- The MVRV ratio declined to 1.24, but more than half of FLOKI global holders remained in profit.

- FLOKI broke out of a parallel channel and could now be on its way towards the $0.00005 level.

The memecoin market continues to bleed, with the MVRV ratio for FLOKI showing a MVRV of 1.24 per IntoTheBlock, indicating that the average holder’s purchase price was lower than the current market price.

This suggested a generally profitable position for most investors. Historically, an MVRV above 1 often signals that holders could start taking profits especially as prices trends down, which could increase selling pressure.

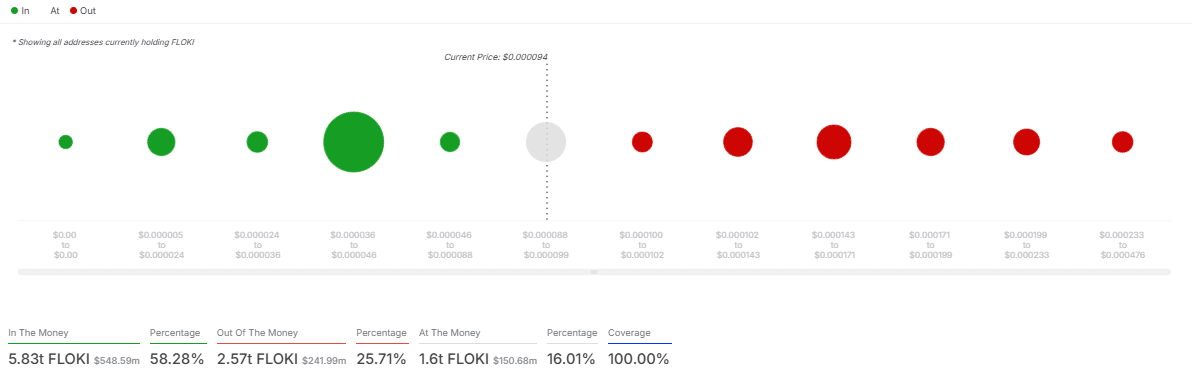

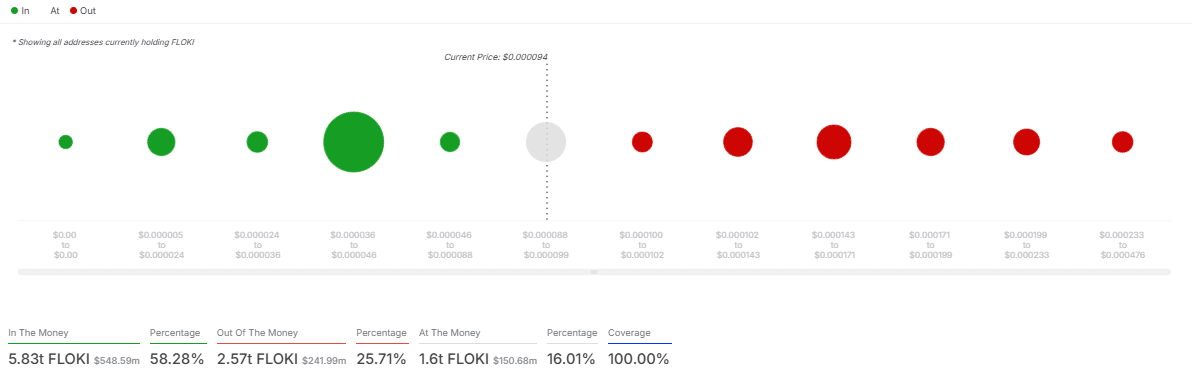

Simultaneously, the “In/Out of the Money” data revealed that 58.28% of FLOKI holders were in profit, with a substantial amount still holding coins bought at lower prices.

This profitability ratio, despite a recent decline in the MVRV, showed resilience in holder sentiment.

Source: IntoTheBlock

An unexpected rise in MVRV could trigger FOMO, pushing prices up rapidly. Conversely, a sharp decline might incite panic selling, leading to further drop in FLOKI price.

In essence, while a significant portion of the market remains ‘In the Money,’ the health of the MVRV ratio at 1.24, despite being lower than previous highs, still supports a cautiously optimistic outlook for FLOKI.

What are potential targets for FLOKI?

FLOKI recently breached the confines of a parallel channel, confirming a bearish breakdown that could send its price toward $0.00005.

The sideways channel had formed just around its highs of the recent bullish trend that run through Q4 of 2024.

The memecoin is currently trading at $0.00009535, failing to reclaim its previous support level around $0.00011, which has now turned into resistance.

This price level is crucial as it serves as the immediate resistance point following the breakout.

A sustained move above this could invalidate the bearish outlook, opening the way towards $0.00014 and beyond.

The Fibonacci retracement levels indicated that the 0.618 level at $0.0001055, just below $0.00011, has been tested and rejected, reinforcing the bearish outlook.

Source: Ali/X

If selling pressure persists, FLOKI may slide further toward the 0.5 Fibonacci level at $0.00007294, followed by the 0.382 level at $0.00005041, which aligns with the anticipated bearish target.

A breakdown below this zone could see FLOKI extending losses toward $0.00003192 at the 0.236 Retracement Level.

Conversely, a recovery above $0.00011 could invalidate this bearish structure, pushing the price toward $0.00017 before testing $0.00025.

However, momentum remains weak, making further downside more likely unless buyers regain control at key support levels. The next sessions will be crucial for determining FLOKI’s trajectory.