- Tether could be forced to sell $8B BTC to comply with new U.S. regulations, per J.P. Morgan.

- Tether’s CEO has clarified that the firm is liquid and the U.S. bills were still in the early stages.

Paolo Ardoino, Tether’s CEO, has discredited the recent J.P. Morgan report claiming that the firm could face compliance risk in the U.S. if the current stablecoin bills are adopted.

Ardoino termed J.P. Morgan as ‘salty,’ stating that his firm is very liquid with +$20B and could accommodate the demands of the proposed bills.

Source: X

The Tether executive added that more clarity on the bills and consultations would be known in the coming weeks.

J.P. Morgan questions Tether’s reserve

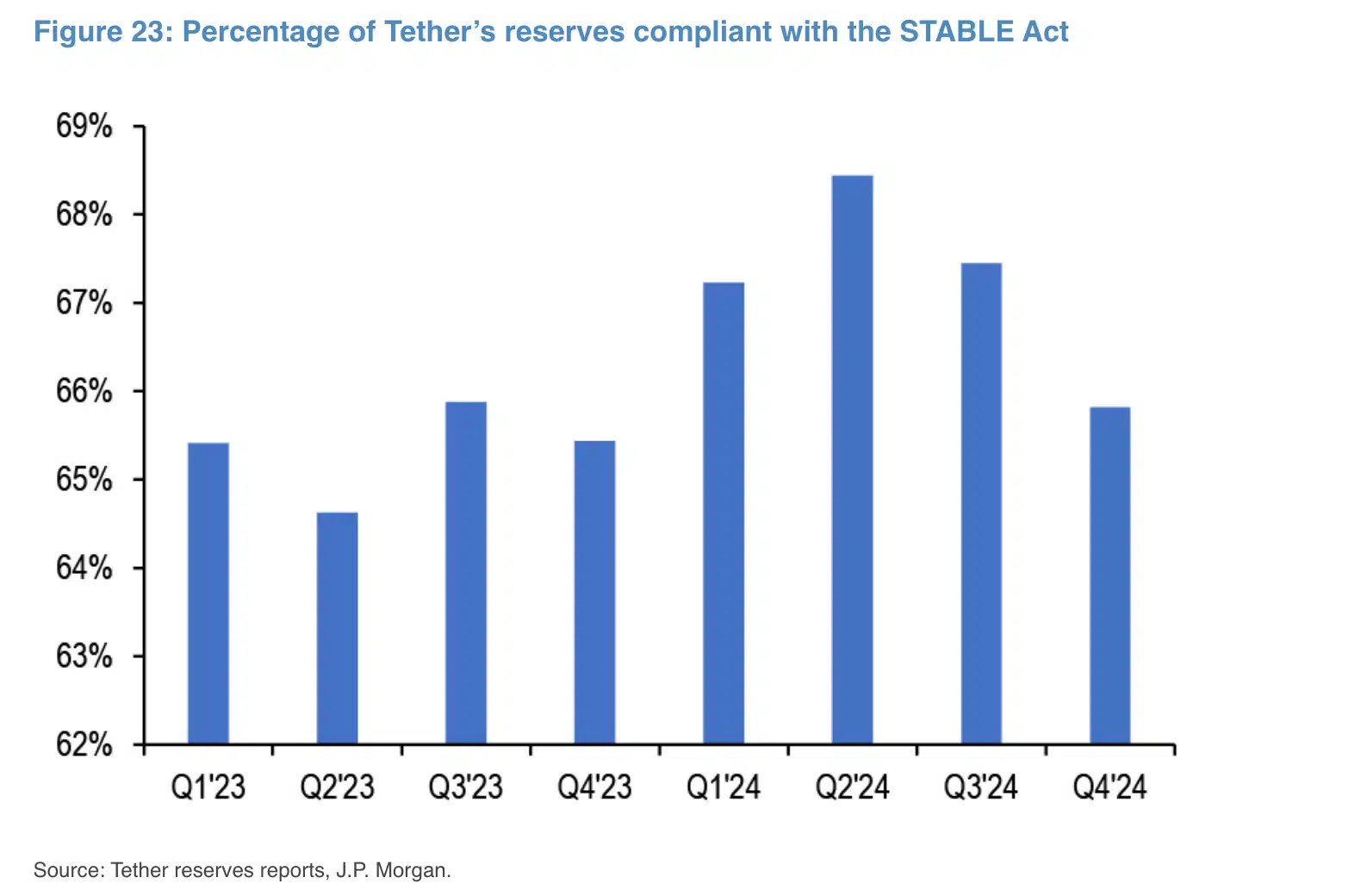

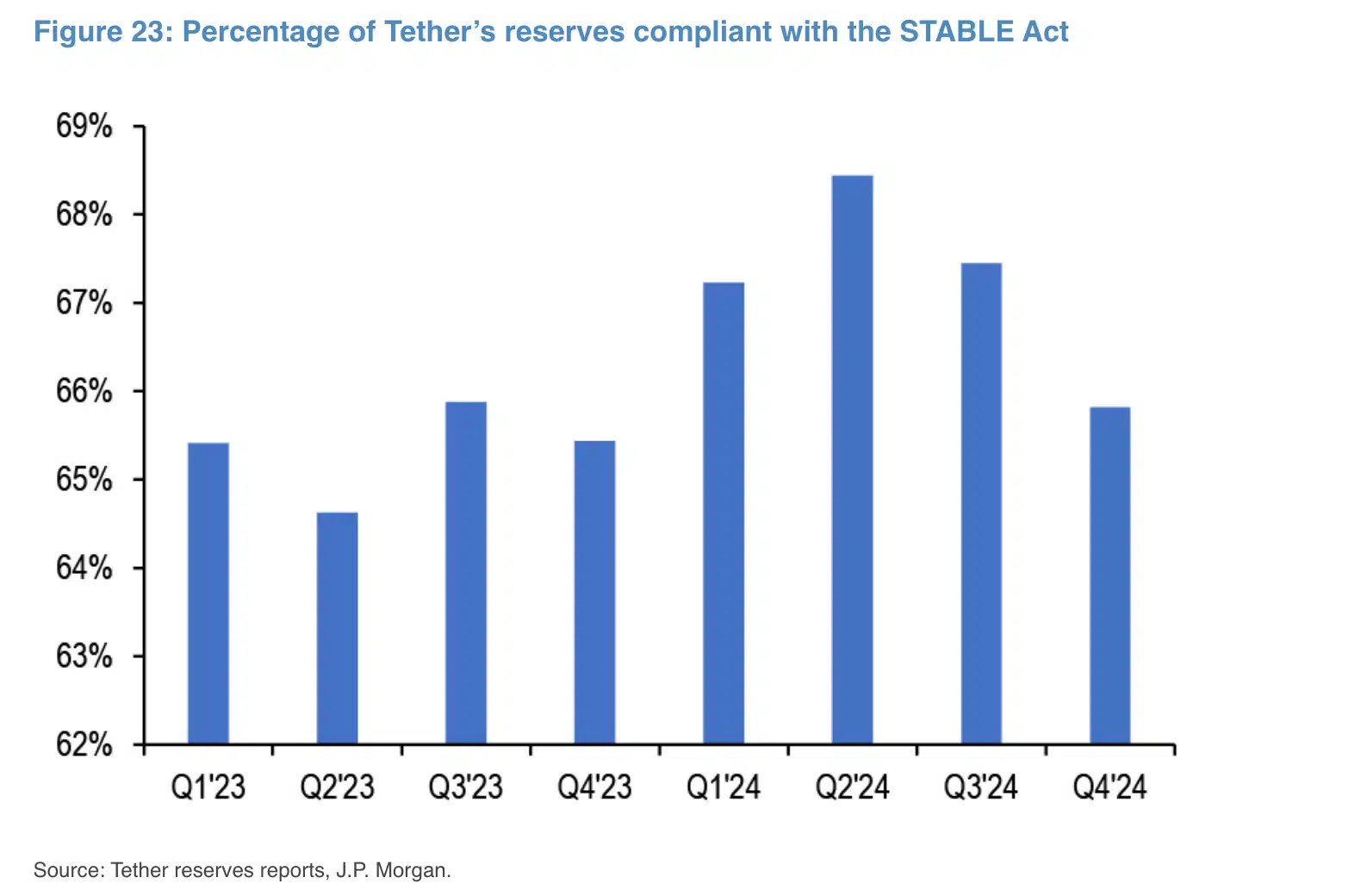

According to J.P. Morgan, only 66%-83% of Tether’s reserve assets comply with the GENIUS Act and STABLE Act, two stablecoins bills proposed by the U.S. policymakers. Part of the J.P. Morgan analysis, as reported by The Block, read,

