- Sei Network’s growth can be highlighted by a 124.75% surge in daily active addresses

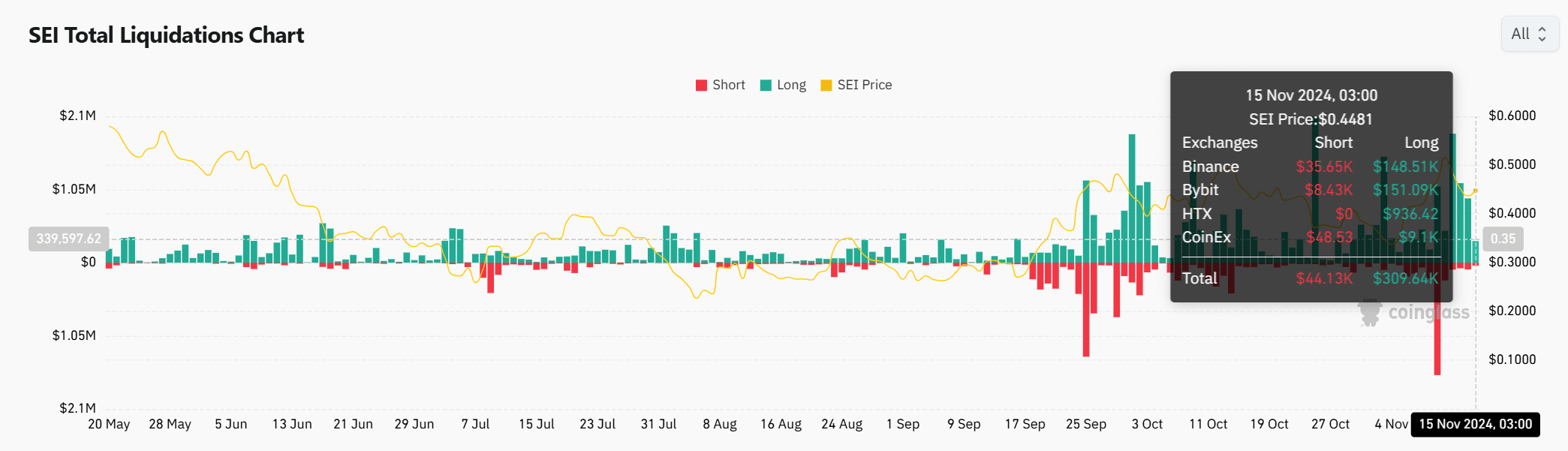

- High development activity and significant long liquidations underlined both commitment and volatility around SEI

Sei Network [SEI] has seen unprecedented growth lately, with a 124.75% surge in daily active addresses pushing its figures to an impressive 182,825. This rapid hike in user engagement underscored rising interest in SEI, fueling speculation about its future potential within the crypto ecosystem.

However, while user growth is a sign of enthusiasm, the market remains uncertain. Will SEI leverage this momentum to solidify its place among top blockchain networks? Let’s explore SEI’s technical indicators and on-chain metrics to understand its possible trajectory.

Technical analysis – Will SEI overcome key resistance levels?

