- Shiba Inu whales have sold 801 billion tokens in 24 hours.

- The memecoin was up by 8.45% over the past day until press time.

Over the past three days, crypto markets have experienced extreme volatility. With the widespread crash, investors, retailers, and whales have expressed heightened panic and fear.

Thus, as the market crashed, Shiba Inu [SHIB] whales turned to selling. Inasmuch, whale activity on the sell side has spiked over the past day.

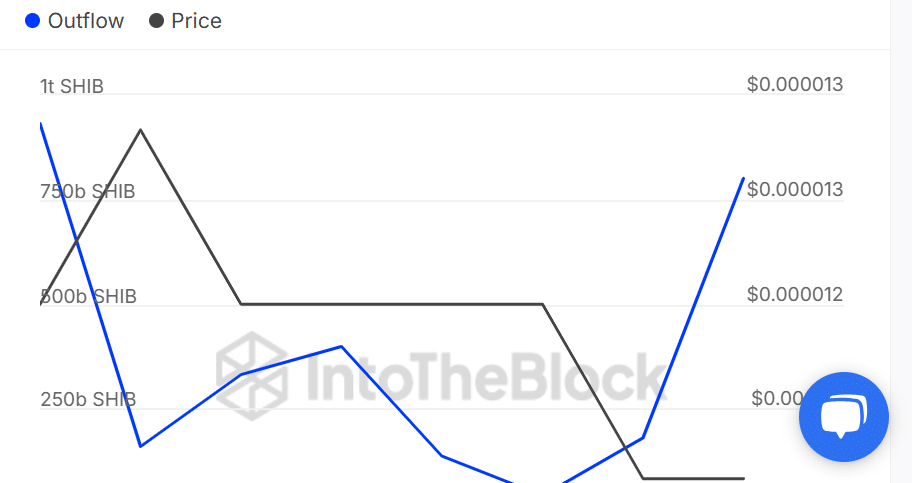

Source: IntoTheBlock

According to IntoTheBlock, Shiba Inu whales have sold 801.04 billion tokens, an increase from 180.76 billion the previous day. This marked a 343.18% increase in large holder’s outflows.

Such a spike implies that Shiba Inu whales are aggressively selling than they are buying.

