- Hyperliquid responds to JELLY market concerns with on-chain validator voting and increased transparency.

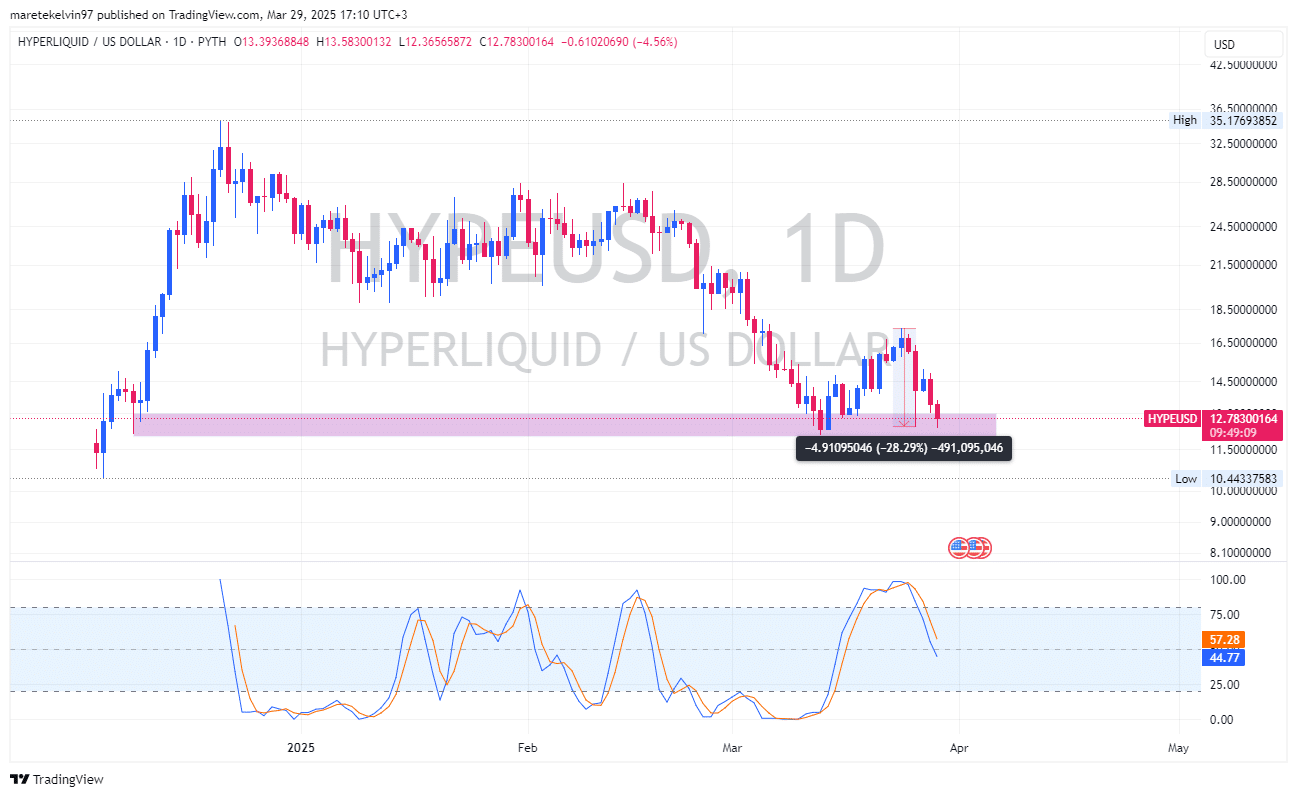

- HYPE Open Interest shows recovery as the market regains confidence after risk management upgrades.

Hyperliquid [HYPE] acted swiftly after a series of suspicious market movements led to JELLY perpetual contracts being delisted.

The move, carried out by the platform’s validator set, was to protect traders and maintain trust.

In order to offset users’ losses, the Hyper Foundation committed to paying affected traders—excluding flagged addresses—via on-chain data. Hyperliquid confirmed the decision on March 27 through a tweet on X.

Bitget’s Gracy Chen through her recent tweet however condemned the action by comparing the action to the FTX tragedy. She questioned the decentralization of Hyperliquid and the vault management as well.

In response to this, Hyperliquid made substantial risk management upgrades to enhance security and transparency.

Fully on-chain validator voting is now enabled

To prevent future disagreements, Hyperliquid upgraded its blockchain to allow for fully on-chain validator voting for delisting an asset, as announced on their recent tweet.

