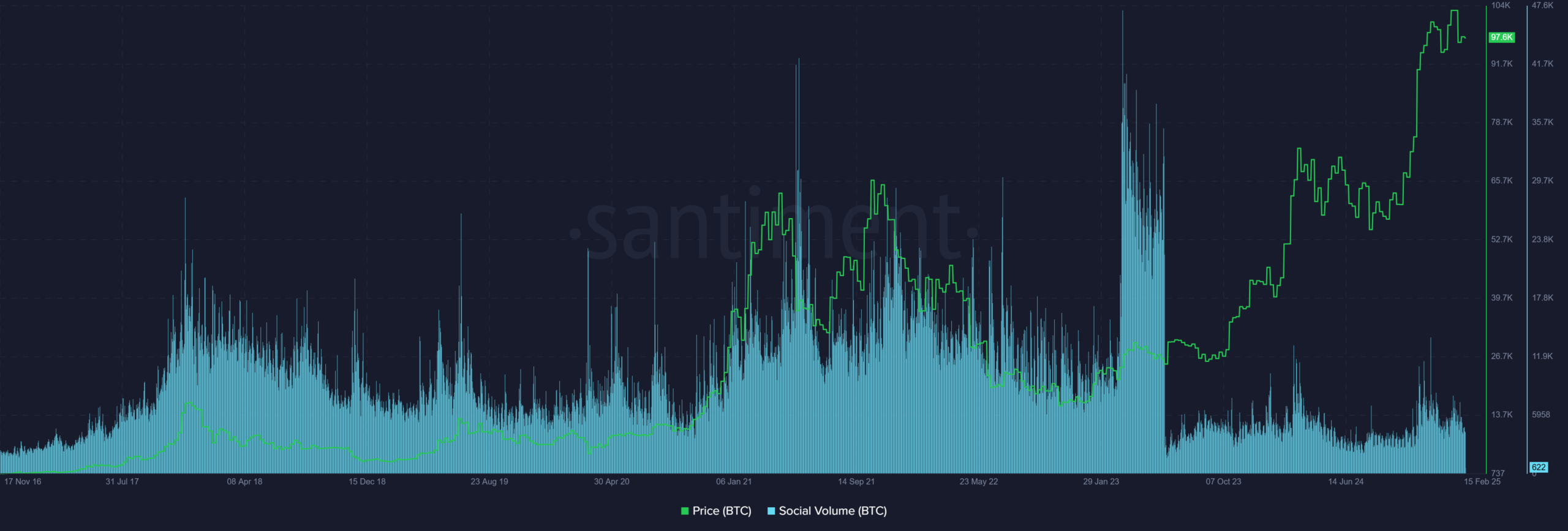

Source: Santiment

When positive sentiment is high, it can drive buying activity, while negative sentiment can trigger selling pressure.

Historically, Bitcoin has seen significant price fluctuations following shifts in social media sentiment. For example, in 2017, a surge in positive tweets about Bitcoin preceded its meteoric rise. On the contrary, downturns in 2018 and 2022 were reflected by growing pessimism online.

A warning or an opportunity?

