- Biggest gainers: Four [FORM], PancakeSwap [CAKE], Hyperliquid [HYPE].

- Biggest losers: Pi Network [PI], JasmyCoin [JASMY], Movement [MOVE].

This week, the cryptocurrency market displayed significant divergence, with select tokens posting remarkable gains while others experienced substantial declines.

These trends highlight the importance of selective positioning in the current trading environment, as sector-specific momentum continues to drive price action rather than broad market trends.

Top market performers

Four [FORM]: Layer-2 protocol leads the pack

Four [FORM] dominated the crypto markets this week, skyrocketing 54% from $1.20 to $1.85.

The layer-2 smart contract platform staged a remarkable breakout after accumulating at key support levels throughout early March.

The rally kicked off with explosive momentum on the 17th of March, when FORM surged from $1.20 to $1.80 in a single session, immediately capturing market attention.

After a brief pullback to test $1.65 as support, buyers returned in force, pushing the token to a weekly high of $2.05 on the 18th of March.

While profit-taking emerged above the $2.00 psychological level, FORM demonstrated resilience by maintaining most of its gains.

The mid-week consolidation around $1.75 established a healthy base before renewed buying interest appeared on the 20th-21st of March.

Trading volume peaked impressively during the initial surge, suggesting strong conviction behind the move.

The token’s technical structure shows a clear breakout from its multi-month range, with the $1.75 level now representing crucial support.

PancakeSwap [CAKE]: DEX token shows impressive strength

PancakeSwap [CAKE] delivered an impressive performance this week, surging 40% from $1.85 to $2.59.

The Binance Smart Chain’s leading DEX token defied broader market trends, demonstrating exceptional strength as it broke through multiple key resistance levels.

The rally began decisively on the 17th of March, when CAKE exploded from $1.85 to $2.15, breaking above its 50-day moving average at $1.96 for the first time since January.

This technical breakout triggered significant buying interest, with trading volume nearly doubling compared to recent averages.

Source: TradingView

After a brief consolidation around $2.50 mid-week, buyers returned on the 22nd of March, pushing CAKE to test the $2.75 resistance level.

While this zone triggered some profit-taking, the token has maintained most of its gains, finding solid support around the $2.60 mark.

Technical indicators strongly favor continued bullish momentum. The 50-day moving average has begun to curve upward toward the 200-day MA [$2.25], potentially setting up a golden cross formation in the coming weeks.

Additionally, accumulation-distribution patterns show consistent inflows throughout the rally, suggesting institutional interest rather than retail-driven speculation.

The impressive price action comes amid several fundamental developments for the PancakeSwap ecosystem, including enhanced staking rewards, new token listings, and governance proposals aimed at increasing token utility.

These factors have likely contributed to the sustained buying pressure.

For traders looking ahead, CAKE faces immediate resistance at $2.80, with a breakthrough potentially opening the path toward the $3.00 psychological level last seen in December.

On the downside, the newly established support at $2.50-$2.60 should be closely watched for any signs of weakness.

The token’s outperformance in a challenging market environment highlights its potential role as a market leader in the DEX sector as DeFi activity continues to recover.

Hyperliquid [HYPE]: Perpetual exchange token breaks out

Hyperliquid [HYPE] delivered impressive gains this week, climbing 16% from $13.80 to $15.80.

The decentralized perpetual exchange token demonstrated remarkable strength across multiple trading sessions, confirming its breakout from the previous consolidation range.

The rally unfolded in two distinct waves, with HYPE first surging from $13.80 to $15.60 between the 19th and 20th of March before experiencing a pullback to $14.20 as profit-taking emerged.

This retracement proved temporary, with buyers returning forcefully on the 22nd of March, pushing the token to a weekly high of $16.40.

Trading volume spiked significantly during both advances, particularly on the 22nd of March, when volume nearly doubled compared to the weekly average.

This increased participation suggests genuine institutional interest rather than retail-driven speculation.

Technical indicators remain firmly bullish, with HYPE establishing a series of higher lows and higher highs. The $15.50 level now represents key support, with buyers consistently defending this zone during recent pullbacks.

Other notable gainers

Beyond the top performers, the broader market saw several jaw-dropping moves.

BugsCoin [BGSC] led the top 1,000 tokens with a 339% gain, while Keta [KTA] and Mubarak [MUBARAK] followed with impressive gains of 290% and 258%, respectively.

This week’s biggest losers

Pi Network [PI]: Mobile mining token collapses

Pi Network [PI] suffered a devastating collapse this week, plummeting 33% from $1.50 to $1.00. The mobile mining project’s token faced relentless selling pressure, with bears dominating every trading session since Monday.

The decline began immediately on the 17th of March, with PI dropping 7% in the opening session.

This initial breakdown accelerated dramatically on the 18th of March when the token crashed through the critical $1.30 support level that had previously been held since February.

By the 21st of March, panic selling intensified as PI plunged to a three-month low of $0.87 before a modest relief bounce emerged.

While this technical oversold condition triggered some dip-buying, the recovery proved short-lived and weak, with the token struggling to reclaim even $1.10.

