- ETH/BTC ratio nears the critical 0.05 BTC level, signaling potential further losses if key support fails.

- Institutional preference for Bitcoin and Ethereum’s lack of catalysts contributes to ETH’s prolonged underperformance.

The Ethereum[ETH]-to-Bitcoin[BTC] (ETH/BTC) ratio has faced persistent struggles, with a staggering 77% of trading days being unprofitable for ETH holders against BTC.

The recent market turbulence has exacerbated these conditions, as evident from on-chain data and price performance charts. But what does this mean for traders and investors?

Understanding the ETH/BTC profitability chart

The chart illustrates ETH/BTC’s profitability over time by marking profitable and unprofitable trading days. Green signifies days when ETH outperformed BTC, while red highlights periods of underperformance.

The orange-shaded area at the bottom represents the increasing percentage of unprofitable days over time.

Source: checkonchain

Analysis reveals that since early 2022, ETH has consistently underperformed Bitcoin, with only a few brief intervals of profitability.

The latest downturn in early 2025 has reinforced this bearish trend, with ETH’s relative weakness pushing the unprofitable trading days beyond 77%—a historically significant threshold.

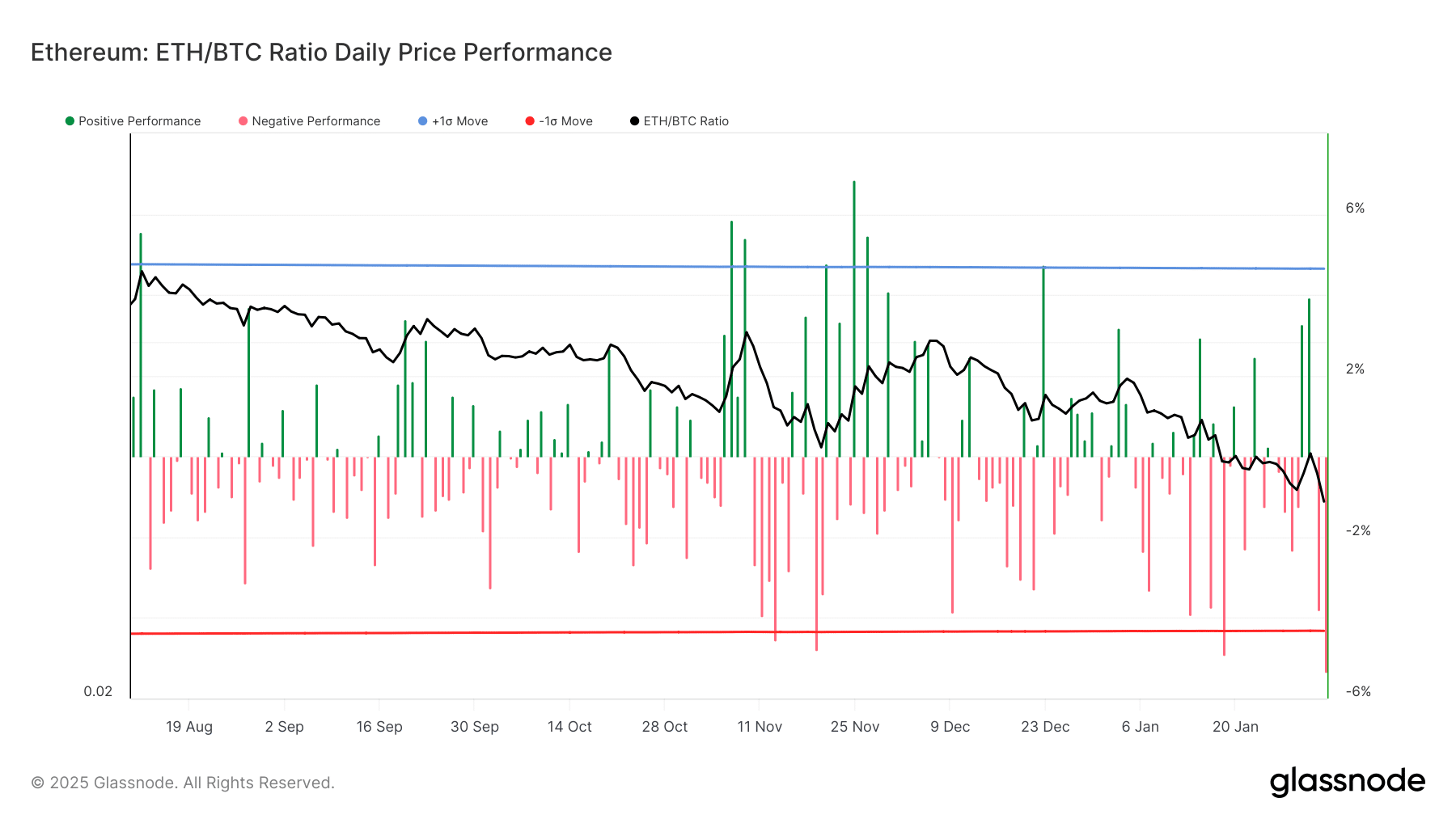

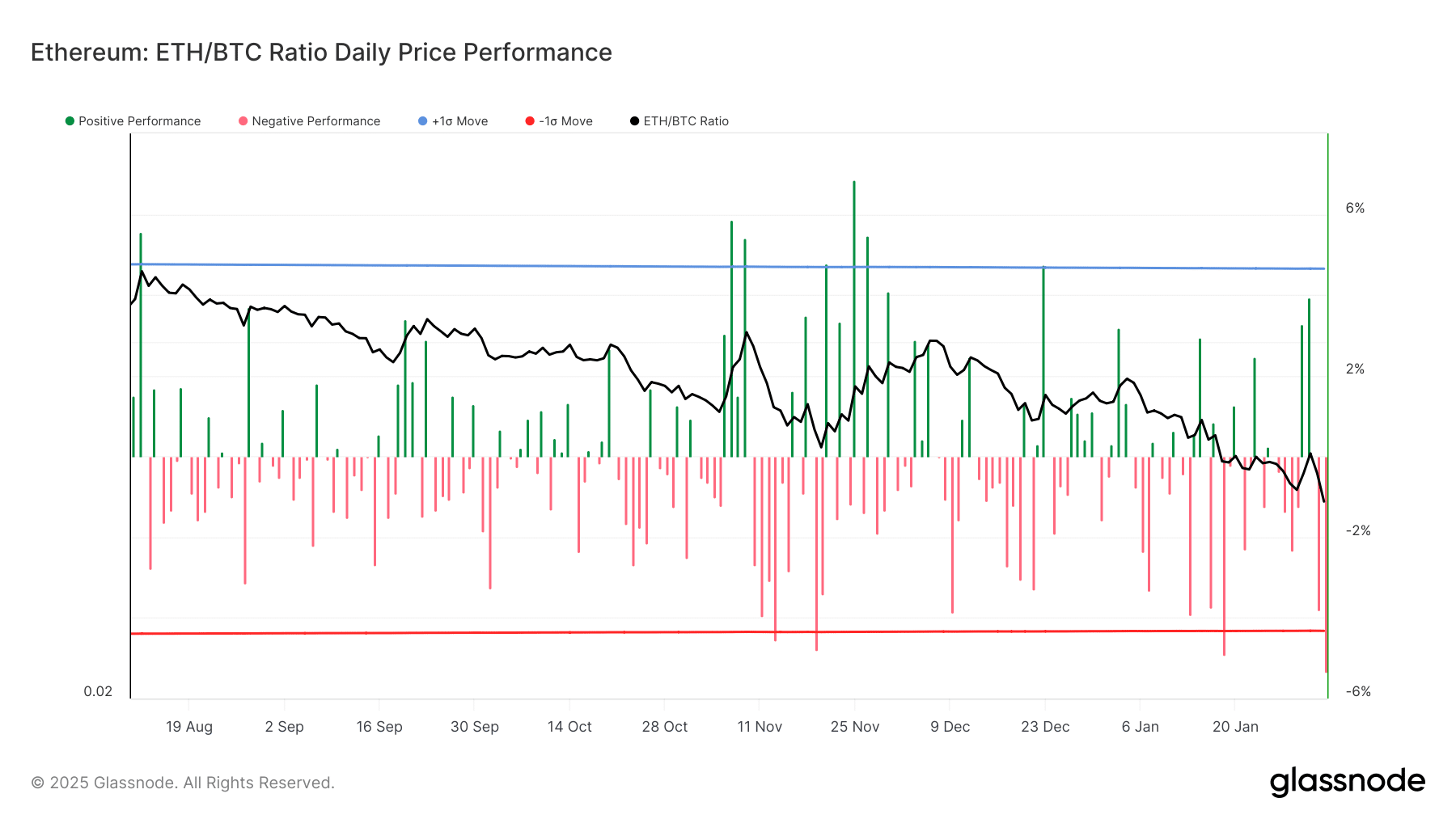

ETH/BTC price action: A brutal wick

Analysis of the ratio chart shows ETH/BTC’s daily price performance and highlights extreme volatility.

The latest price action included a brutal downward wick, underscoring a sharp rejection from resistance levels and heavy selling pressure.

