- The memecoin market and Dogecoin have been inexorably bearish since December

- A turnaround is not in sight right now, and investors might have to wait the summer out before buying

The memecoin market has been in down-only mode since December. Most of the popular memecoins, barring Dogecoin [DOGE] and Shiba Inu [SHIB], have erased most or all of their gains from the past nine months.

This trend is due to the flood of memecoins in the market. Since memes depend on market hype rather than fundamentals, it has been difficult for bulls to drive gains for meme tokens.

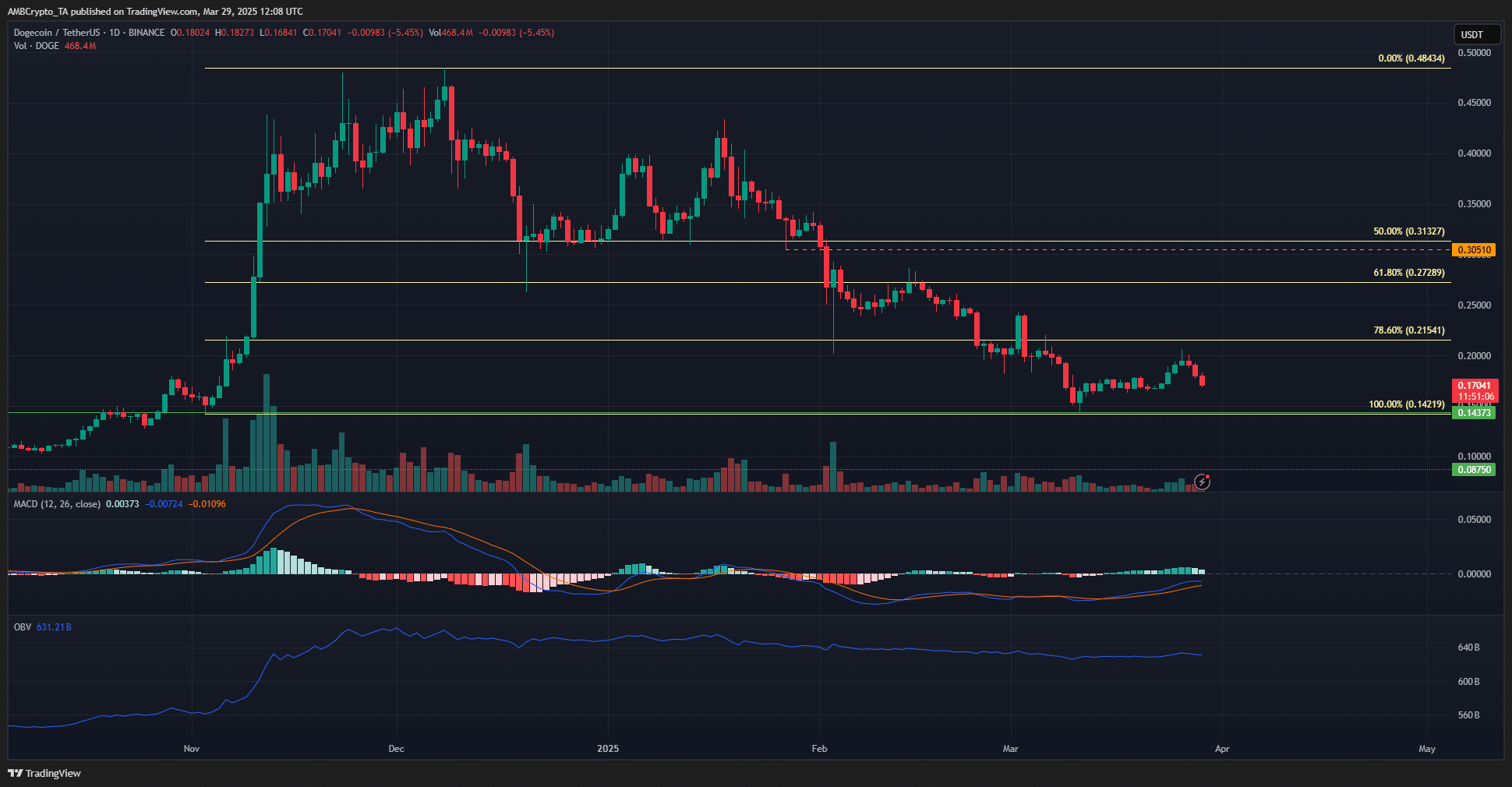

Source: DOGE/USDT on TradingView

Dogecoin’s 1-day price chart exhibited a clear downtrend with its series of lower highs and lower lows since late January. In fact, DOGE