- The SEC’s move brings Grayscale’s Dogecoin spot ETF closer to approval, fueling speculation about DOGE’s market impact.

- DOGE’s price action shows consolidation as traders anticipate potential ETF-driven momentum in the coming weeks.

The U.S. Securities and Exchange Commission [SEC] has officially acknowledged Grayscale’s 19b-4 filing for its spot Dogecoin [DOGE] exchange-traded fund (ETF).

This marks a significant milestone in bringing the popular memecoin closer to mainstream institutional adoption.

While this is just the first step in the regulatory approval process, it signals increasing interest in DOGE as a financial asset.

Market reaction and price analysis

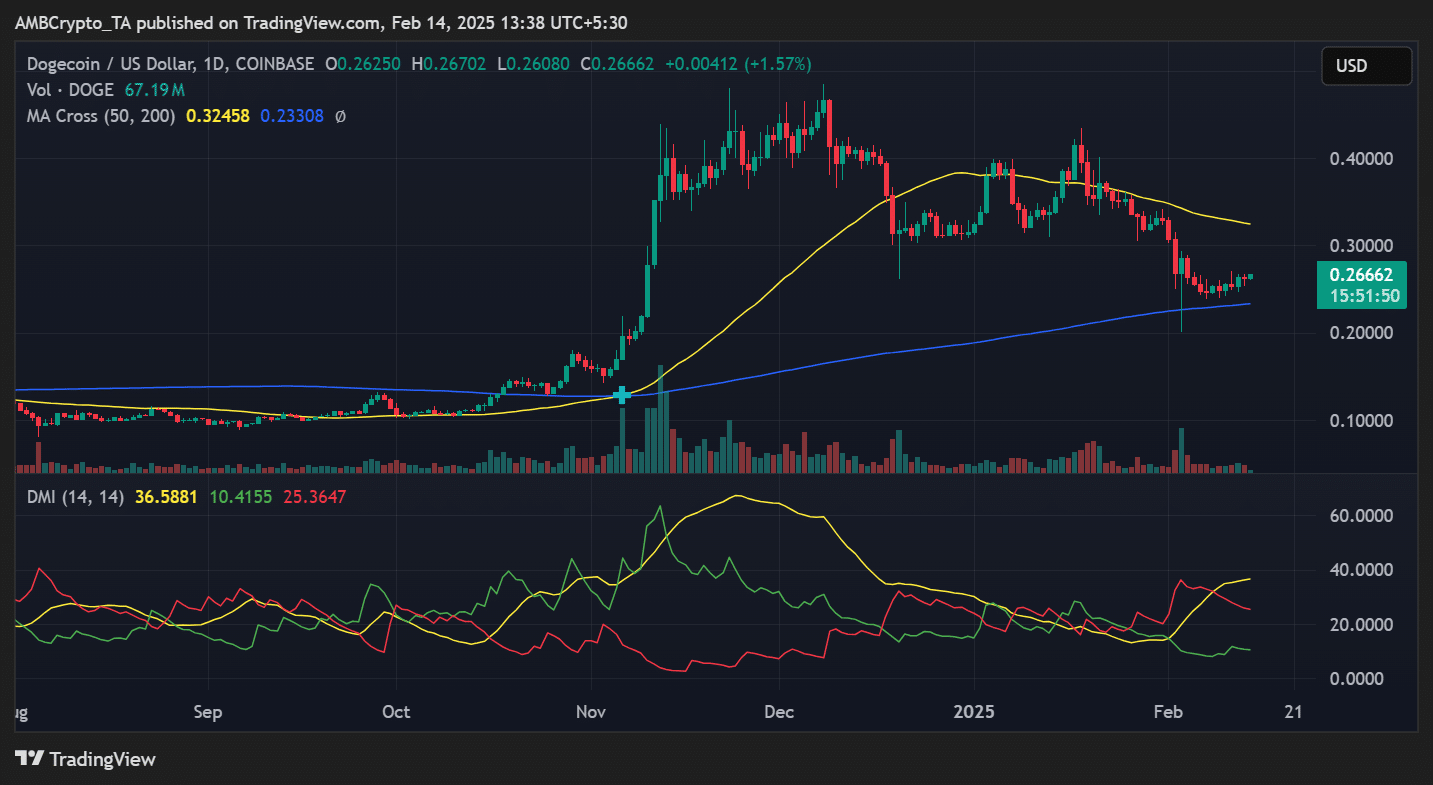

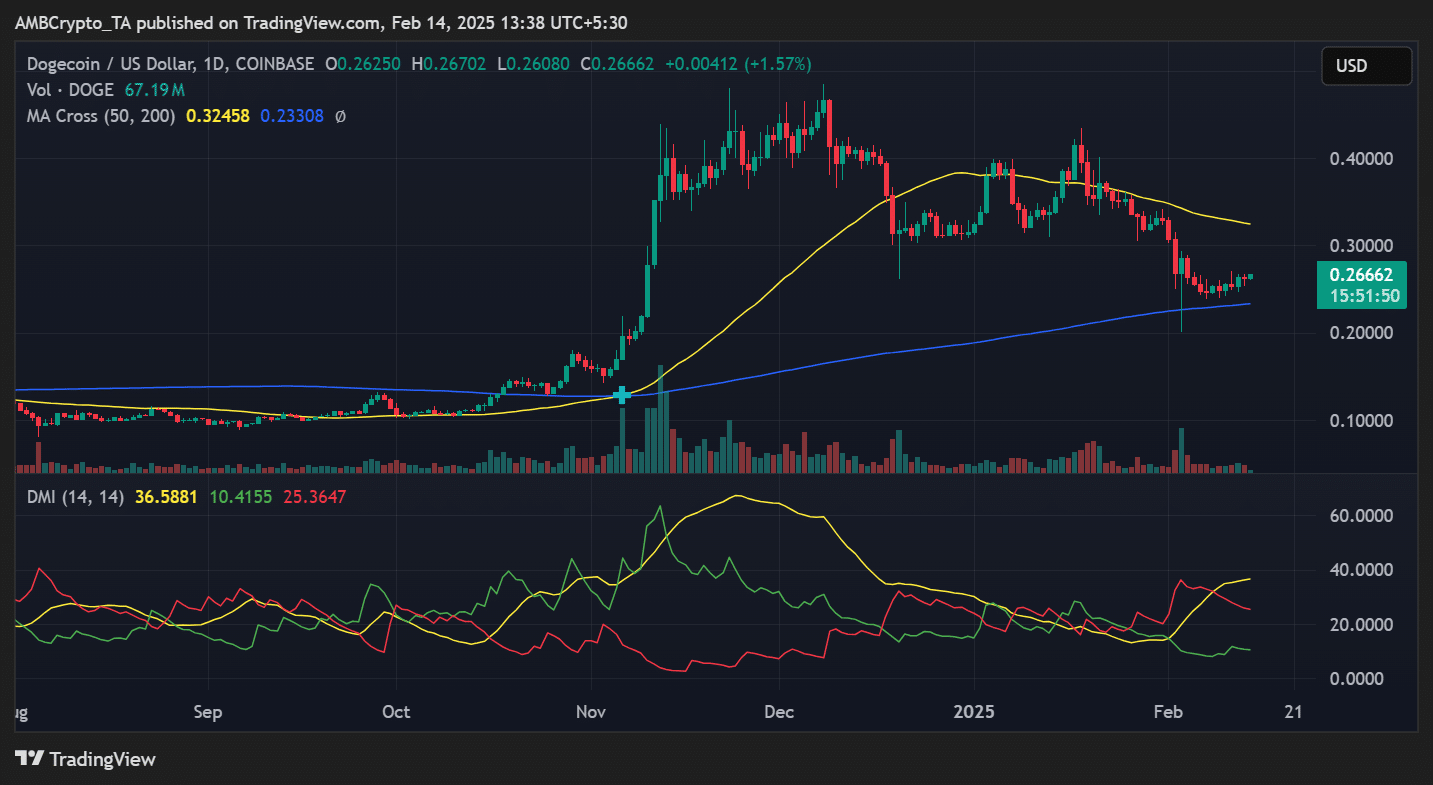

Following the news, Dogecoin saw a slight price uptick, trading at approximately $0.266,6 at the time of writing.

The chart highlights key technical levels, with DOGE currently sitting above its 200-day Moving Average (MA) of $0.2330 but below its 50-day MA of $0.3245.

A successful break above the short-term MA could indicate a bullish shift in momentum.

Source: TradingView

The Directional Movement Index (DMI) provides further insight into market sentiment. The ADX value stands at 36.58, indicating strong trend strength.

However, the -DI (red line) remains above the +DI (green line), suggesting bearish momentum is still in play.

A reversal of this setup would be a key indicator of potential upward movement.

Implications of a spot DOGE ETF

If approved, the spot Dogecoin ETF would open the door for traditional investors to gain exposure to DOGE without directly purchasing or storing the asset.

This could lead to increased liquidity, reduced volatility, and broader cryptocurrency adoption.

Additionally, approval could set a precedent for other altcoin ETFs, further integrating crypto assets into mainstream financial markets.

What comes next?

The SEC’s acknowledgment does not guarantee approval, as the regulatory body will now review the filing in detail. Similar spot crypto ETFs, including Bitcoin’s[BTC], faced multiple delays and rejections before eventual approval.

Market participants will closely watch for updates on comment periods and potential revisions to the proposal.

For now, DOGE traders should monitor key resistance levels, particularly the $0.30 mark, to gauge potential breakout opportunities.

Meanwhile, the growing institutional interest in memecoins could mark the beginning of a new phase in cryptocurrency adoption.