- Tron’s whale netflows dropped 121.7% in 7 days despite rising TVL and price gains.

- TRX long positions dominate at 65%, showing crowd optimism but increasing downside risk.

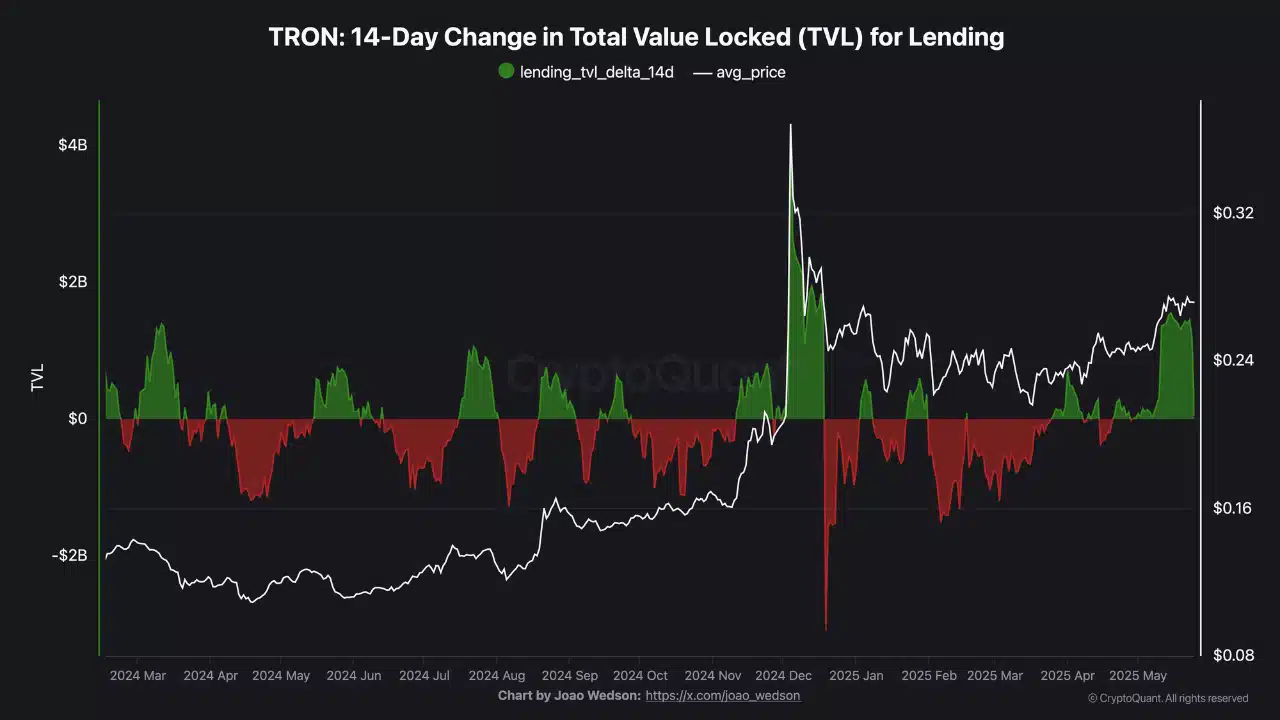

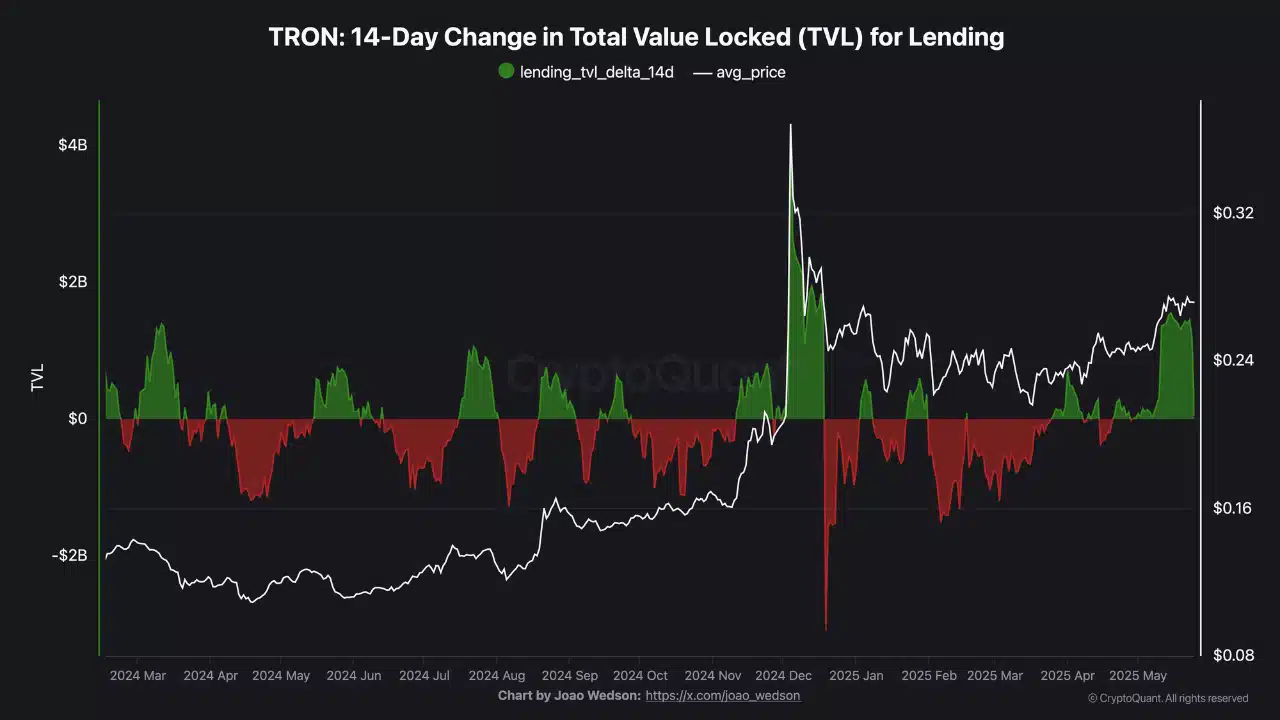

TRON’s [TRX] ecosystem is witnessing a notable uptick in Total Value Locked (TVL), a key indicator of capital inflows and investor confidence.

Historically, TRX has shown a strong correlation with TVL trends — rising liquidity often fuels price gains, while capital outflows signal weakening sentiment and downside pressure.

While the current surge reflects bullish conviction and improved yield appetite, such spikes can also stem from fear of missing out (FOMO), leading to unsustainable inflows driven by greed rather than fundamentals.

Therefore, relying solely on TVL growth as a bullish trigger may overlook underlying risk factors, especially if the rally is driven more by emotion than fundamentals.

Source: CryptoQuant

Why are whales staying quiet while TVL climbs?

Despite TRON’s TVL rising, large holder netflows tell a different story. Over the last 90 days, whale netflows dropped by 111.36%, while the 7-day change plummeted by a staggering 121.7%.

This persistent decline suggests that large holders are either exiting positions or choosing not to accumulate during the current rally.

Historically, sustainable uptrends require institutional or whale support to maintain momentum. Therefore, the absence of meaningful whale activity may indicate underlying weakness.

Source: IntoTheBlock

Are TRX traders becoming too confident?

Tron’s Long/Short ratio on Binance rose to 1.86, with 65.07% of accounts positioned long. This shows clear bullish sentiment, likely influenced by rising TVL and recent price momentum.

However, overly skewed long positioning can become a liability. If prices pull back, these positions face liquidation risk, which can accelerate downside pressure.

