- A whale’s sale of 60,289 SOL sparks questions about potential downturn or market rally.

- Solana’s growth remains strong, with 11.12 million addresses and key support being tested.

The whale unstaked 60,289 Solana [SOL] tokens, selling them for 7.67 million USD (in USDC) at a price of $127 per token.

This massive transaction has raised significant questions about Solana’s [SOL] immediate price action. Is this large sale an indicator of a potential downturn, or could it be a strategic move before a larger market rally?

SOL network growth: Surpassing new milestones

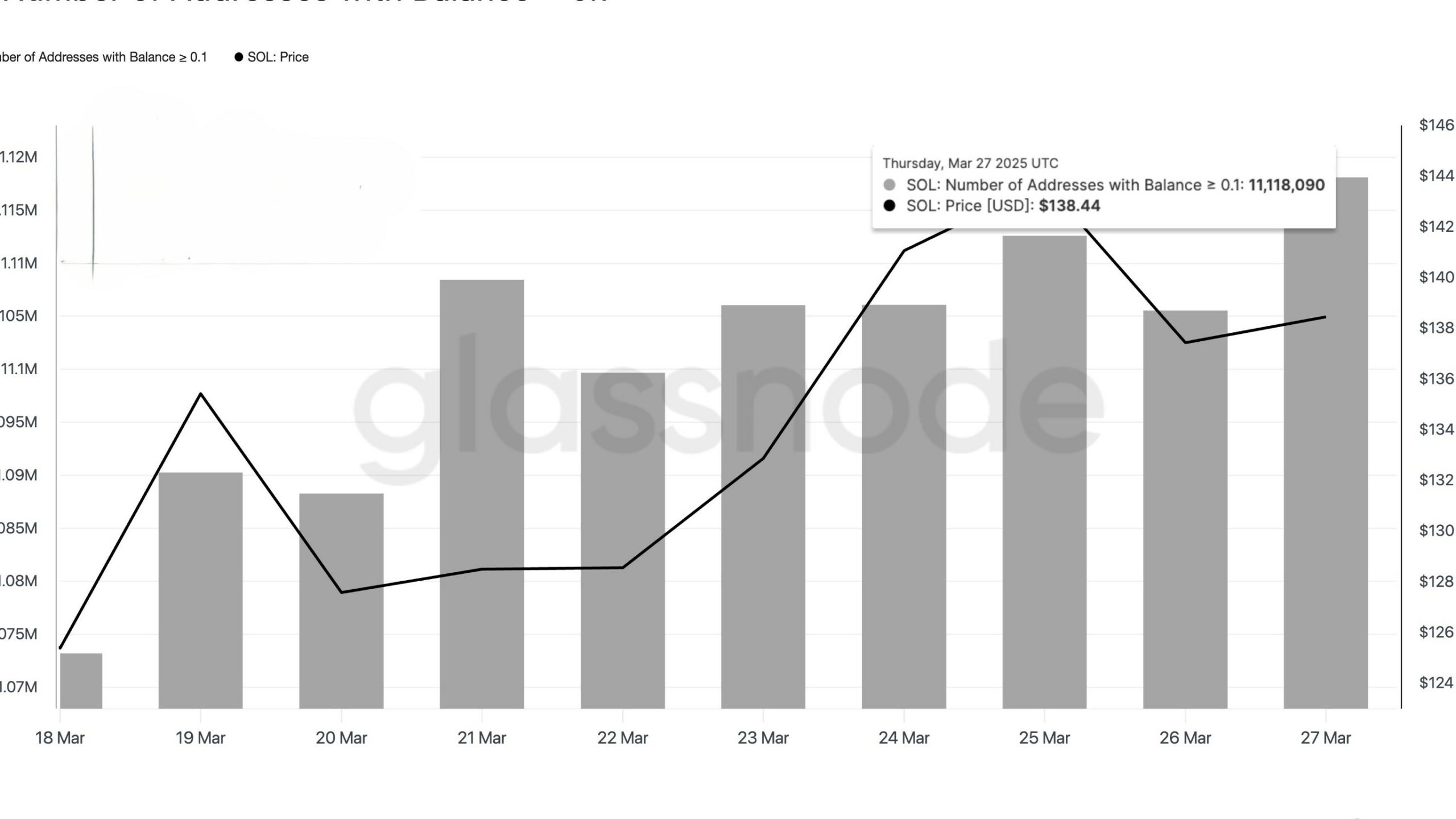

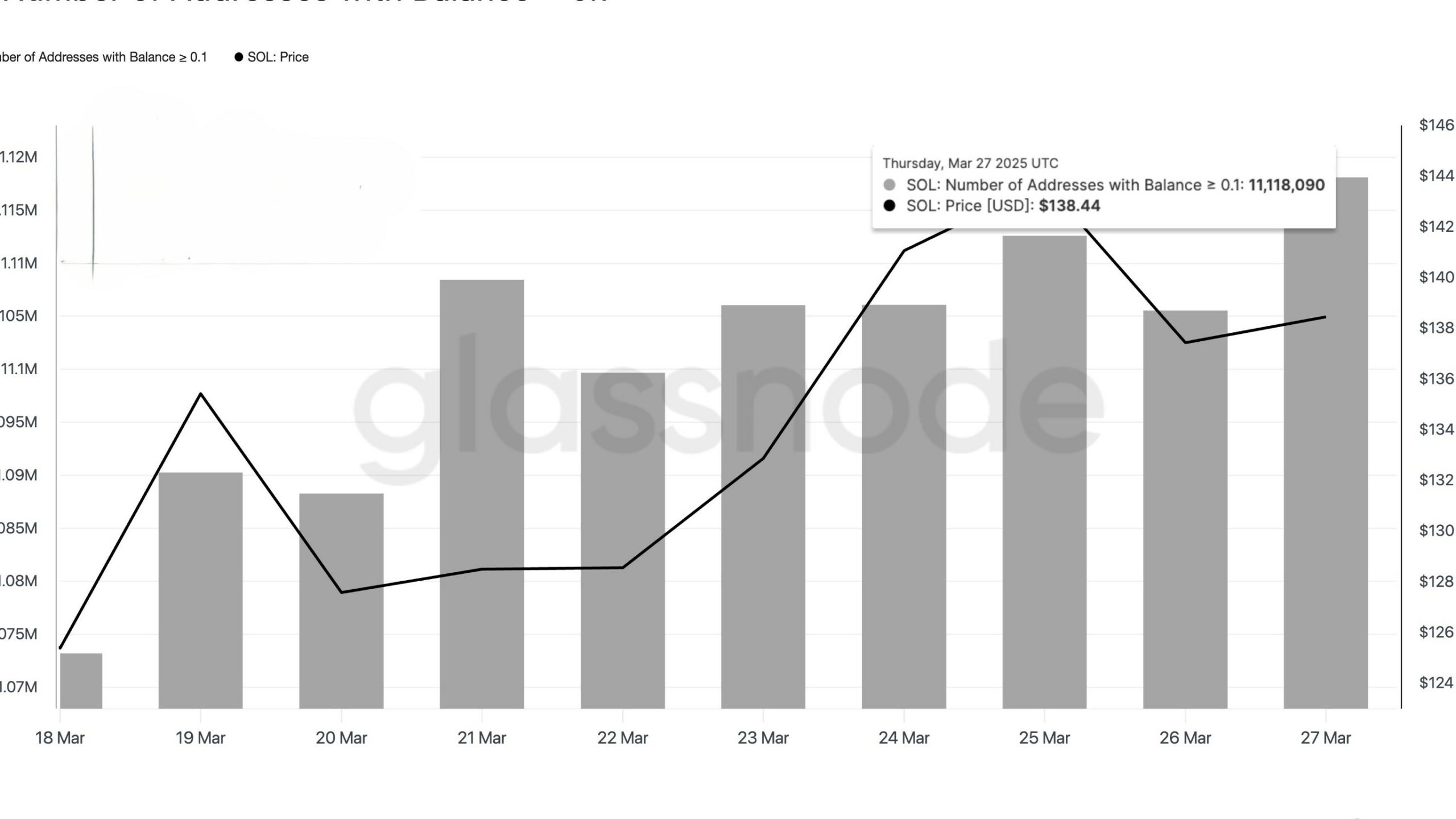

Despite this whale activity, Solana’s network is showing robust growth. The network recently surpassed an all-time high of 11.12 million addresses holding at least 0.1 SOL.

This milestone highlights growing adoption and strong interest in the Solana ecosystem.

It reflects the increasing involvement of retail investors and developers, which could provide long-term support for the network.

Therefore, despite some short-term selling pressure, the overall trajectory for Solana remains positive in the bigger picture.