has fallen to near its November lows at $0.142. Although its OBV was not diving lower, the downtrend was visible. The MACD also outlined bearish momentum since February.

AMBCrypto examined other metrics to understand if investors should buy near the $0.14-$0.15 lows from November, hoping for a rally in the coming months.

Whale accumulation gives a tiny flame of hope for DOGE bulls

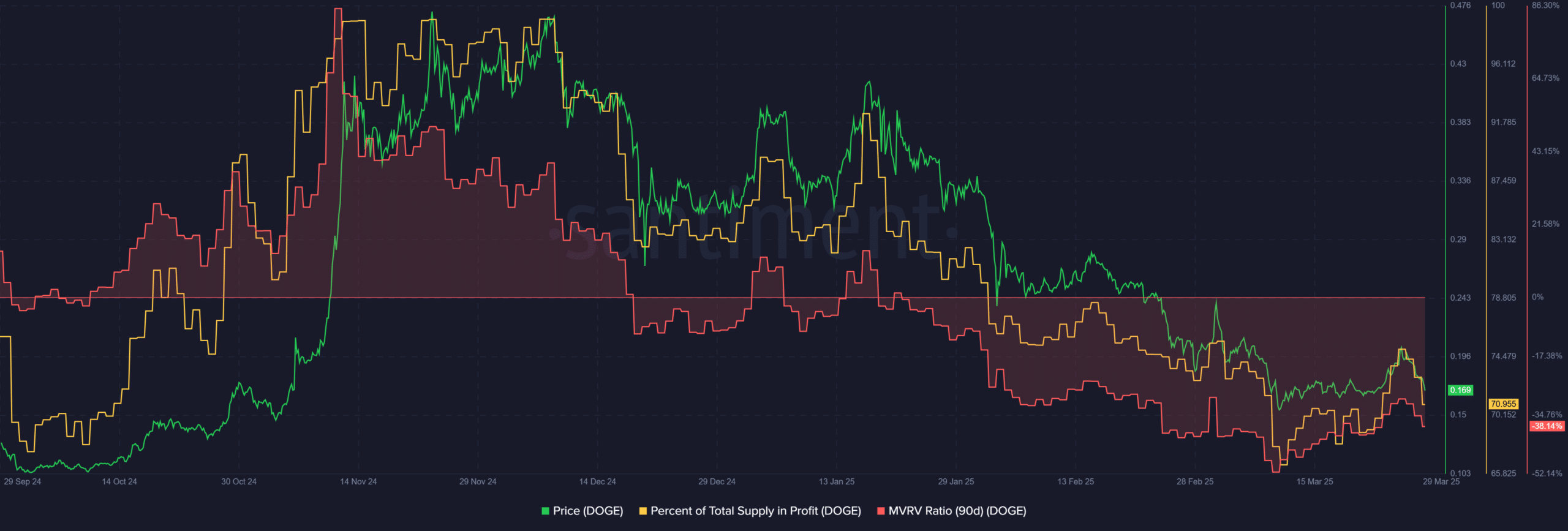

The supply in profit (as a percentage) has been falling since December. This mirrored the price action, as it should. The metric has fallen from 99.44% on 8 December to 70.95% at press time.

The 90-day MVRV ratio was also deeply negative, with a reading of 38.14%. Together, the metrics underlined the bearish viewpoint the price chart explored earlier.