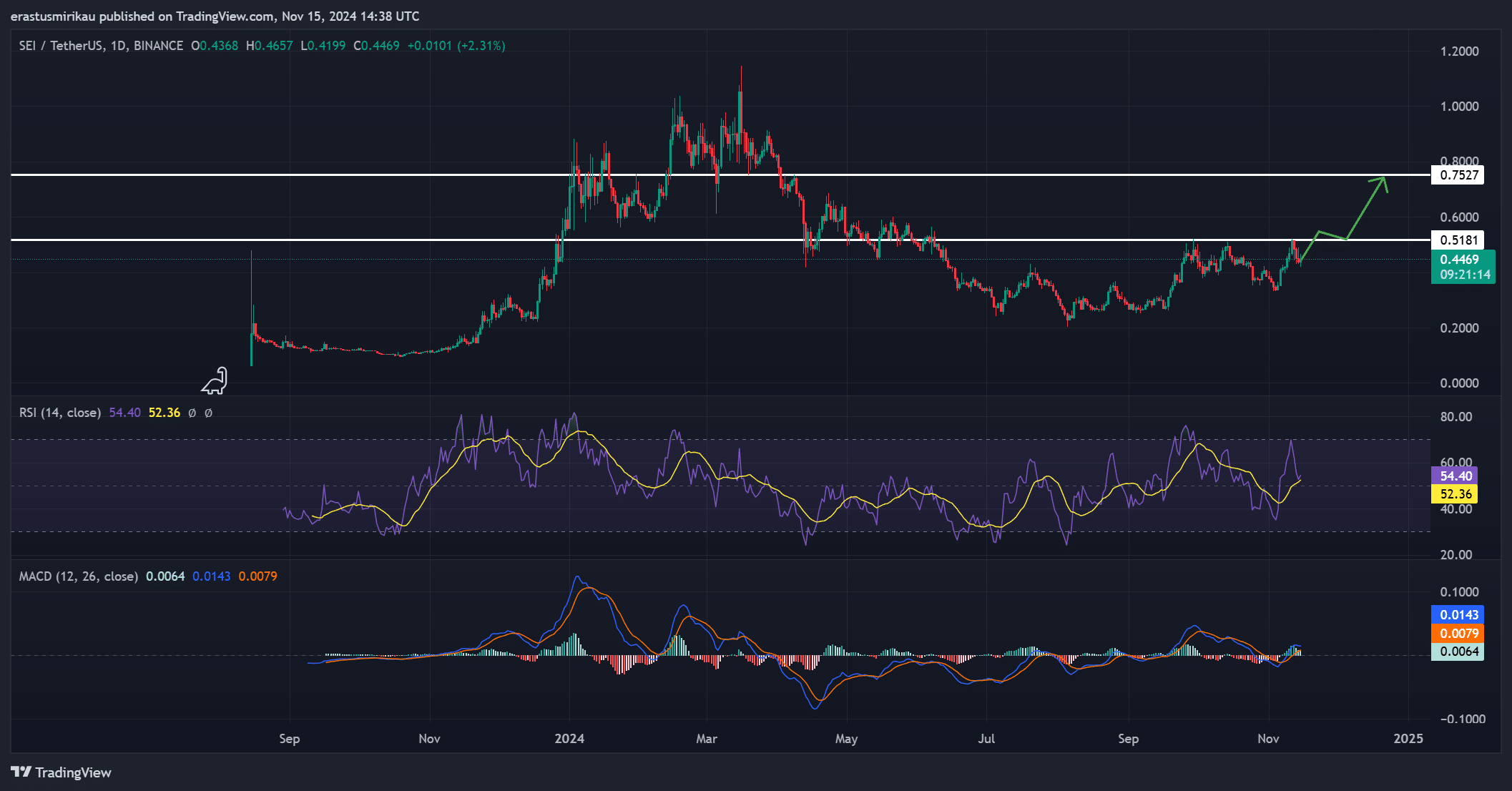

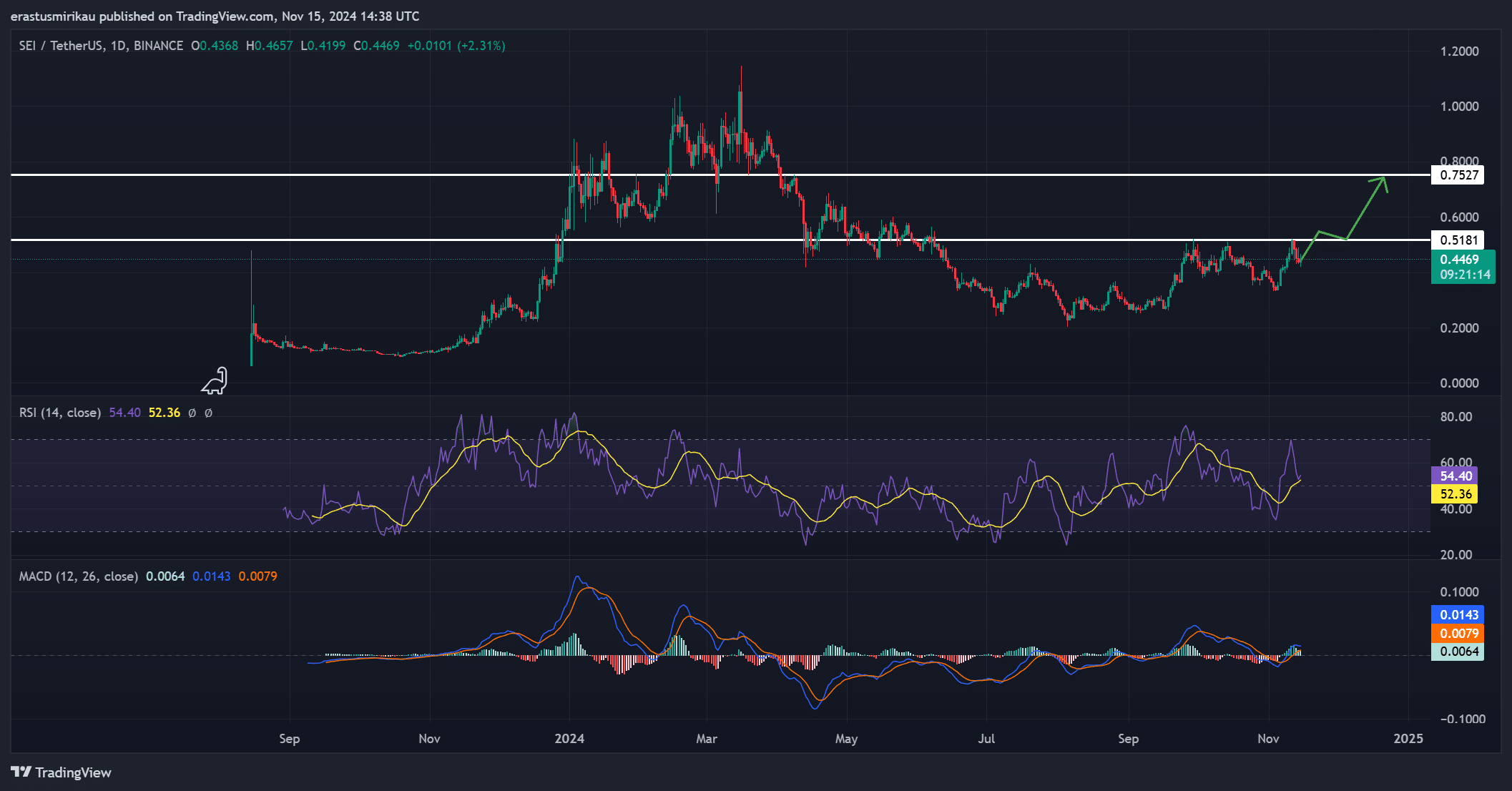

For SEI to continue its upward trajectory, it must clear its critical resistance at $0.5181 – A level it was testing at press time, with a secondary target at $0.7527. These levels are essential to watch, as breaking through them could confirm a bullish continuation, while failure may lead to a pullback and affect trader sentiment.

Additionally, the RSI sat at 52.36, suggesting that SEI may have room for growth without immediate overbought concerns. The MACD, showing a slight positive divergence with a recent crossover, indicated potential upward momentum.

A sustained push beyond $0.5181 could mean a bullish rally towards higher resistance levels.