The permission less, stake-based mechanism removes off chain coordination. When a quorum of validator stake votes for delisting, the action automatically executes through HyperCore.

To illustrate the upgrade, validators 2-5 of Hyper Foundation conducted a test vote to delist MYRO perps on the 29th of March.

Validator 1 will continue to abstain until early adopters of the Delegation Program complete their stake distribution. This assures greater fairness and decentralized control.

Users should expect validators in the future to preview their voting intention for transparency.

Market reaction and Hyperliquid price indicators

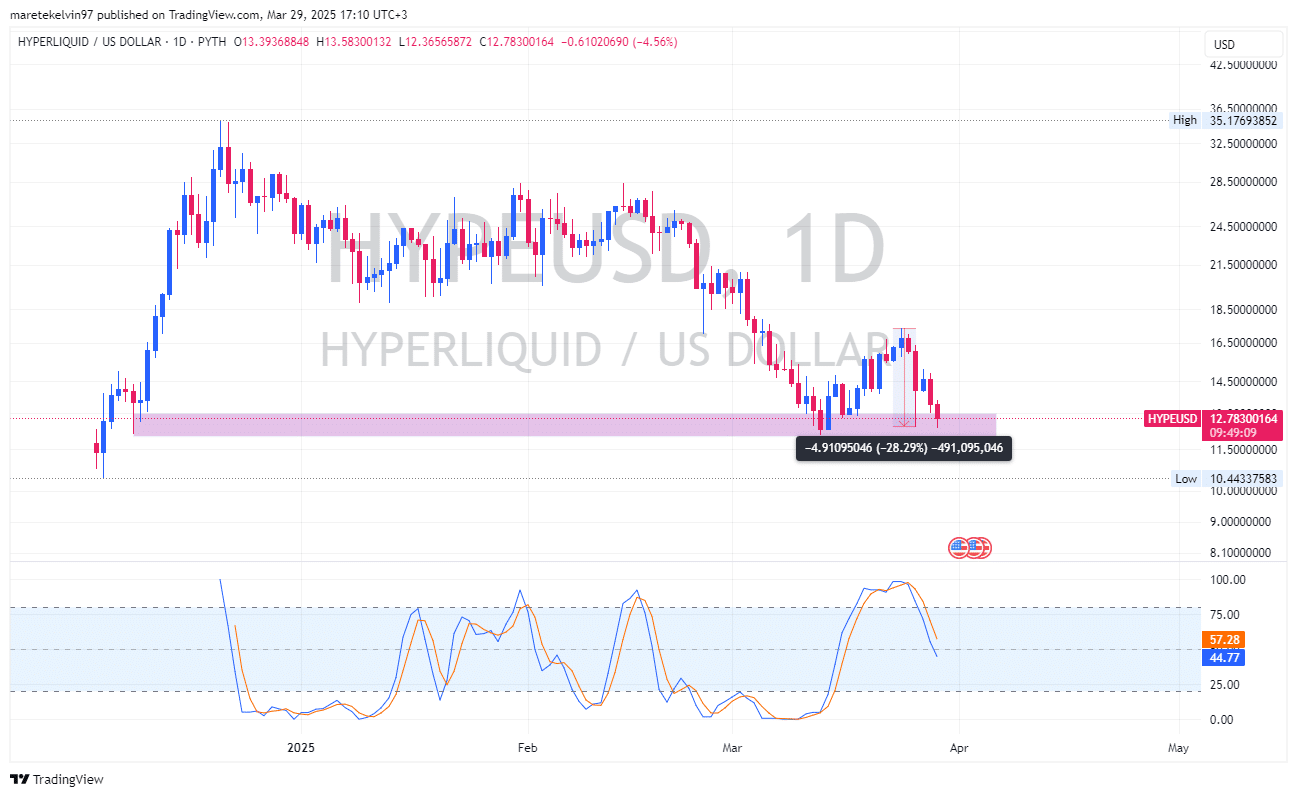

Following the JELLY incident, Hyperliquid’s price action has been bearish all along. HYPE price have declined by approximately 28% since the incident occurrence.

However, the bearish pressure has begun to fade, as evident on the daily chart since the implementation of the updated risk management system.

If the demand zone at around $12.20 remain strong, HYPE bullish reversal could be on cards.

Source: TradingView

HYPE Open Interest is sparking revival signals after the sluggish decline during the scandal. Investors are beginning to feel hopeful as Hyperliquid enhances the security and voting protocols.

According to their recent tweets, other technical improvements will be expected to enhance the transparency of the ecosystem.

Source: Coinglass