Recent sessions show PI consolidating around the psychologically important $1.00 level, though bears remain firmly in control.

For any meaningful recovery, the token must first reclaim the $1.15 resistance level, though the severe technical damage suggests further downside remains likely.

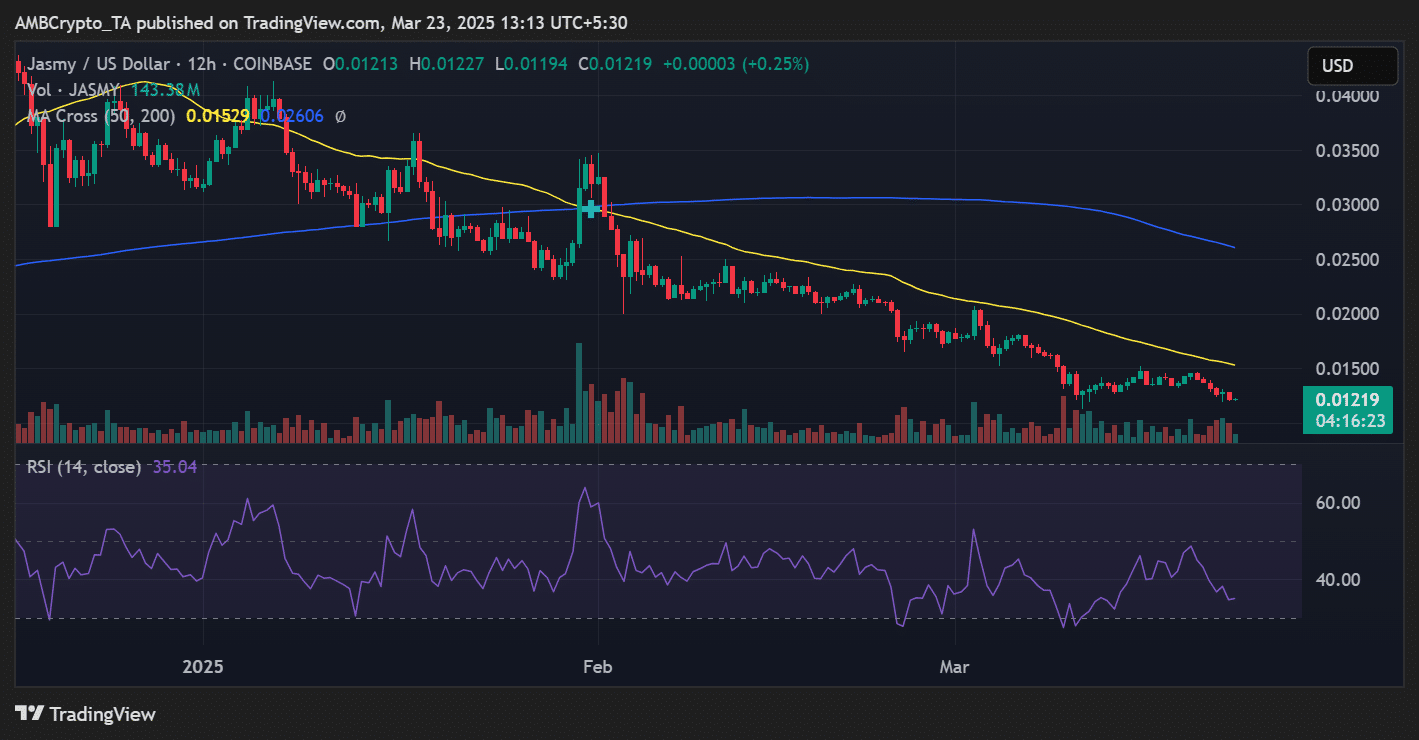

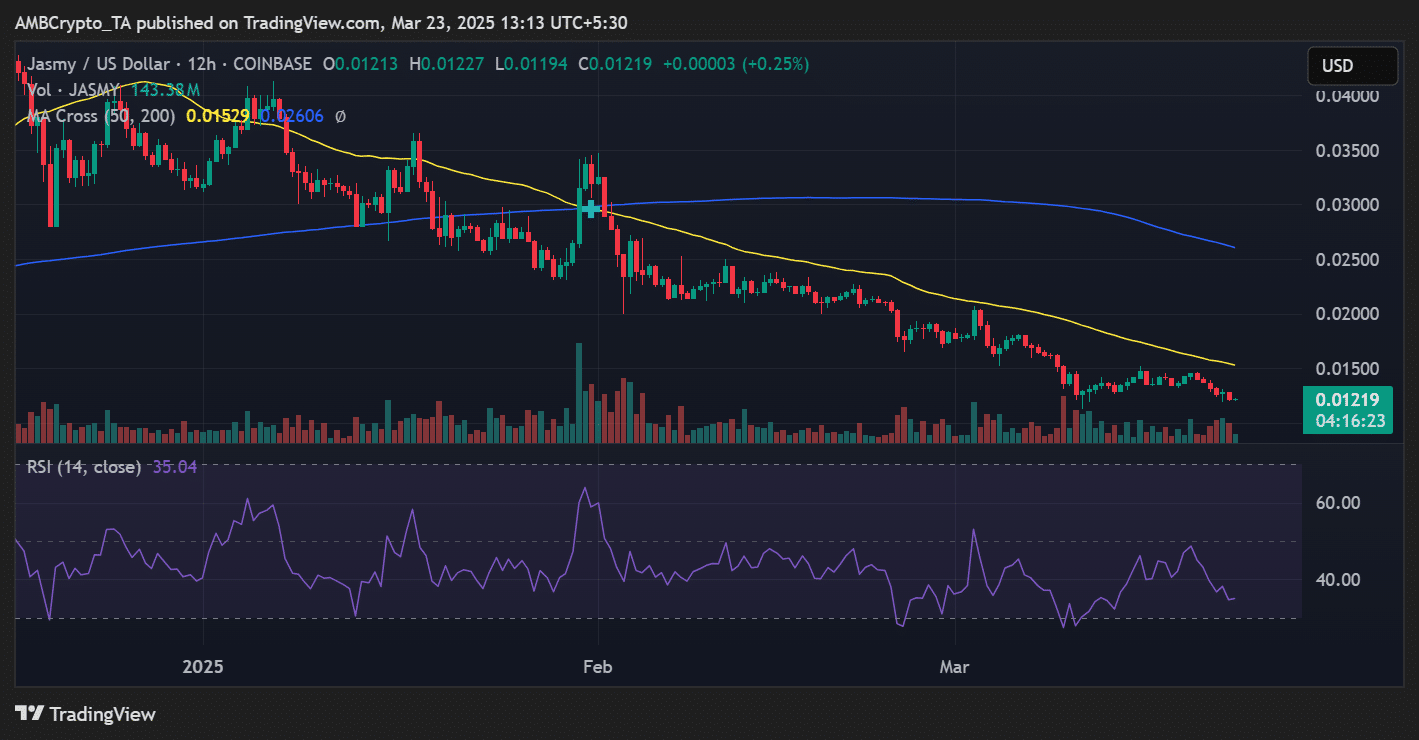

JasmyCoin [JASMY]: Japanese token extends downtrend

JasmyCoin [JASMY] suffered another punishing week, dropping 14% from $0.0144 to $0.0122.

The Japanese data decentralization token extended its multi-month downtrend despite brief recovery attempts, confirming that bears remain firmly in control.

The week began with JASMY consolidating around $0.0144, following a minor bounce from the previous week’s lows.

This stability proved short-lived, as sellers emerged on the 18th of March, pushing the token below the $0.014 support level that had previously held throughout early March.

A temporary relief rally materialized on the 19th and 20th of March, with JASMY recovering to test the $0.0145 resistance zone.

This technical bounce showed promise as trading volume nearly doubled compared to the weekly average.

However, the rejection at this level proved decisive, triggering another wave of selling that would dominate the remainder of the week.

Source: TradingView

The most significant breakdown occurred on the 21st of March, when JASMY plunged through multiple support levels, accelerating its decline as stop losses were triggered.

By the 22nd of March, the token had reached $0.0125 before experiencing another failed recovery attempt.

Technical indicators paint a concerning picture for JASMY holders. The RSI has dropped below 35, approaching oversold territory but showing no clear divergence signals that might suggest an imminent reversal.

Both the 50-day ($0.0152) and 200-day ($0.0160) moving averages continue to trend lower, maintaining the death cross formation established in January.

