- Terra Classic (LUNC) is eyeing breakout with targets at $0.00058046, $0.00098584, and $0.00139122

- Rising trading volume and cautious bullish sentiment can drive LUNC as traders monitor key support levels

The crypto market is closely watching Terra Luna Classic (LUNC) after analysis pointed to the potential for a breakout, one that could result in an over 1,100% rally. LUNC was priced at $0.0001115 at press time, with a 24-hour trading volume of $23,876,010.

The token has seen a 2.20% hike over the last seven days, although it did fall by 2.02% in the last 24 hours too. With a circulating supply of 5.5 trillion tokens, $LUNC held a market cap of $614,461,915.

According to Javon Marks’ analysis though, previous breakouts for $LUNC successfully met three major price targets, driven by strong volume and market participation. However, the altcoin’s price chart seemed to be suggesting a similar potential breakout again, one that could lead to price levels of $0.00058046, $0.00098584, and $0.00139122. Especially if bullish momentum builds under favorable conditions.

Source: X

Technical patterns point to consolidation and potential for upward movement

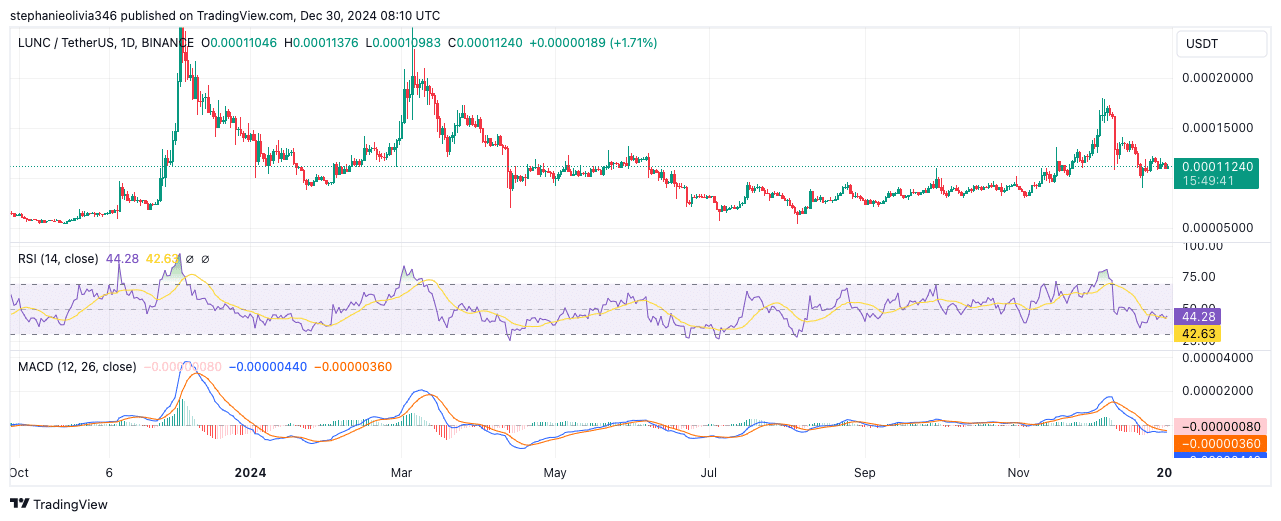

Terra Classic’s price chart highlighted a consolidation phase, one that could serve as a foundation for future bullish action. In fact, analysts have in the past noted higher lows and a symmetrical or rounded pattern, often associated with trend continuation. These indicators, together, often could suggest that LUNC may be preparing for a breakout.

At press time, however, these technical indicators flashed mixed signals. For example – The RSI sat at 43.49, indicating bearish momentum but near neutral territory, alluding to possible stabilization.

Additionally, the MACD flashed a bearish crossover, with the MACD line at -0.0000087 below the signal line at -0.00000362, reflecting weak momentum. The key support was identified at $0.00009883, which will need to hold for any recovery to materialize.

Derivatives market highlighted greater trading activity

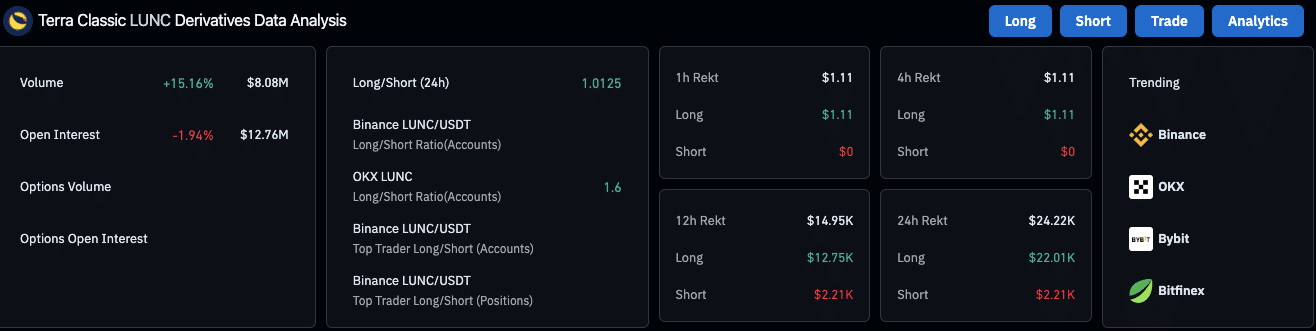

The derivatives market for Terra Classic saw a 15.16% hike in 24-hour trading volume, hitting $8.08 million. This growth indicated heightened interest among traders.

However, Open Interest declined by 1.94% to $12.76 million, reflecting some closures of existing positions. This combination of rising trading activity and declining Open Interest may signal indecision among market participants.

Additionally, the long/short ratios revealed cautious optimism. On Binance, the ratio stood at 1.0125, showing near-equal sentiment between long and short positions.

Meanwhile, OKX reports a ratio of 1.6, reflecting a stronger bullish sentiment among its traders.

Liquidation data suggests low leverage activity

In the last 24 hours, $24.22k in liquidations were recorded, with $22.01k from long positions and $2.21k from short positions. The higher liquidation of long positions indicated that bullish traders have been facing challenges during price fluctuations.

However, the relatively low liquidation figures also alluded to limited leverage activity, reducing the risk of extreme price swings.

Owing to these developments, Terra Classic remains a closely watched asset as traders evaluate its potential for another breakout.