- BNB Smart Chain has recorded the highest volume across all other chains in the past month, with its TVL rising.

- Buying volume in the derivatives market saw a corresponding surge among Binance and OKX traders.

In the past 24 hours, Binance Coin [BNB] has seen a minimal surge of 2.14%, continuing its bullish streak from the past week of 10.24%, as it trades at $670.98.

Analysis of the market condition showed that BNB was likely set to continue its bullish path, as several market sentiments remained in favor, including its growth in volume on-chain and across the derivatives market.

New high despite market downtime

BNB Smart Chain remains the only chain in the market over the past seven and 30 days to have recorded positive volume growth, while other chains, including Solana [SOL], Ethereum [ETH], Base, and Arbitrum [ARB] have seen a drop.

At the time of analysis, DeFiLlama showed that weekly volume growth reached 66.63%, reaching $31.194 billion, and in the past 24 hours, it has climbed to $3.735 billion, the highest across all chains.

Source: DeFiLlama

The Total Value Locked (TVL), which is used to determine the amount locked within protocols on a chain, has seen steady growth in the case of BSC. Between the 3rd of February and press time, TVL has risen from $4.895 billion to $5.56 billion.

When there’s a significant surge such as this—a $665 million increase in TVL—it suggests growing confidence in BNB, as renewed interest tends to lead to a price rally while supply across exchanges reduces at the same time.

Buying volume surge on exchanges

There’s been a surge in the buying volume of BNB across top cryptocurrency exchanges, Binance and OKX, among perpetual market traders.

This was confirmed with the Taker Buy Sell Ratio surging significantly above 1 on both exchanges—Binance and OKX—with readings of 1.727 and 2.33, respectively.

When the Taker Buy Sell Ratio is above 1, it suggests there is more buying volume in the market among these perpetual traders than selling volume.

Typically, the further away from 1 it is, the more buying volume there is compared to selling volume.

Source: Coinglass

The Open Interest, which records the amount of unsettled derivative contracts in the market, has also seen a gradual rise, with growth of 1.78%, bringing the total value of these contracts to $866.70 million.

Resilience despite exchange flow increases

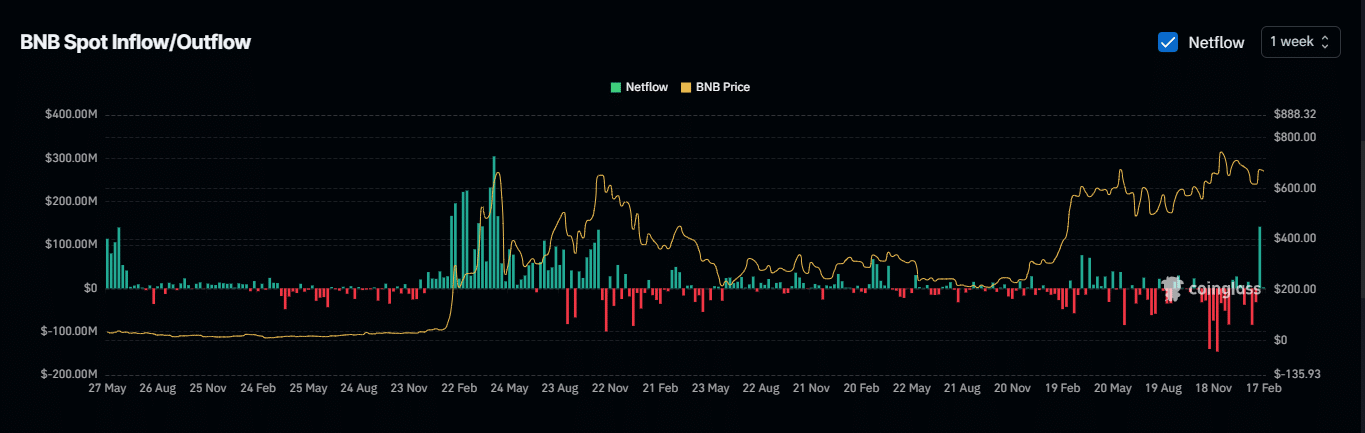

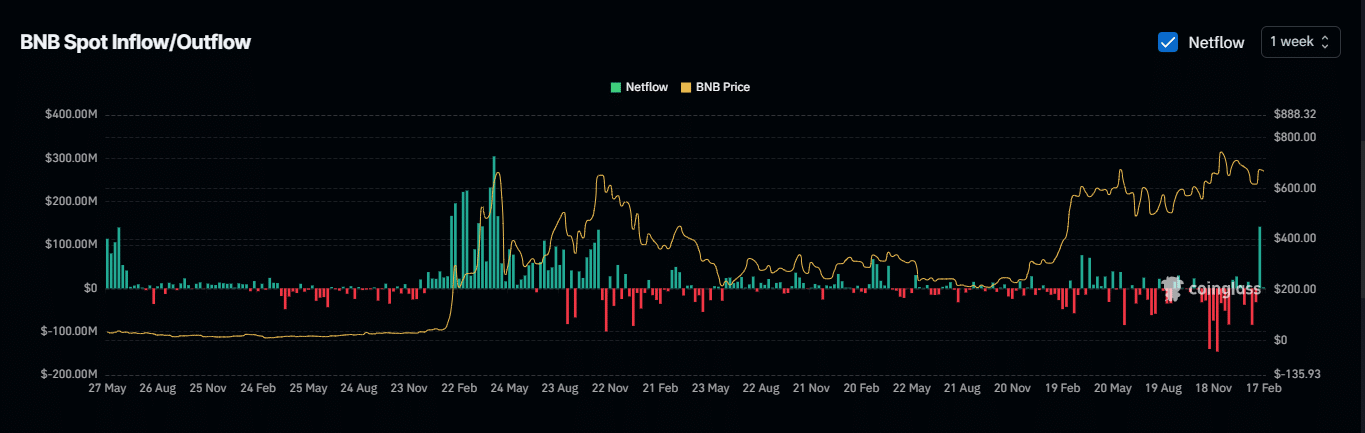

In the past week, between the 10th to the 16th of February, a massive surge in exchange netflow was recorded, with a reading of approximately $142 million in netflow—the highest since May 2021.

When there’s a surge such as this, it indicates that sellers are moving their assets into exchanges with the goal of selling.

However, despite this large sell volume on the spot market, BNB surged 10%, indicating the presence of demand to acquire the sold assets.

Source: Coinglass

Should this demand keep rising, BNB could continue to surge moving into the week.