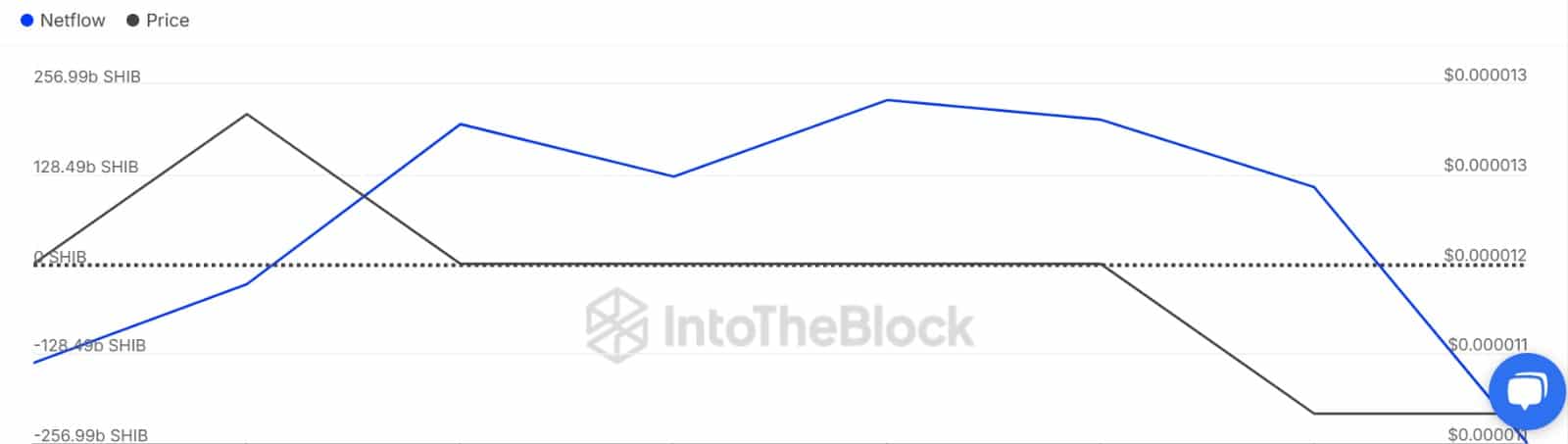

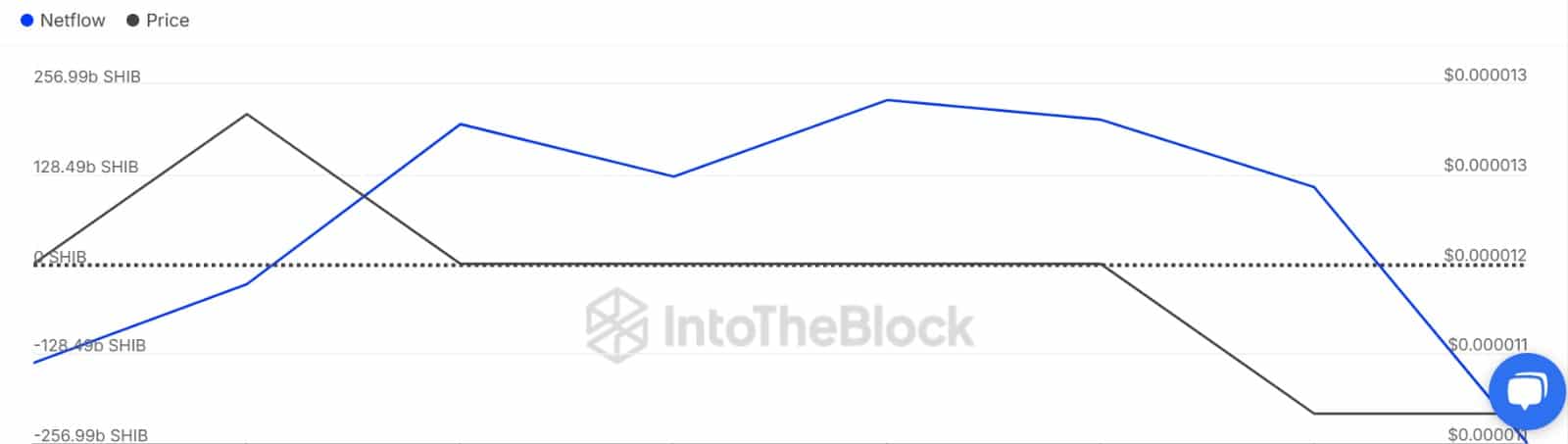

Source: IntoTheBlock

In addition, there has been more selling from large holders than capital inflows. This was evident through the large holder’s netflow, which experienced a sharp decline, dropping into negative territory.

At press time, the netflow sat at 256.9 billion. When netflow hits negative, it implies that there’s more capital outflow from large holders than inflows. Thus, whales only bought 544 billion tokens over the same period.

Such a negative imbalance suggests that large holders are currently at the crossroads, lacking conviction with the market.

When whales turn to massive selling, it implies that they are bearish and expect prices to drop, thus they turn to sell and cut losses.

Impact on SHIB?

As expected, increased offloading from whales has negatively impacted Shiba Inu’s price movement. On the daily charts, the memecoin has dropped from a high of $0.00001173 to a low of $0.00001125.

As of this writing, Shiba Inu was trading at $0.00001131.

This decline after showing signs of recovery from the past day and rising by 8.45% suggests that whale-selling activity is being felt in the market. The question is; is Shiba Inu set for more losses?

What’s next for the memecoin?

According to AMBCrypto’s analysis, Shiba Inu faced strong downward momentum amidst soaring selling pressure, as evidenced by the declining Stoch RSI and MACD.

Looking at the Stoch RSI, it has declined to 3.23 from 11 over the past 24 hours until press time. Such a dip suggests the downward momentum is stronger than ever before.

Source: TradingView

This is further validated by the MACD line, which has declined into the negative territory. With these momentum indicators declining, they suggest a continuation of the prevailing trend.

Therefore, if selling activity continues while bearish momentum remains strong, Shiba Inu could drop to $0.000010. For a bullish reversal to emerge, the memecoin needs a daily close above $0.00001142.