- SOL declined by 35.5% over the past months.

- Solana’s daily Active Addresses and on-chain activity declined, signaling downward pressure.

Since hitting a local high of $195 three weeks ago, Solana [SOL] has experienced strong bearish pressure. Over this period, Solana has declined to hit a three-month low.

With such a strong downtrend, the question is what’s causing Solana to decline? Analysis suggests that Solana is struggling fundamentally with low on-chain activity.

Solana’s On-chain activity decline

Solana’s chain activity has been on a steady decline over the past months. As such, the network’s number of daily active addresses has declined to hit a three-month low of 3.5 million.

Source: Artemis

When active users decline, it reflects a strong decline in market interest and lower adoption. Often, lower active users lead to reduced on-chain activity, which could result in price depreciation.

Historically, a lower number of users typically correlates with price decline as demand drops.

Source: Artemis

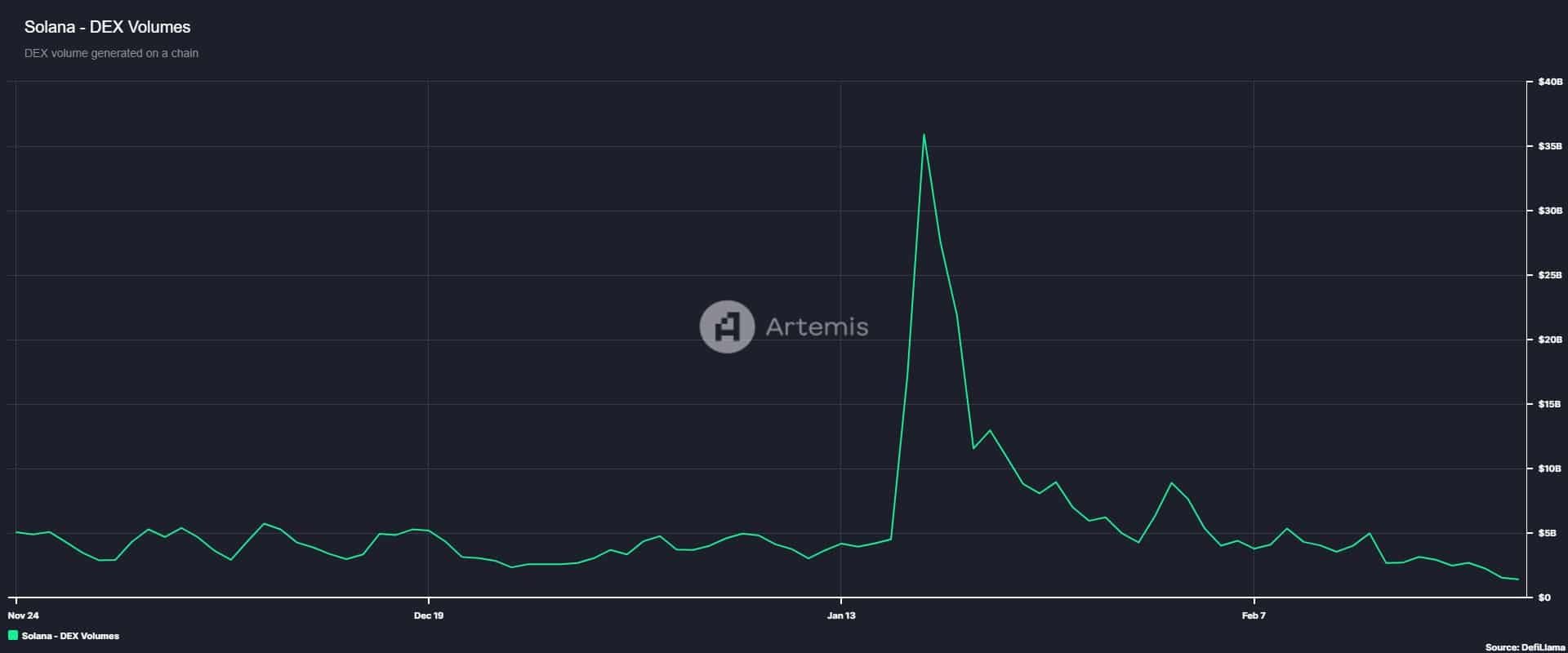

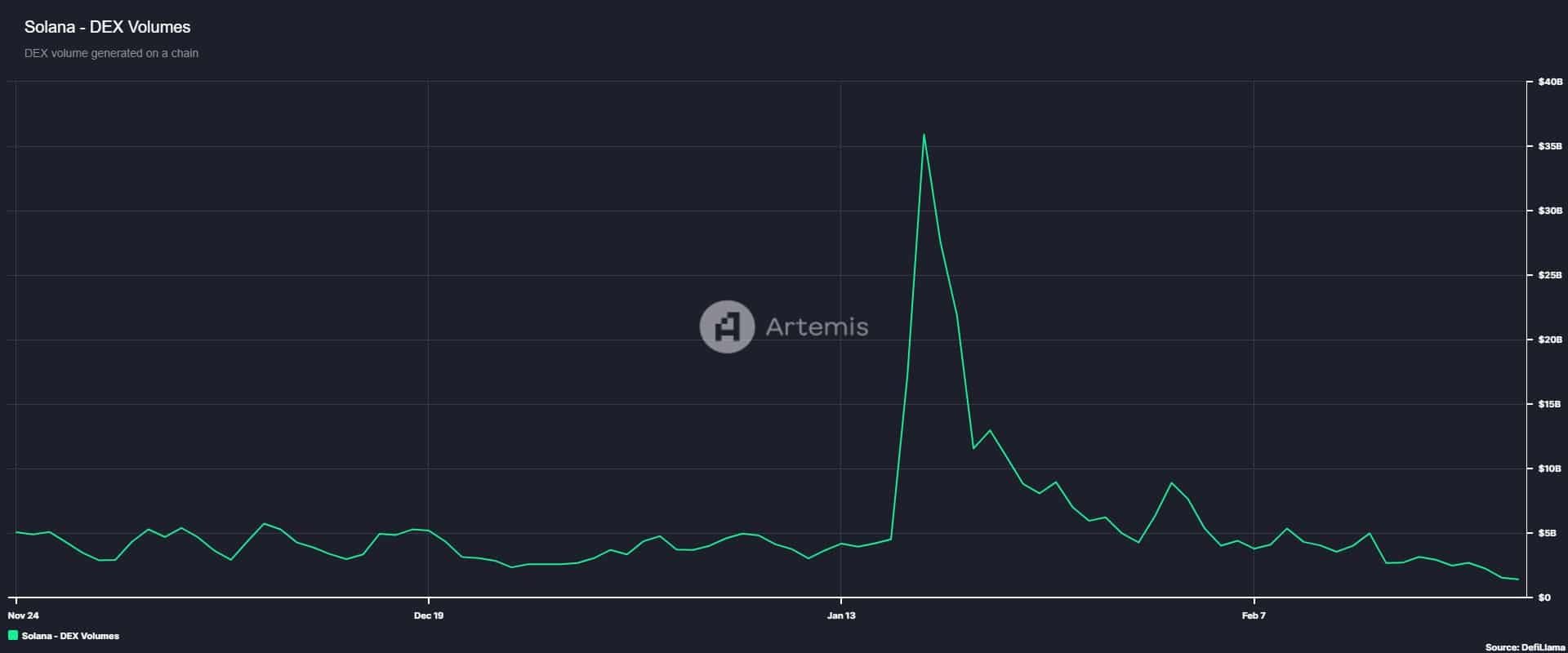

This reduced on-chain activity on Solana is further evidenced by the declining Decentralized Exchange (DEX) trading volume. According to Artemis data, this has dropped to hit a four-month low of $1.5 billion.