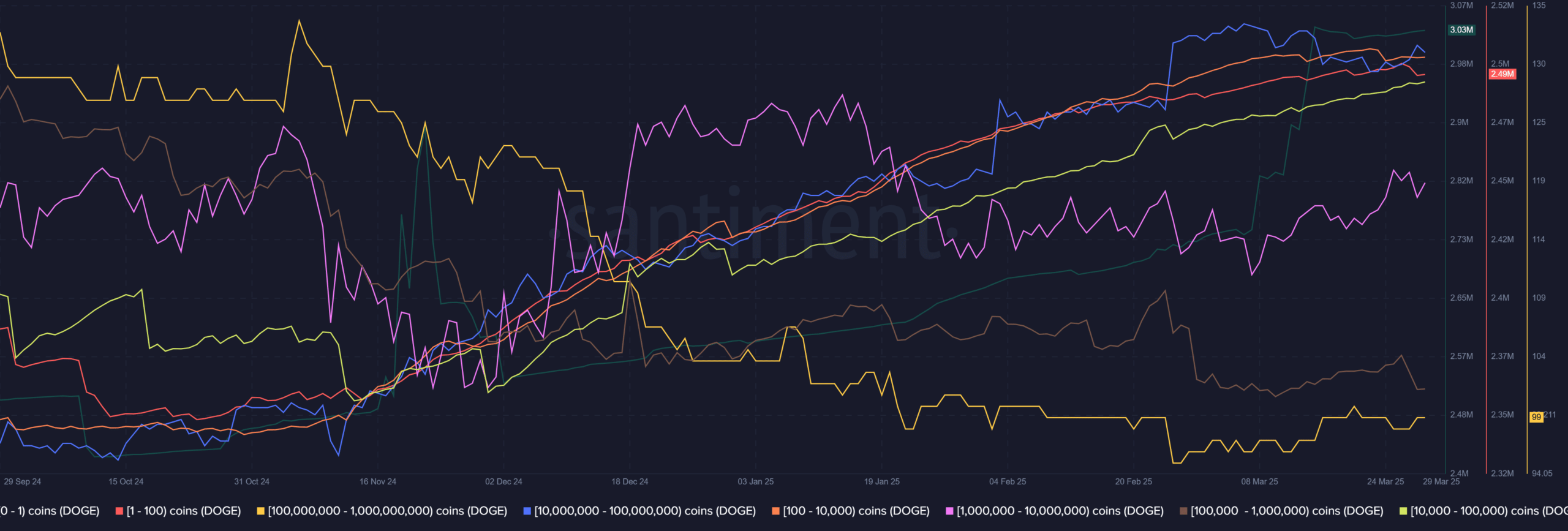

Examination of the supply distribution can illuminate if the whales were accumulating or distributing their Dogecoin. The metric revealed that the 100k-1M DOGE cohort has been on a slow downtrend in recent months. Figures for the same saw a minor uptick in March, but fell again over the past month.

On the contrary, smaller wallets have been accumulating. More interestingly, and with more potential for market impact, is the 1M-10M DOGE holding cohort. These wallets have increased their DOGE holdings since 7 March. This, despite they recording a minor dip in recent days too.

Here, it must be noted that Dogecoin is inflationary, meaning more Dogecoin is entering the supply over time. And yet, some accumulation among the whales is a slightly hopeful sign.