Moreover, such imbalances often precede corrections, as overconfidence creates a false sense of security.

Thus, while trader optimism remains high, it also reflects growing exposure to abrupt trend reversals.

Source: IntoTheBlock

Does TRX transaction activity confirm institutional interest?

The latest transaction data reveals a surge in small-volume activity, particularly in the $0–$1 range, which jumped 9.73%.

Meanwhile, transactions over $1 million dropped nearly 80%, and the >$10 million bracket recorded a full 100% decline.

This suggests that retail players dominate recent activity rather than institutions or whales. Retail-driven rallies tend to be more volatile and emotionally charged.

Therefore, while activity is rising, it may not reflect sustainable growth or long-term accumulation by strategic market participants.

Source: IntoTheBlock

Are liquidations hinting at balance or building risk?

Liquidation data from the 26th of May shows modest volume, with $10K in short liquidations and $6.79K in long liquidations. While this reflects low immediate volatility, the imbalance still leans bullish.

However, this also means long traders have not faced significant liquidation pressure yet, leaving the market exposed if sentiment shifts. In euphoric setups, the absence of forced exits can be misleading.

Therefore, current liquidation trends may precede volatility spikes once a retracement begins, especially if longs remain crowded.

Source: TradingView

Is the rally sustainable or setting up for a correction?

Although TRON’s rising TVL and bullish positioning have supported recent price gains, underlying metrics reveal a fragile structure.

The absence of whale accumulation, dominance of retail trades, and skewed long bias all suggest the move might be more speculative than fundamental.

Therefore, this uptrend may not last unless institutional confidence steps in to validate the momentum.