- ETH traded above the realized price, showing long-term holder profits and an institutional-driven rally

- Binance leads ETH volume as institutional buys show renewed confidence post-Pectra upgrade

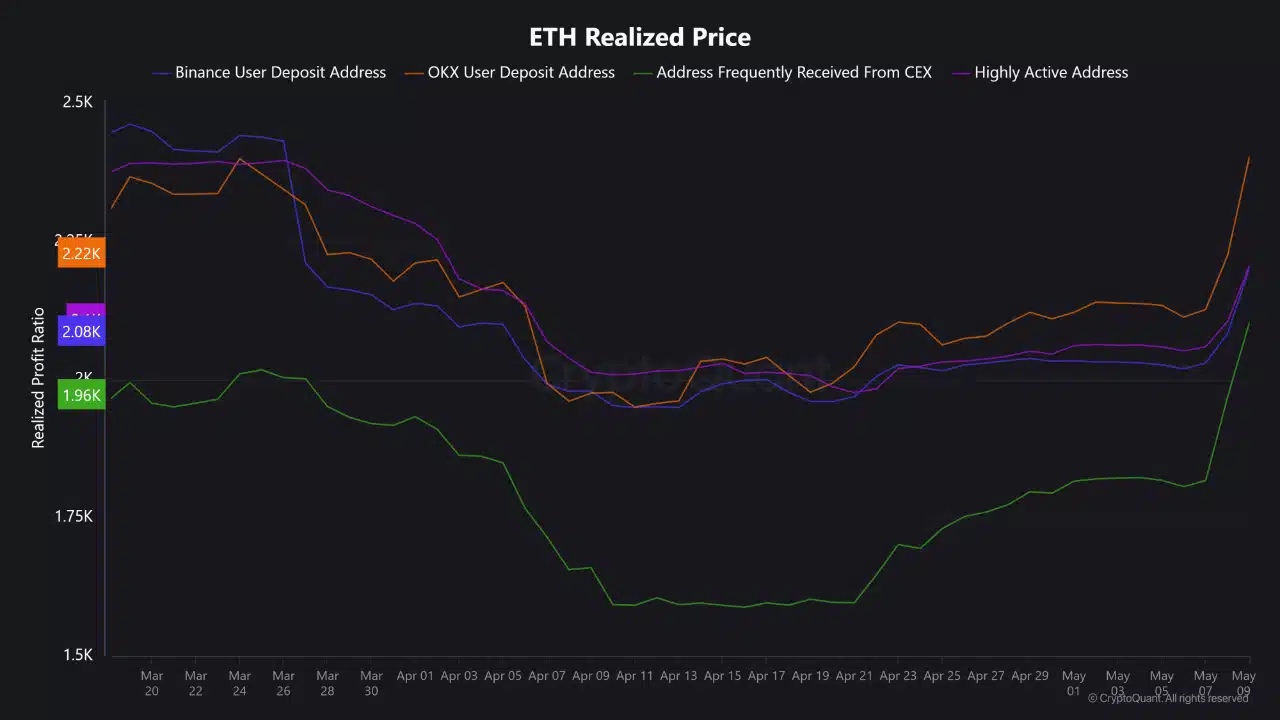

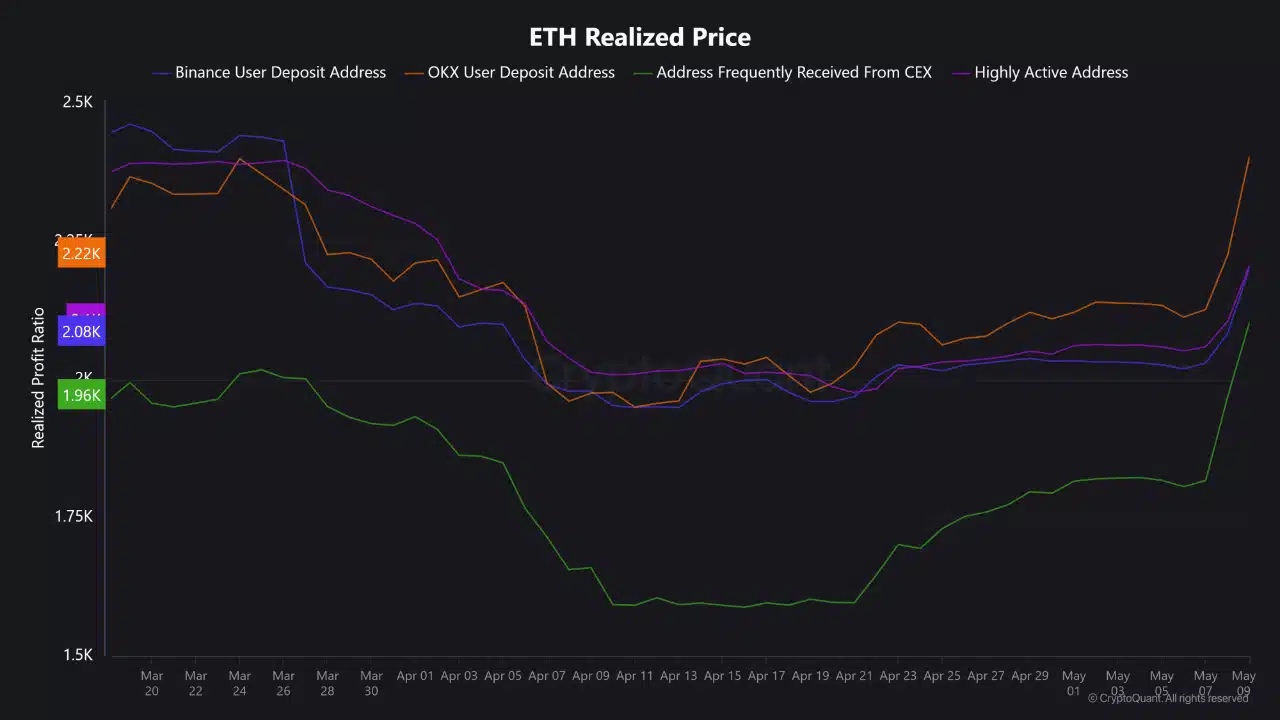

Ethereum [ETH] has crossed a critical threshold – its market price has moved above its realized value, showing a shift in sentiment among long-term holders.

Nowhere is this more apparent than on Binance, where rising trading volumes and increased profit-taking point to renewed conviction, deeper liquidity, and Ethereum’s reassertion of market leadership.

ETH long-term holders are now in profit

At the time of writing, Ethereum was trading above its realized price of $1,900. The average ETH holder, especially those in accumulation addresses, was in profit.

This acts as a marker of long-term investor confidence. When price climbs above realized value, historically, it correlates with stronger conviction among holders and a shift in trader psychology.

Source: CryptoQuant

The chart reveals that accumulating wallets began acquiring below $1,900, and current prices confirm those positions. This threshold flip often signals renewed capital inflows, especially from institutions and swing traders aiming to capitalize on momentum.

Since this breakout occurs despite weak retail participation, it suggests that larger investors are driving the move.