Source: Glassnode

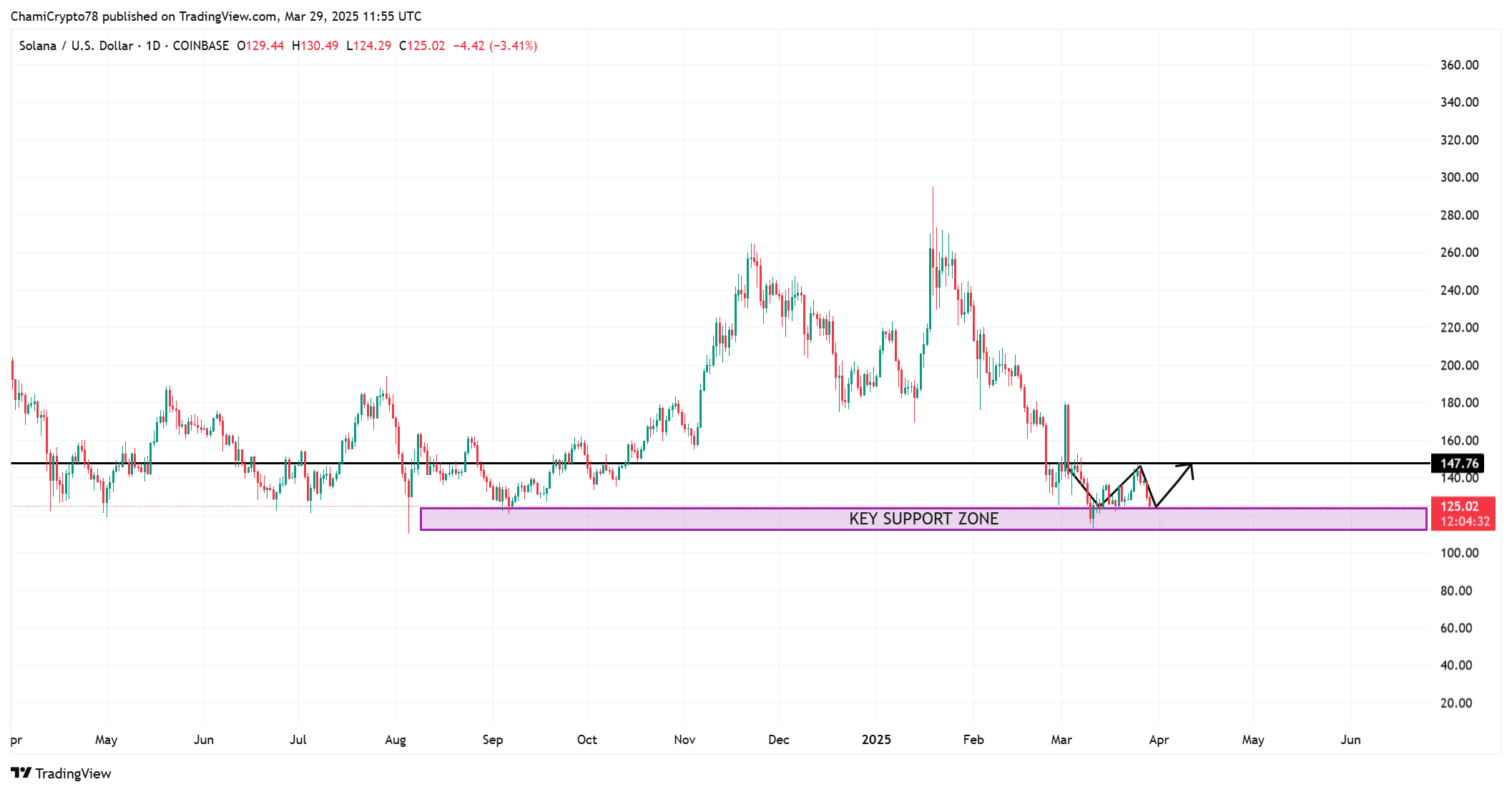

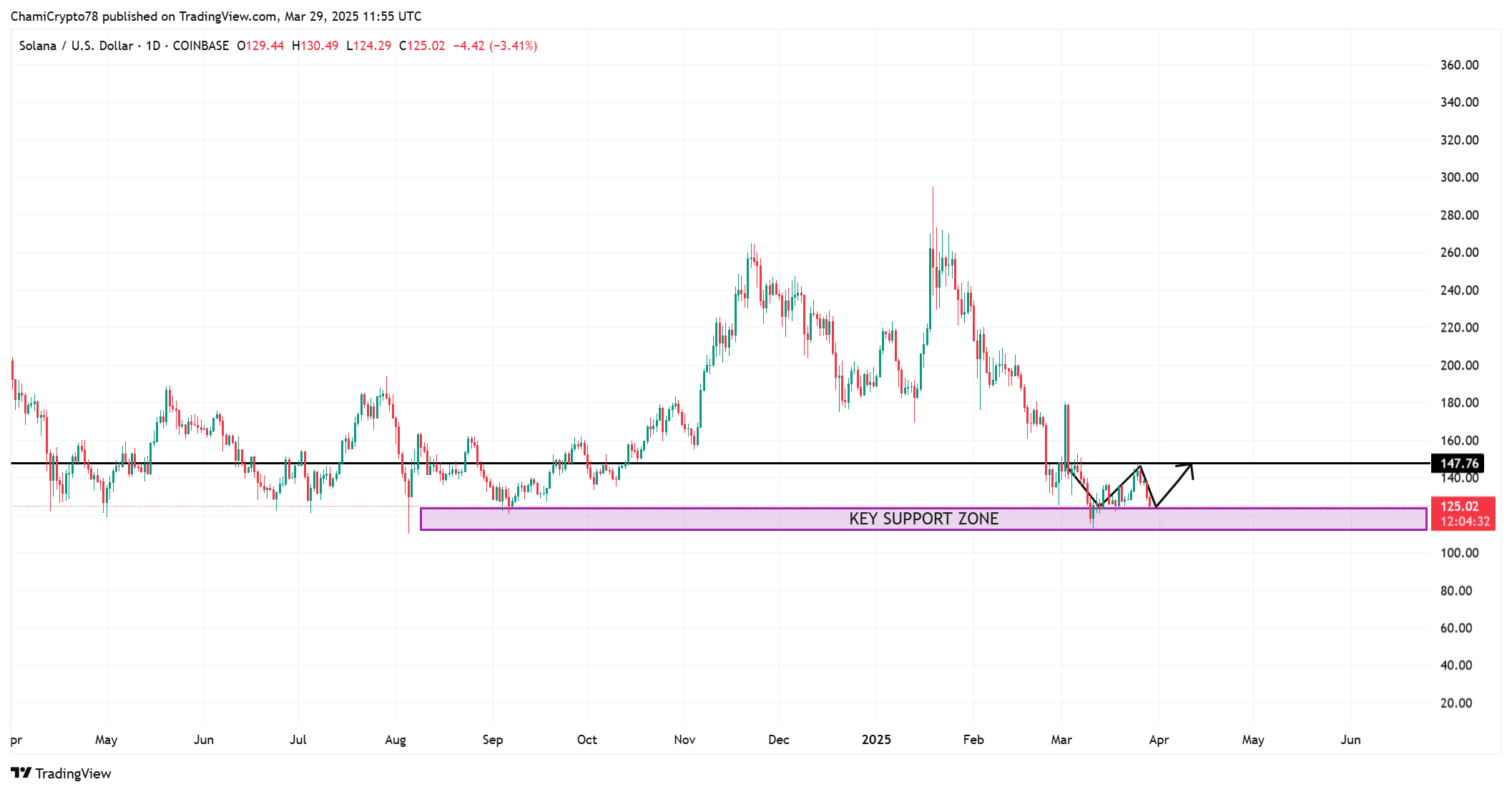

SOL price action: Retesting key support zone

In terms of price action, Solana is currently retesting a key support zone. Traders are closely watching this level to determine if the token will bounce back or break through.

The chart indicates that the support has historically held strong, which could pave the way for a rebound.

However, at press time, SOL is trading at $125.19, showing a 4.99% decline over the past 24 hours.

This decline has added to concerns about whether Solana can sustain its bullish momentum, or if it will face further price corrections.

