- Ethereum’s latest bullish divergence hinted at end of bearish trend and start of a bullish trend

- CVD revealed many DEX traders are taking profits or closing their positions

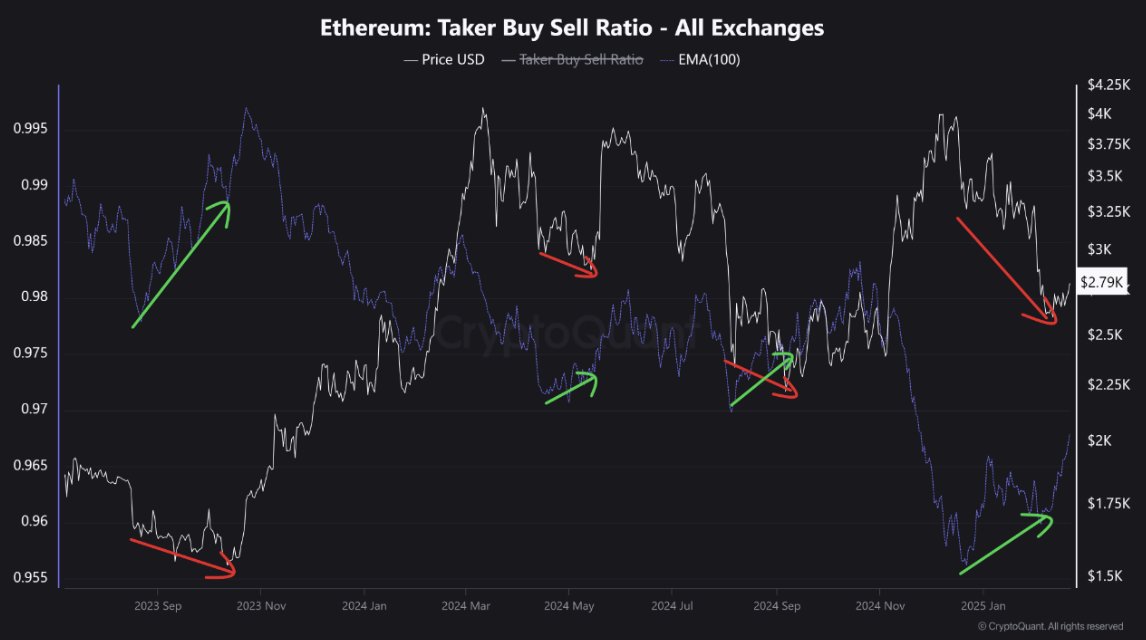

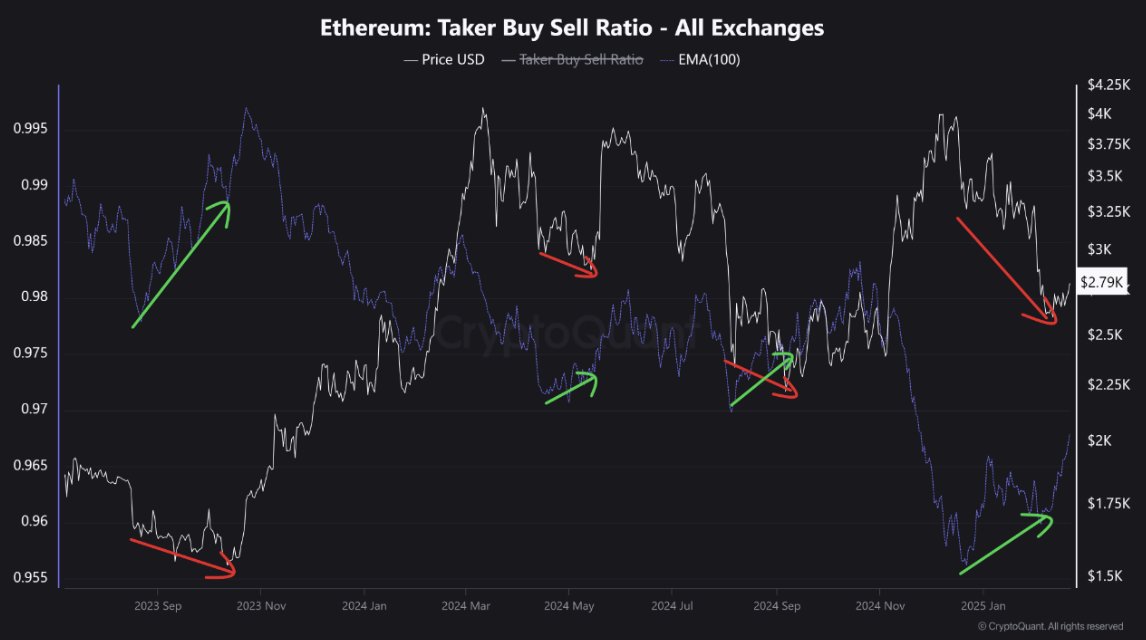

Ethereum’s (ETH) market, at press time, projected a major bullish divergence, one identified by the taker buy-sell ratio against the price trend. Such a divergence often precedes a market recovery on the charts.

For instance, back in September 2023, despite the price declining to close to $1,500, the taker buy-sell ratio began to climb – A sign of buildup in buying pressure. This soon resulted in ETH recovering towards the $2,000-level.

Also, from November 2024 to January 2025, Ethereum’s price plummeted to around $2,700. However, the taker buy-sell ratio again flashed an uptrend, highlighting potential buying interest despite the fall in the altcoin’s price.

Source: CryptoQuant

Historically, such patterns signal the end of bearish phases and initiate new bullish trends.

Its latest interplay suggested that despite the press time price of $2,800, an uptrend could be imminent. This could mirror past patterns where rising taker buy activity correlated with price recoveries.

Whales vs Smart DEX traders

Furthermore, recent activities across the Ethereum ecosystem presented a striking contrast between large-scale buyers and active traders on decentralized exchanges. This was in the midst of rising prices, before the sharp drop due to the Bybit hack where $1.4 billion ETH were lost.

Notably, whale accounts have ramped up their holdings by accumulating an additional 140,000 ETH – Signaling a bullish position or a long-term hold. This mass acquisition seemed to be in line with an uptrend in ETH’s price, hinting at strong confidence among large holders.

Source: iCryptoAI/X

Ethereum’s log curves

Ethereum, at the time of writing, was trading in the oversold zone. This historically means a potential reversal on the charts. ETH’s price seemed to be trading below this critical threshold within the log curve zones – Increasing the likelihood of a price bounce.

Historically, such positioning has preluded major rebounds, like in mid-2017 and late 2020. During this period, ETH navigated from the oversold region to higher zones, reflecting strong buying interest at perceived value levels.

Source: Coinvo/X

Conversely, while oversold conditions often herald recoveries, external market shocks or broader bearish sentiment could override this potential, pushing ETH further down before any major recovery occurs.

The prevailing oversold status could catalyze a bullish reversal or trigger a longer downtrend.