Source: TradingView

Development activity – Consistent progress reflects growth potential

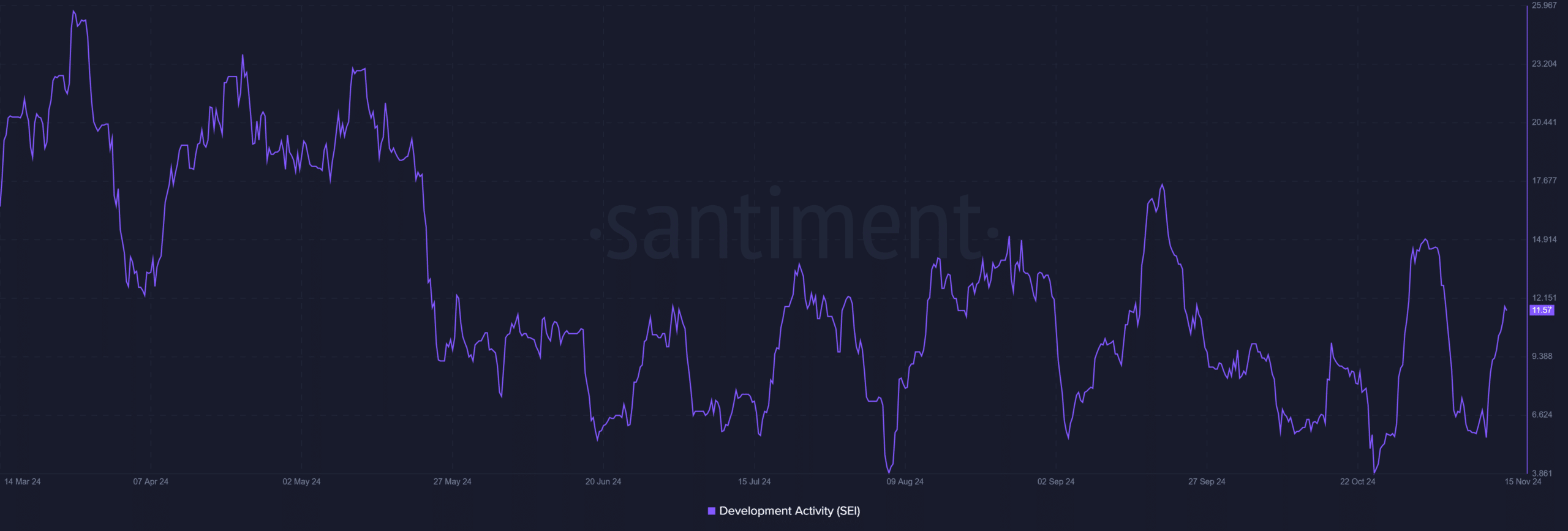

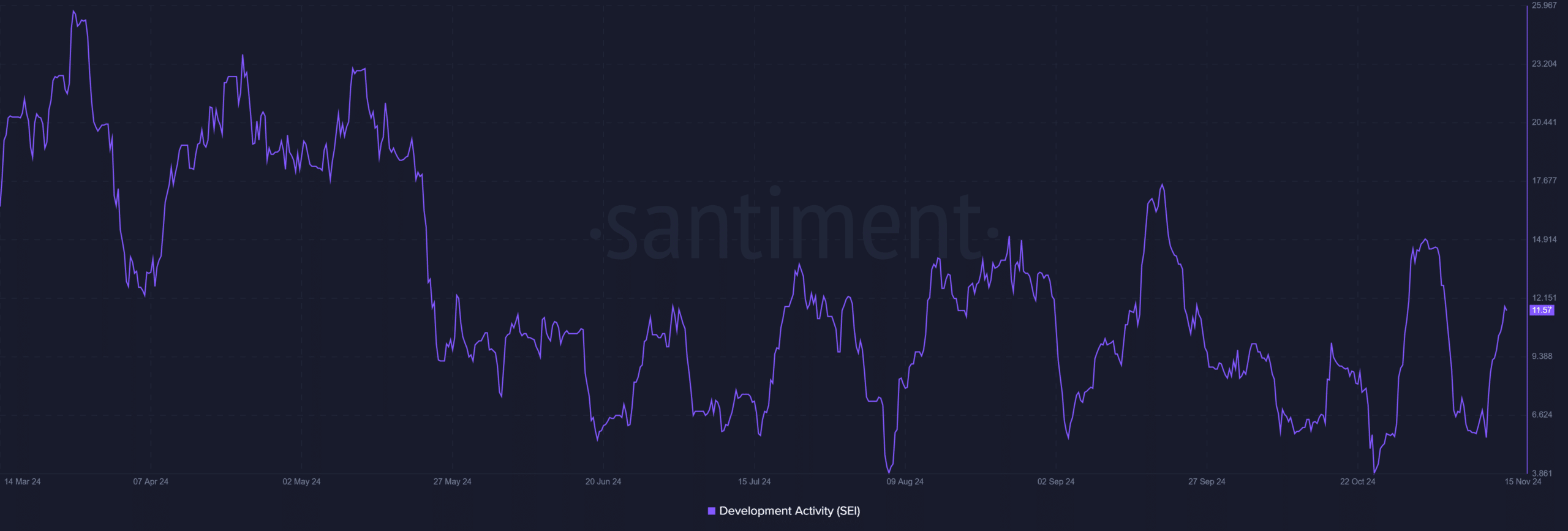

Development activity climbed from 10.57 to 11.57, showcasing continuous improvements and commitment from the developer community. This steady progress is a sign of the team’s dedication, which is vital for maintaining investor confidence.

Additionally, high development activity often points to a robust project foundation, attracting long-term holders. Therefore, as SEO continues to develop, it will reassure investors that the team is committed to long-term growth, not just short-term hype.