Source: TradingView

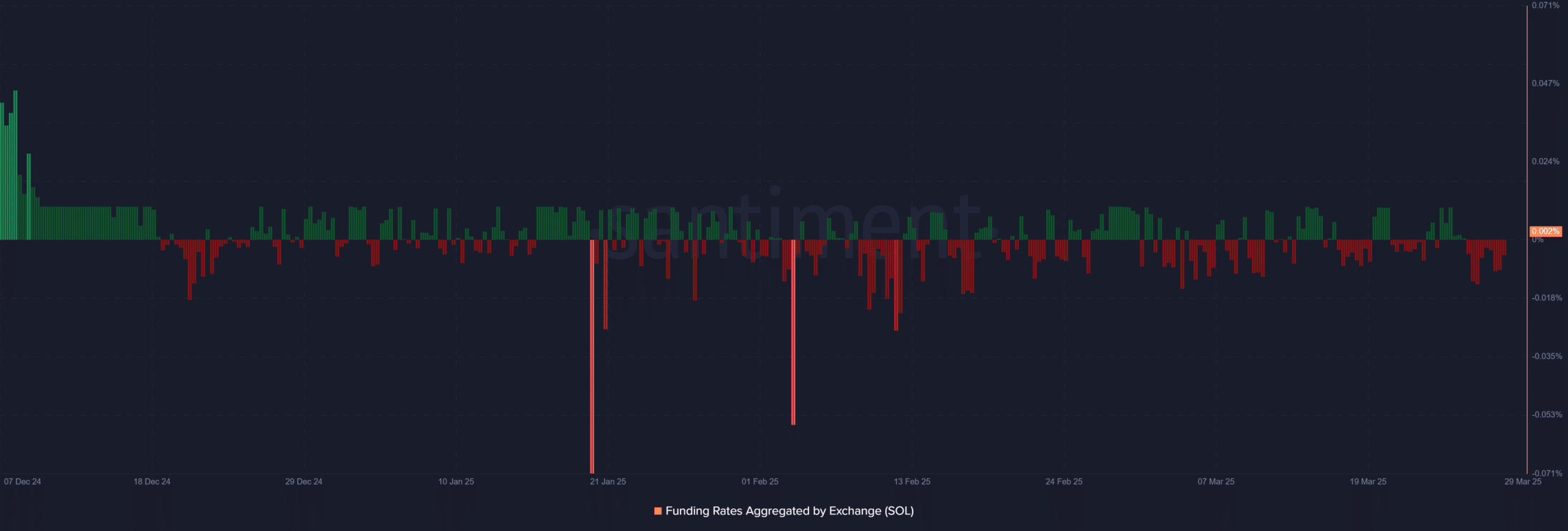

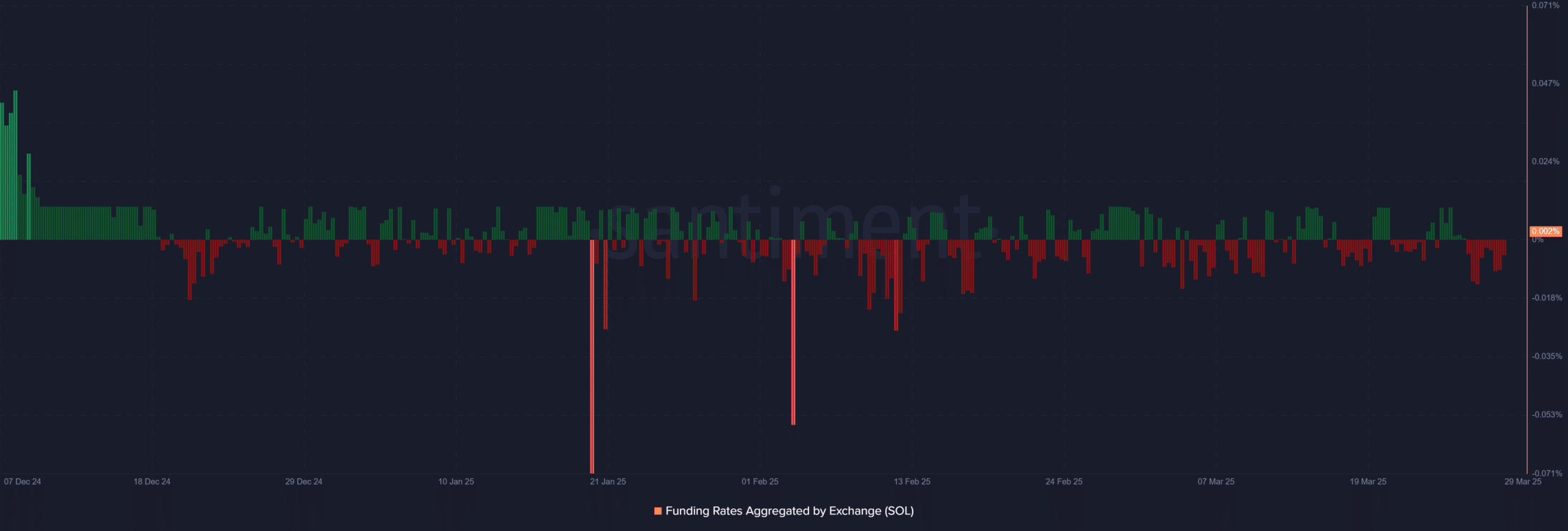

Mixed market sentiment

When analyzing the Funding Rates across exchanges, it’s clear that the sentiment among traders is mixed. At press time, the Funding Rate for SOL across exchanges is showing a value of 0.002343%.

This figure suggests that there is a neutral stance in the market, with no overwhelming bias towards long or short positions.

The fluctuations in the Funding Rate indicate that while traders are not extremely bearish, they are also cautious about making strong bullish moves.

Therefore, the market remains uncertain, waiting for more signals from the price action and broader market trends before committing to a clear direction.

Source: Santiment

Does the whale sale signal a downturn for SOL?

The recent whale sale of 60,289 SOL tokens may have sparked concerns about Solana’s short-term outlook. However, the network’s growth, alongside the retesting of key support, suggests that SOL is still in a healthy position.

Despite the price decline and mixed Funding Rates, the fundamental strength of the network and potential for a rebound makes the current situation more of a short-term correction.

Therefore, the whale’s move does not necessarily indicate a downturn; instead, it might be a strategic decision, with a market rally still possible in the near future.