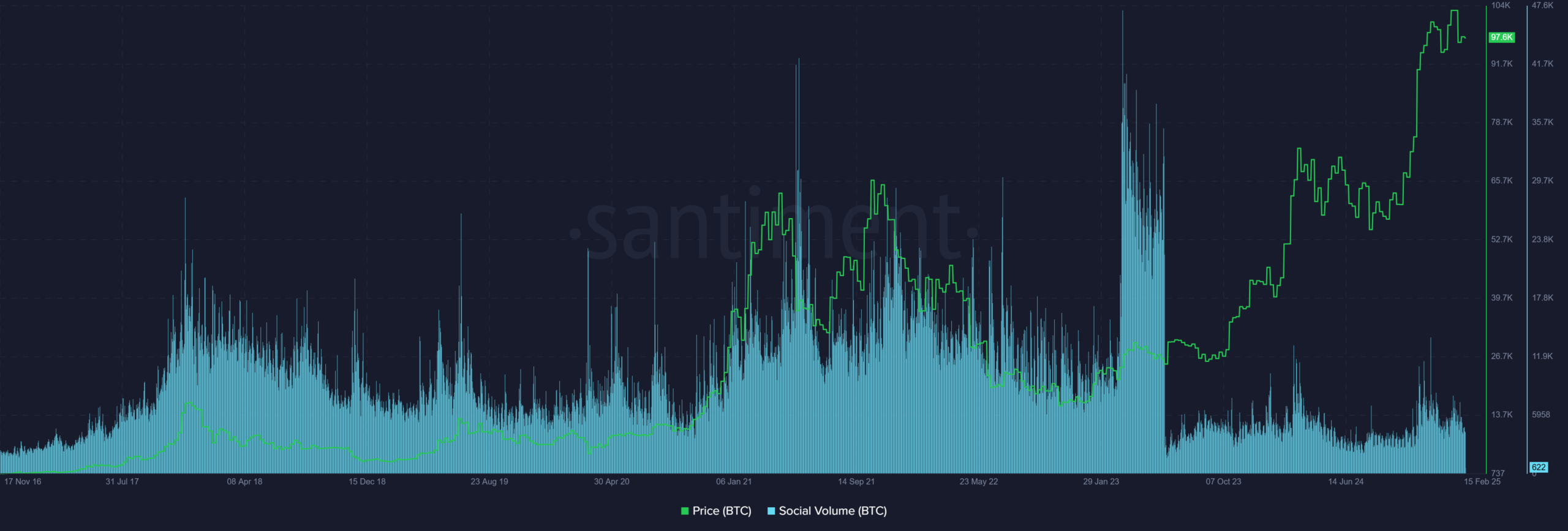

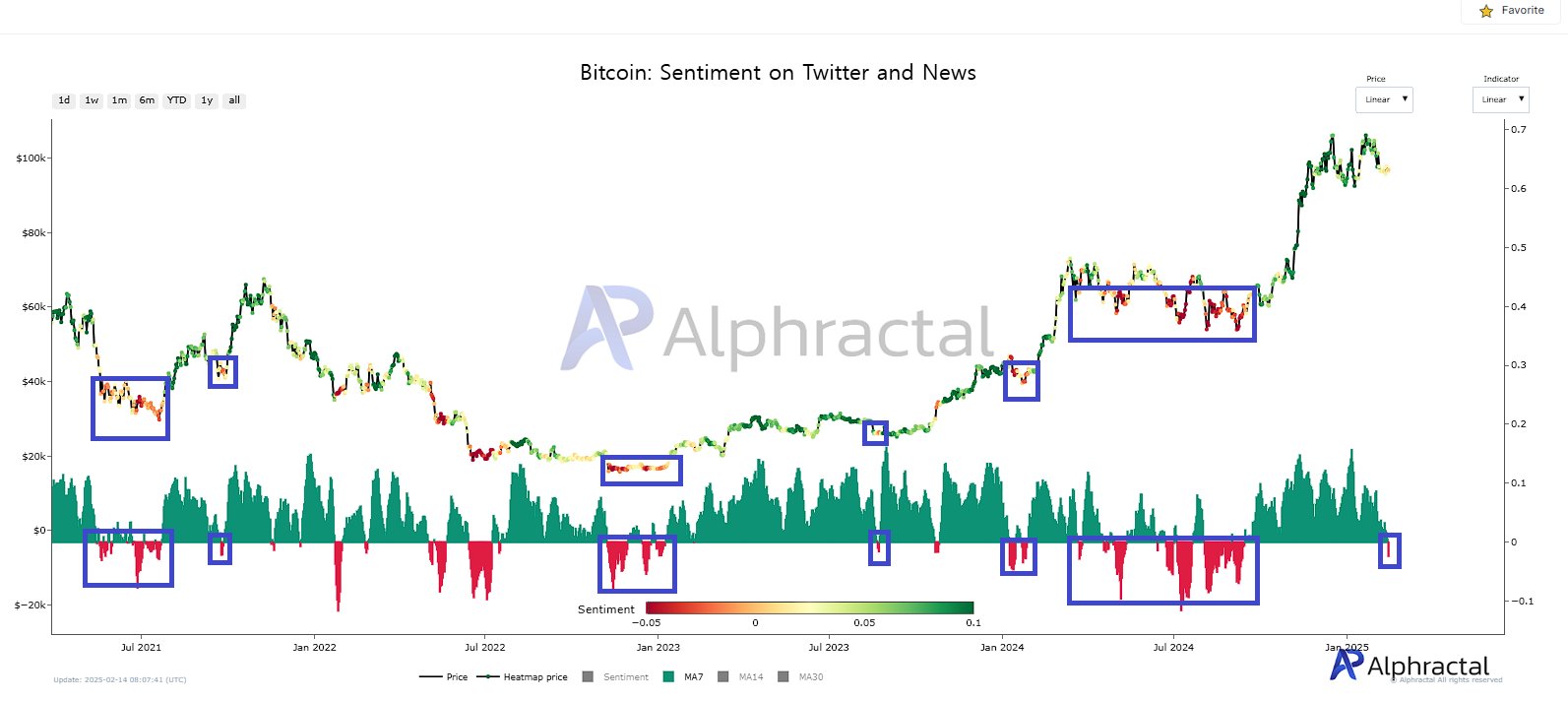

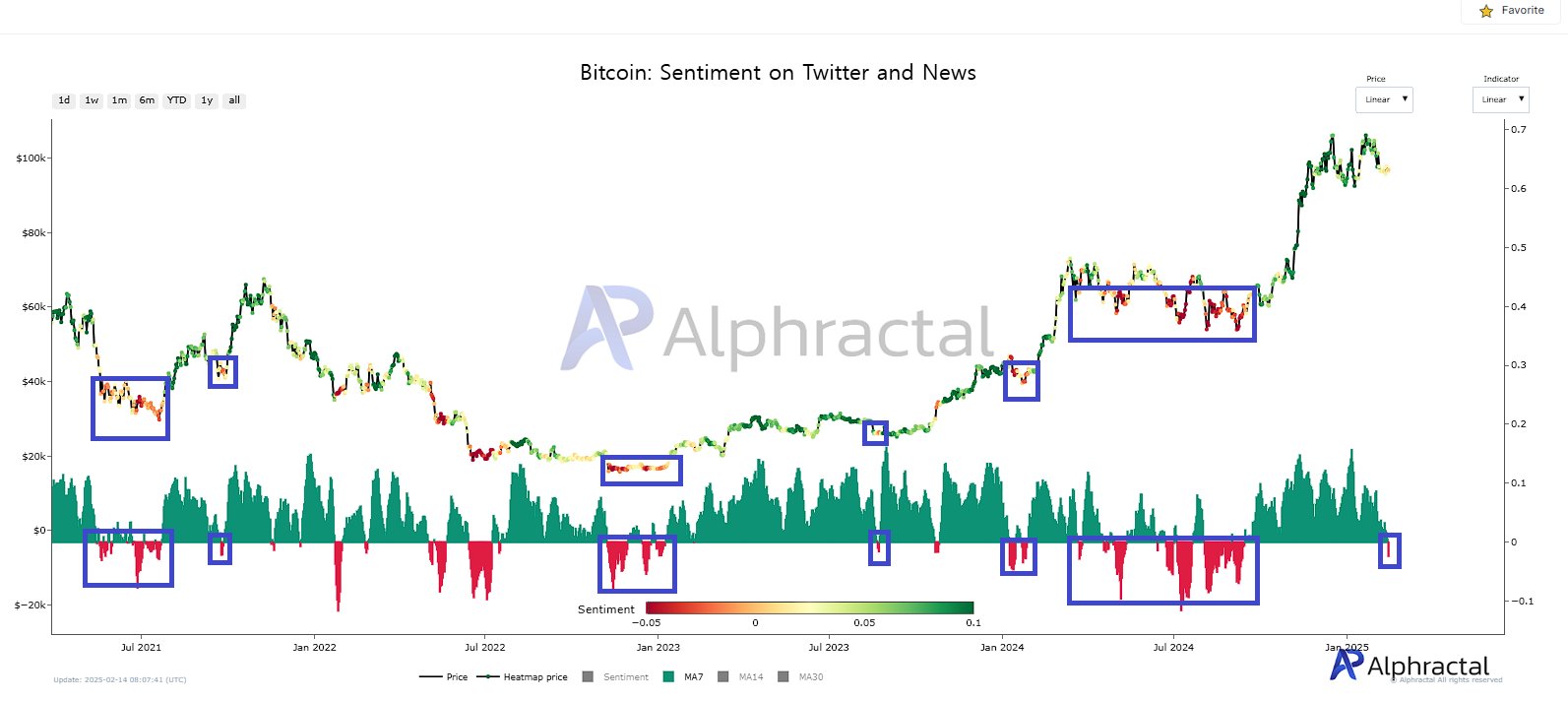

Bitcoin’s sentiment has flipped negative for the first time since December 2024, marking a stark contrast to the euphoria that fueled its recent highs.

Historically, such downturns in sentiment have acted as inflection points – Either preceding extended consolidation, as seen in mid-2024, or setting the stage for a sharp rebound, like in early 2023.

Source: Alphractal

The critical takeaway isn’t just that sentiment has turned negative; it’s that the market’s emotional cycle is resetting. This phase often sees weak hands exiting, while institutional and deep-pocketed investors quietly accumulate. Fear-driven selling has historically created asymmetric opportunities for contrarian investors.

Rather than treating this as a definitive bottom signal, traders should use this moment to reassess their positioning. Tracking derivatives and on-chain data will be key to determining whether Bitcoin is gearing up for a recovery or bracing for a deeper shakeout.

Bitcoin nears $100k amid rising on-chain activity and hashrate

Bitcoin’s daily chart underlined a consolidation phase, with the price hovering near $97,600 on the charts. The 50-day SMA at $98,762 seemed to be acting as immediate resistance, while the 200-day SMA at $79,836 hinted at long-term support.

Source: TradingView

The RSI at 46.89 alluded to neutral momentum, reflecting indecision in the market. Meanwhile, the MACD was negative, with weak bullish divergence hinting at a possible trend shift.

If Bitcoin reclaims $100k, it could trigger renewed bullish sentiment. However, failure to break key resistance levels may lead to further consolidation or a retest of lower support zones.

Source: Santiment

There has also been a surge in daily active addresses and whale transactions – A sign of growing institutional and retail participation.

Historically, such spikes have preceded major price moves and they can be interpreted to imply high market interest.

Source: Cryptoquant

Meanwhile, Bitcoin’s hashrate has been soaring too, indicative of miner confidence and long-term network security. The resilience of miners at these price levels means reduced sell pressure – Highlighting Bitcoin’s strength.

Bitcoin’s rally has strong fundamentals, despite all the negative sentiment, meaning that this may just be a temporary phase. However, whale activity should be monitored for potential profit-taking near $100k. A decisive breakout could trigger further momentum, but volatility remains a key risk.