- Rival crypto whales, including CBB and Justin Sun, tried to push BTC’s price up.

- A surprise $2.4M long on MELANIA suggests hedging or psychological tactics.

The Hyperliquid [HYPE] whale, known as the “ETH 50x Big Guy,” has been at the center of intense market activity after opening a $449 million short position on Bitcoin [BTC].

This high-stakes trade, executed with 40x leverage, was placed at an entry price of $83,923. If Bitcoin’s price moves above $85,940, their position will be forcibly liquidated, potentially triggering a cascade of short squeezes.

As of press time, Bitcoin was trading at $83,451, meaning the whale was still holding their position without liquidation. Their unrealized profit stood at $4.4 million.

Hyperliquid crypto whale avoids liquidation—for now

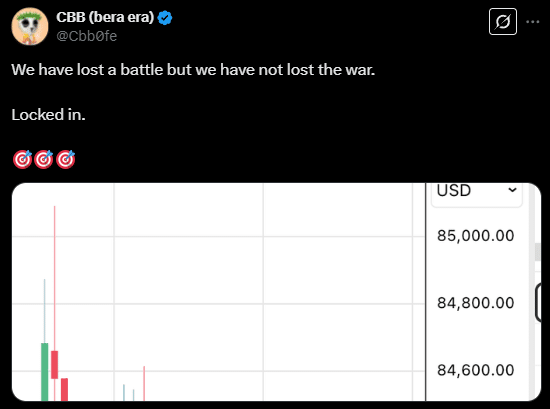

In response to this massive short position, influential traders, including CBB (@Cbb0fe) and Justin Sun, have attempted to drive Bitcoin’s price higher to force the whale into liquidation.

The first major push took place on the 16th of March, when Bitcoin briefly surged to $84,690, coming dangerously close to liquidation.

Source: X

However, 0xf3F4 responded immediately by depositing $5 million USDC, reinforcing their margin and keeping their trade alive.

“The ETH 50x big guy” takes a bold bet

0xf3F4 has implemented multiple strategies to avoid liquidation. Their collateral management has been key, as they continue to add margin whenever the price nears their liquidation level.

This move has allowed him to sustain their position, despite pressure from opposing traders.

He has also been executing TWAP (Time-Weighted Average Price) trading.

So, instead of closing their short position in a single transaction, they have been gradually exiting in smaller portions, reducing market impact while locking in profits.

Controlling Hyperliquid’s order books has been another advantage.

Seemingly, they have placed a $150 million sell wall in the $83,920-$83,925 range, preventing Bitcoin’s price from breaking through resistance.

At the same time, they have positioned $106 million in buy orders at $68,774-$68,775, which serves as a take-profit zone if Bitcoin drops.

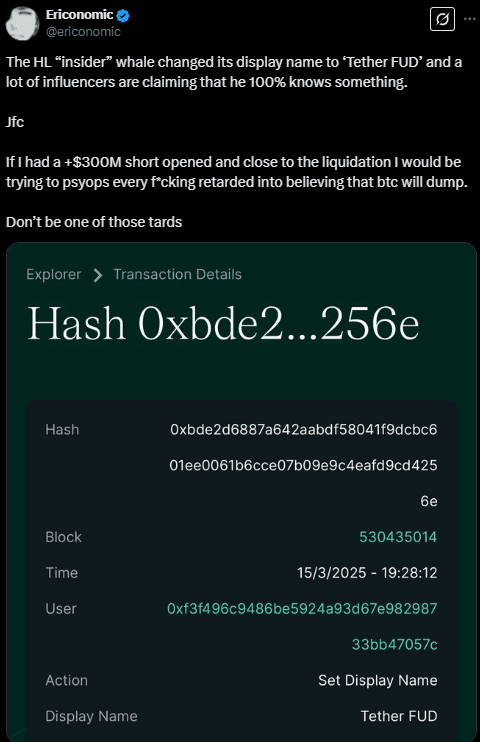

To further influence sentiment, 0xf3F4 has employed psychological tactics as well.

Source: X

They changed their display name to “Tether FUD” to spread fear and uncertainty. By fueling bearish sentiment, they may be trying to convince other traders to sell, which would align with their short position.

Can traders force a short squeeze?

The market response has been aggressive. CBB, a well-known trader, publicly announced their plan to take down 0xf3F4 by pushing Bitcoin’s price upward.

They rallied other traders, revealing that they had already secured “8-figures” in funds for this effort.

Justin Sun, founder of TRON, also engaged in direct discussions with CBB. Sun expressed interest in participating, suggesting that additional capital might be deployed in the fight against the whale’s position.

Despite their efforts, Bitcoin has not yet breached $85,940, and 0xf3F4 remains in control of their trade.

Source: X

Interestingly, 0xf3F4 made an unexpected move by opening a $2.4 million long position on MELANIA tokens.

An unexpected twist

The reason for this trade is unclear, but analysts believe it could serve different purposes.

Source: Hypurrscan

One possibility is hedging, where the MELANIA long acts as a safeguard in case Bitcoin’s price rises and puts pressure on his short position.

Another theory is speculation, suggesting they might be positioning himself for potential gains if a short squeeze occurs.

Some also view this as a psychological tactic, aimed at distracting market participants from their Bitcoin short.

Whatever the intent, this move indicates that they are actively managing risk across multiple assets.

Paying the price

The cost of maintaining this trade has been high.

Funding fees have surpassed $391,000, but the whale remains willing to pay them to keep their position intact.

Source: Hyperdash

He has also placed 12 limit buy orders between $58,664 and $69,414, signaling their plan to take profits if Bitcoin falls further.

This setup suggests that they expect downside movement despite market efforts to push BTC higher.

Win or lose, this crypto whale will be remembered

This event is a case study in how a single crypto whale can disrupt the market.

If 0xf3F4 gets liquidated, it will reinforce the idea that collective action can overpower even well-funded traders. If they survive, it will highlight the effectiveness of risk management in high-leverage trading.

For now, the market remains on edge, waiting to see whether Bitcoin will rise and trigger a short squeeze or if the whale will escape with millions in profit.