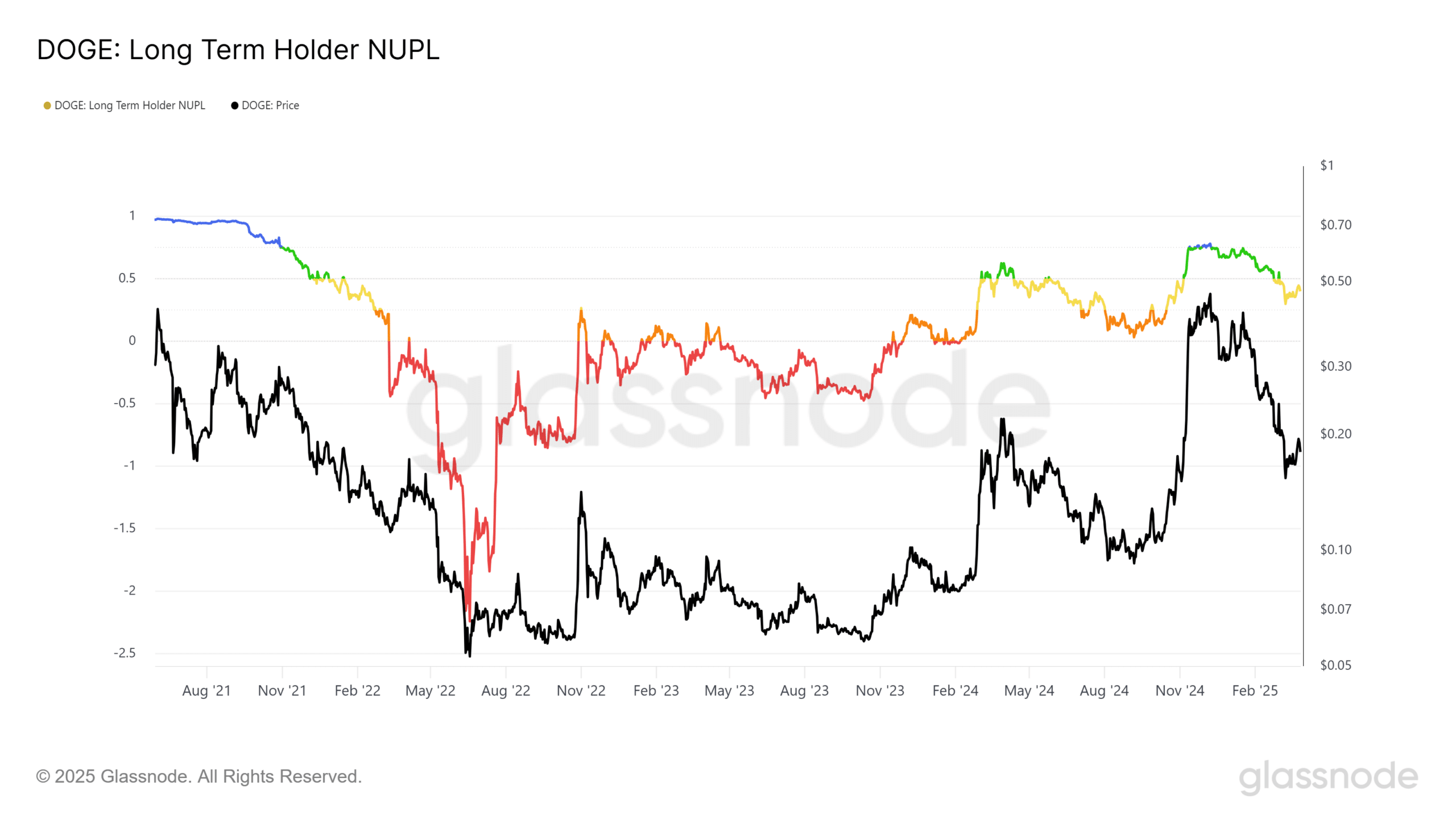

On the other hand, the long-term holder net unrealized profit/loss (LTH NUPL) was rather bleak at press time. It had a value of 0.4, translating to “anxiety” according to the chart. The metric roughly went along the same trends as the first half of 2024.

If the same continues, it could see Dogecoin slump below $0.15 and continue lower in April. A consolidation phase over the summer could be necessary before the bulls have the strength to drive another rally. This was what occurred in July/August of 2024, and something similar might play out in 2025.

The price action and the NUPL showed that the downtrend has remained in place. Long-term investors need to bide their time and wait for a consolidation phase, one that stretches at least for a few weeks.