Such a decline suggests reduced trust in the network, as investors prefer Centralized Exchange (CEX) over security concerns.

Source: Artemis

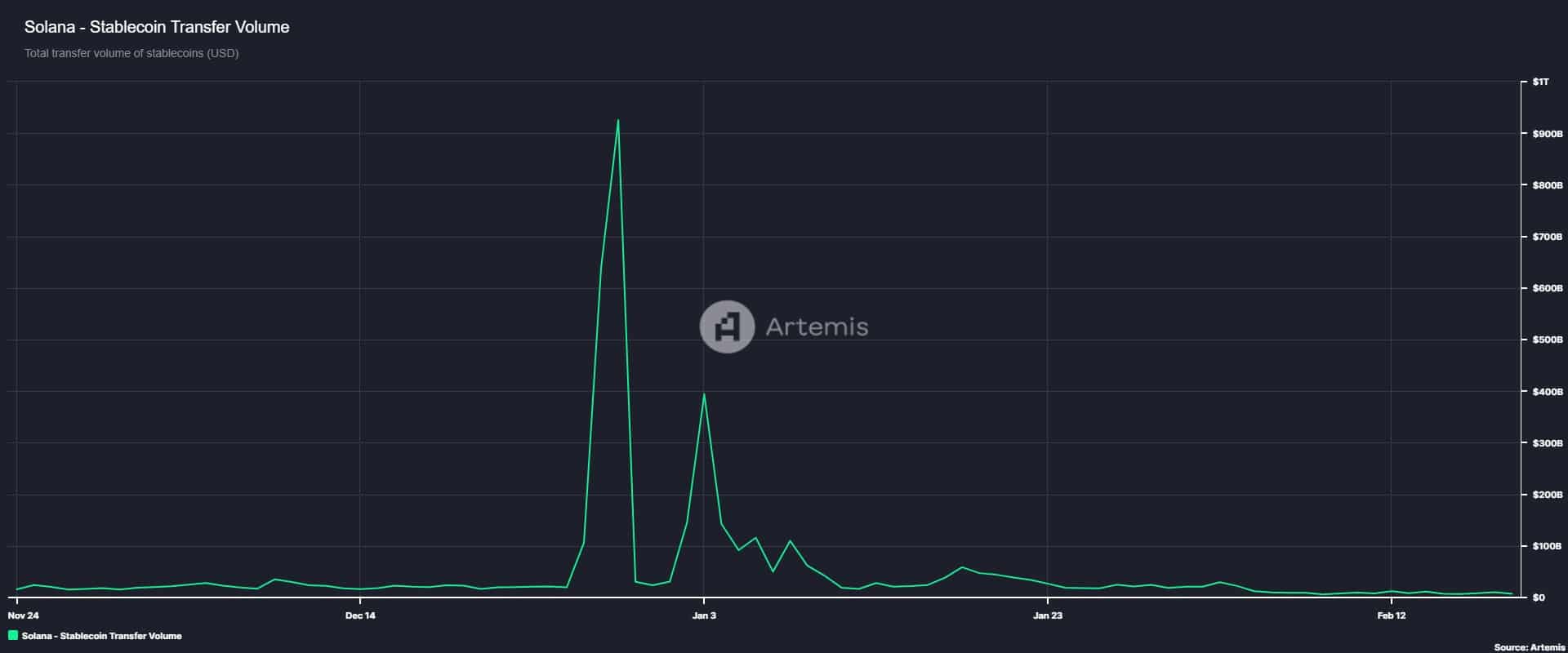

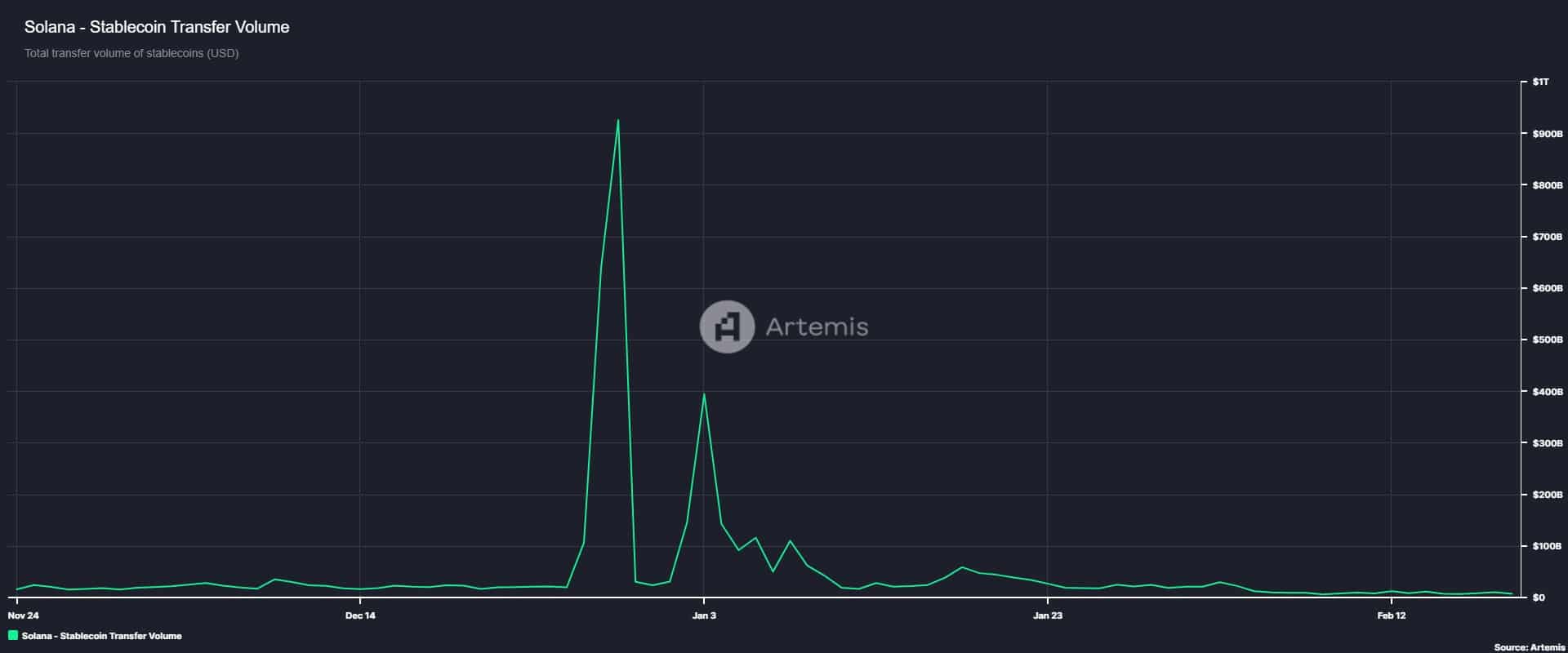

Additionally, Solana’s stablecoin transfer volume has declined to $7.1 billion. This marks a sustained decline from $394 billion a month ago.

Such a significant drop suggests that investors, especially large ones, are considering other chains like Ethereum’s [ETH].

This also reflects a risk-off sentiment among SOL investors.

Impact on SOL?

As expected, reduced on-chain activity has negatively affected Sol’s price movements. This has impacted SOL’s demand side. Usually, low demand leads to less buying pressure, leaving the market to sellers and resulting in downward price pressure.

At the time of writing, Solana was trading at a three-month low of $158. This marked a 7.09% decline on daily charts. Solana has also dropped by 35.52% over the past month.

With strong downward pressure and low demand, SOL could decline further.

If the current trend persists, SOL risks dipping to $154. However, if buyers take this opportunity to buy the dip, SOL could recover to $175.