Additionally, it reinforces that ETH’s rally is backed by strategic accumulation, rather than pure speculation.

Binance takes the lead

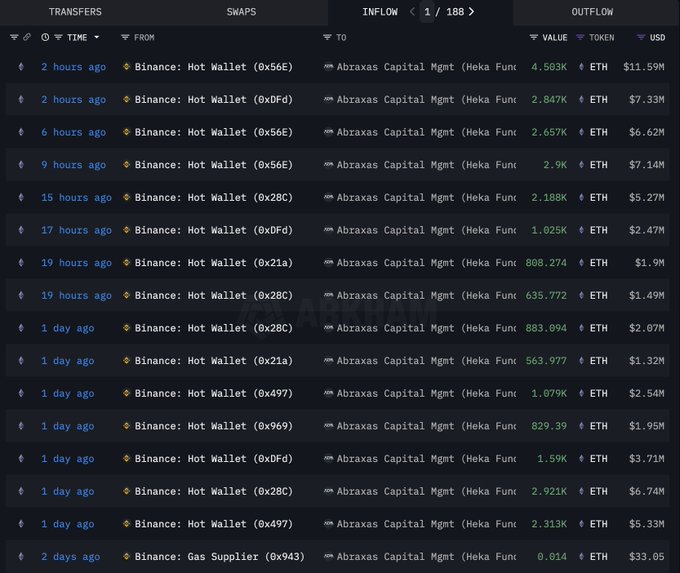

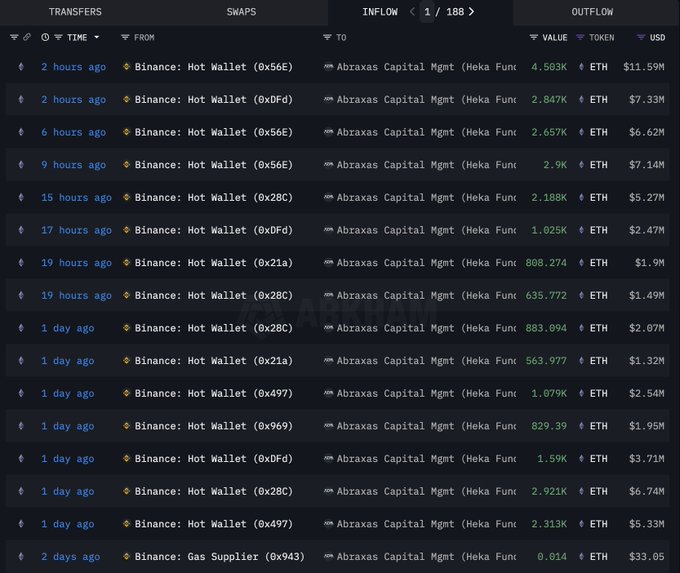

Recent inflow and outflow activity confirms Binance as the center of ETH trading. The exchange recorded the highest ETH transaction volume among all platforms, with outflows notably outpacing inflows during the price rise.

Source: CryptoQuant

The data illustrates that Binance users accumulated heavily during ETH’s dip, and are now realizing gains as price recovers above their average entry. Importantly, this dynamic doesn’t reflect market weakness – it shows strategic rebalancing on a platform known for high liquidity.

An example is Abraxas Capital’s aggressive accumulation of ETH via Binance recently.

Source: X

Ethereum’s price outlook

Ethereum’s surge to $2,600 aligns with the launch of the Pectra upgrade, which has likely added momentum to the recent bullish wave.

However, technical indicators show a short-term cooldown may follow. The RSI has breached the overbought threshold, now sitting above 80 – a level historically associated with pullbacks.

Source: TradingView

Meanwhile, the MACD supported upward momentum, suggesting any correction could be brief or shallow.

With ETH trading at $2,518 at press time, market structure remains bullish, but the next 24-48 hours could bring consolidation as traders digest both the rally and the upgrade news.