Trading volume data shows consistent distribution rather than accumulation, with nearly 143 million units changing hands during the week’s decline.

The selling has been methodical rather than panic-driven, suggesting institutional repositioning rather than retail capitulation.

JASMY must first reclaim the $0.013 level for any meaningful recovery, followed by the more significant $0.014 resistance.

However, the current market structure strongly favors further downside, with the $0.012 psychological support representing the next critical test.

Movement [MOVE]: Fitness token faces continued pressure

Movement [MOVE] struggled throughout the week, dropping 9% from $0.48 to $0.43. The fitness-to-earn protocol failed to maintain support levels as sellers dominated nearly every trading session.

The decline began immediately on the 17th of March, with MOVE plunging from $0.48 to $0.45 in the first day.

After a brief consolidation period, the token made several attempts to recover, notably on the 19th-20th of March when it climbed to test resistance around $0.46.

This rally proved short-lived, as sellers quickly regained control, pushing MOVE to a weekly low of $0.42 on the 22nd of March.

While a modest bounce emerged from this oversold condition, recovery attempts remained weak and unsustained.

Trading patterns show lower highs and lower lows forming throughout the week, confirming the bearish trend remains intact. Each brief recovery was met with fresh selling pressure, particularly evident in the final sessions.

For any meaningful reversal, MOVE must first reclaim the $0.45 level, though the current market structure suggests the path of least resistance remains downward.

Other significant decliners

In the broader market, several tokens experienced dramatic losses.

Entangle [NTGL] led the declines with a 45% drop, followed by Ancient8 [A8] and WhiteRock [WHITE], which plummeted 43% and 39%, respectively, during the week.

Conclusion

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research [DYOR] before making investment decisions is best.