Daily negative performance bars outnumber positive ones, indicating a persistent bearish trend.

Source: Glassnode

From mid-2024 onwards, ETH has struggled to maintain upward momentum against BTC, forming a steady downtrend. Each attempted recovery has been met with selling pressure, pushing the ETH/BTC ratio lower.

The latest drop saw ETH’s value relative to BTC sink to a multi-year low, with the ETH/BTC ratio around the 0.05 level—a key psychological and technical support zone.

Why is ETH struggling against BTC?

Bitcoin remains the go-to asset for institutional adoption, especially following spot Bitcoin ETF approvals in early 2024. Capital continues flowing into BTC rather than altcoins, including ETH.

While Ethereum remains a major blockchain, investors favor BTC as a safer bet.

Unlike Bitcoin, which benefits from macroeconomic narratives and institutional adoption, Ethereum lacks immediate, strong catalysts.

Despite the ETH ETF approval, the impact has not been significant, as seen from its flow compared to the BTC ETF flow.

– Read Ethereum (ETH) Price Prediction 2025-26

What’s next for ETH/BTC?

With ETH/BTC approaching historically significant support levels, traders should watch the 0.05 BTC level closely. If ETH/BTC breaks below this level, the ratio could drop further towards 0.045 or even lower.

This could trigger a wave of liquidations and panic selling. While the trend remains bearish, a rebound from key support levels is possible, particularly if Ethereum sees renewed institutional interest.