“Under the House’s STABLE Act, only 66% of Tether’s reserves are compliant, while under the Senate’s GENIUS Act, 83% meet standards.”

Source: J.P. Morgan

Analysts note that the STABLE Act imposes stricter reserve requirements for potential stablecoin issuers, enforceable at the state level. In contrast, the GENIUS proposal offers a more lenient approach with a diverse reserve range but falls under federal jurisdiction.

However, analysts’ figures indicate a decline in the compliance ratio since last quarter, complicating matters for Tether.

Several crypto exchanges in the E.U. have delisted Tether’s USDT, allowing Circle’s USDC to increase its presence.

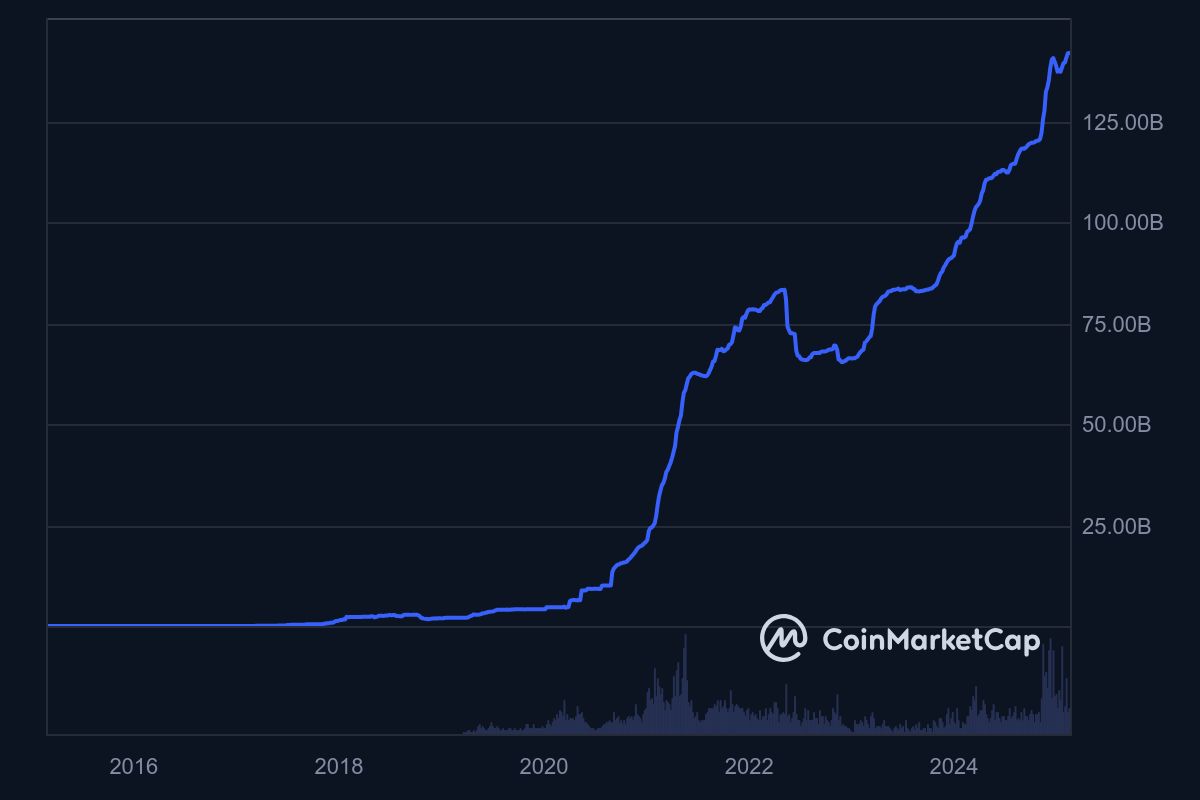

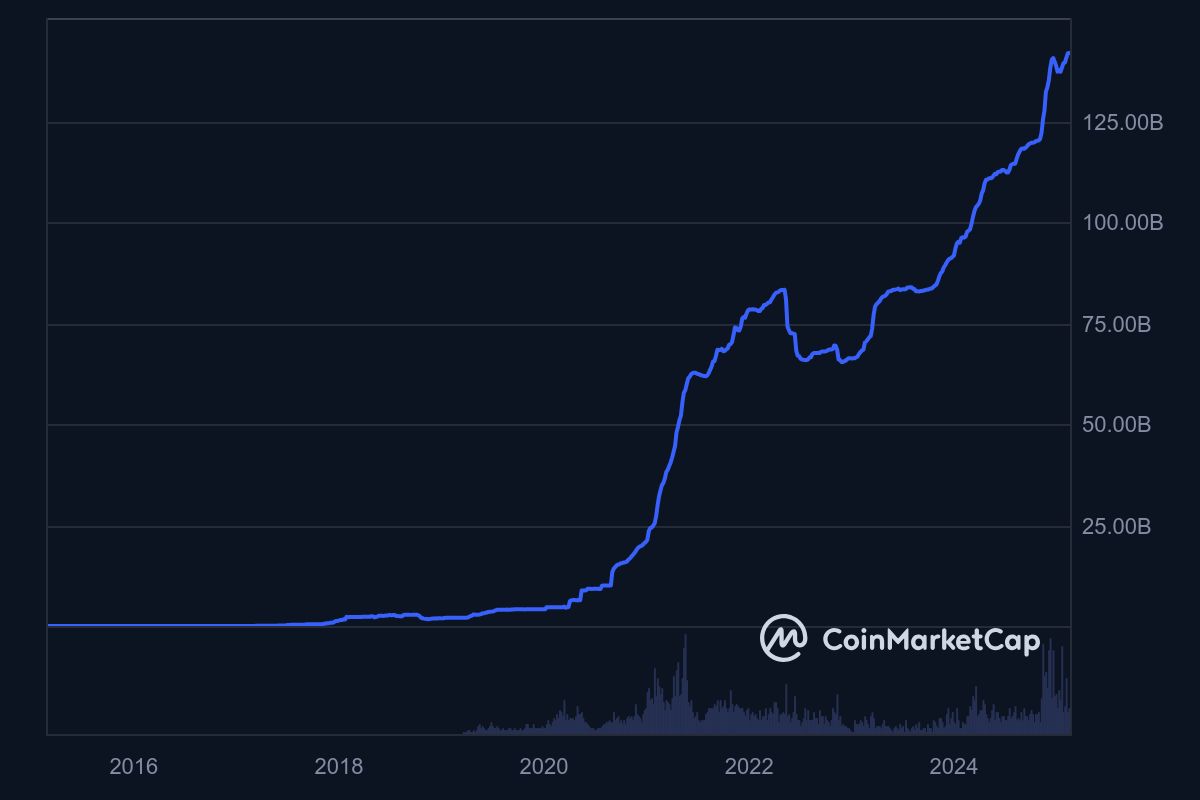

Despite this, USDT’s market size was not severely affected due to its massive dominance in the U.S. and other markets.

In fact, USDT’s market cap recently hit an all-time high of $141 billion.

Source: CoinMarketCap

Nevertheless, the analysts stated that Tether may have to sell some of its non-compliant reserve assets to meet the regulatory threshold set by the two stablecoin proposals.

The report added that this would impact Bitcoin, precious metals, and secured loans. Currently, Tether has 83.7K BTC, worth over $8B.

That said, some market analysts, like Alex Kruger, cautioned that if Tether failed to comply with U.S. stablecoin provisions, it would be negative for the entire market. Reacting to the J.P. Morgan report, Kruger stated,

“This actually makes sense – something to follow closely as would be very bearish”

The two bills could be adopted later in the year, and it remains to be seen how Tether will re-adjust to ensure compliance.