Source: Santiment

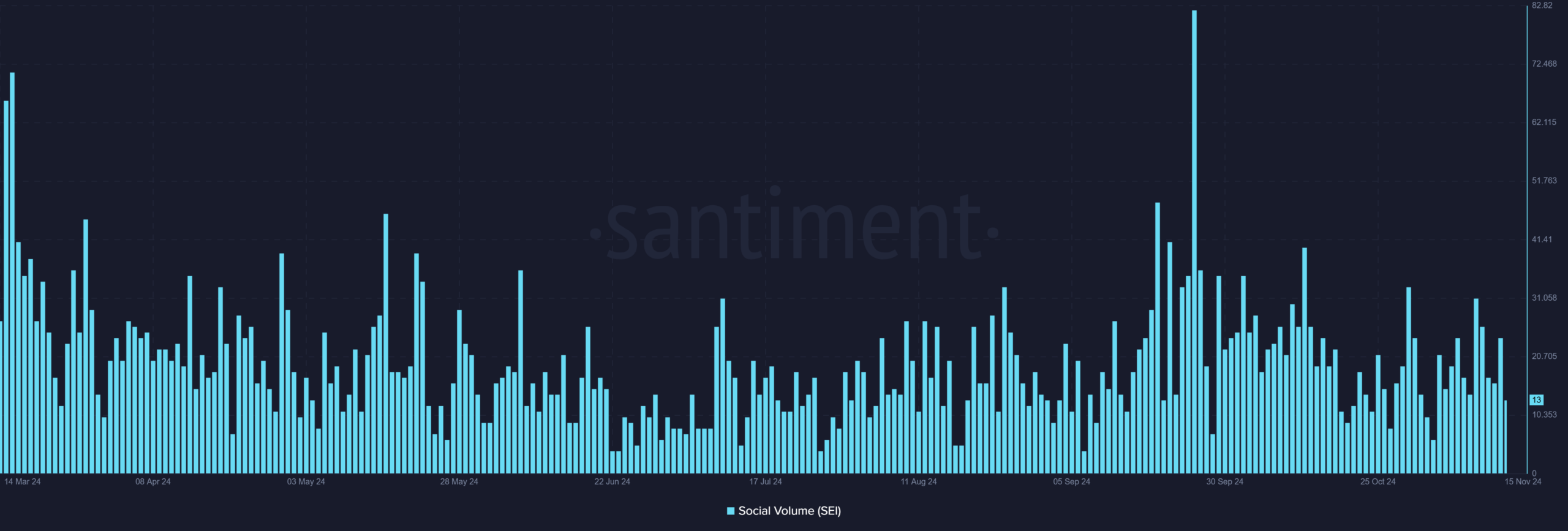

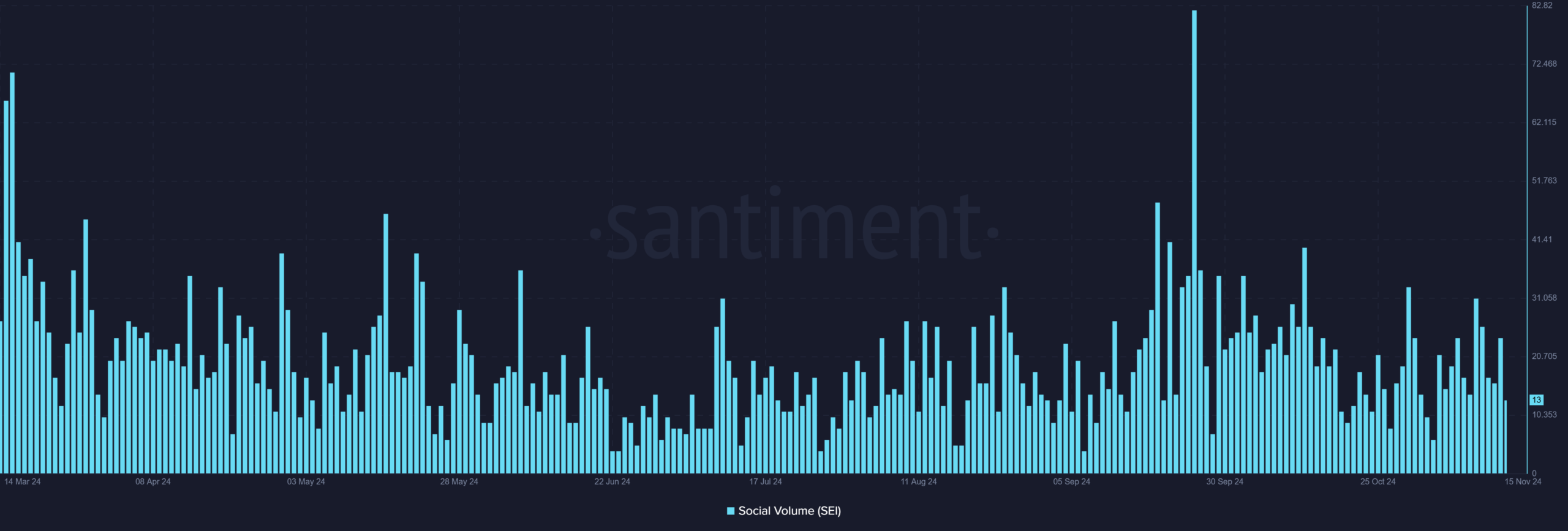

SEI social volume – Is the hype fading?

Its social volume recorded a sharp drop from 24 to 13 in a single day. This decline indicated reduced online discussions, potentially suggesting cooling public interest.

However, a dip in social volume doesn’t necessarily signal the end. It could mean a transition from hype to organic, stable growth. If SEI can sustain development and break resistance levels, renewed interest could follow. This will support its growth in a more stable market environment.

Source: Santiment

Liquidations – Bulls and bears battle for control

Source: Coinglass

Realistic or not, here’s SEI’s market cap in BTC’s terms

Conclusively, Sei Network’s recent growth and active development set a promising foundation for future success. However, SEI must overcome resistance levels and sustain development activity to secure its place in the competitive crypto market.

If it achieves these goals, Sei Network could indeed capitalize on this momentum and establish a lasting presence.