- BTC’s non-empty wallets have hit a 5-month low, reflecting retail traders’ growing concerns amid market volatility.

- Large Bitcoin holders continued to accumulate, signaling potential bullish sentiment despite smaller investors exiting.

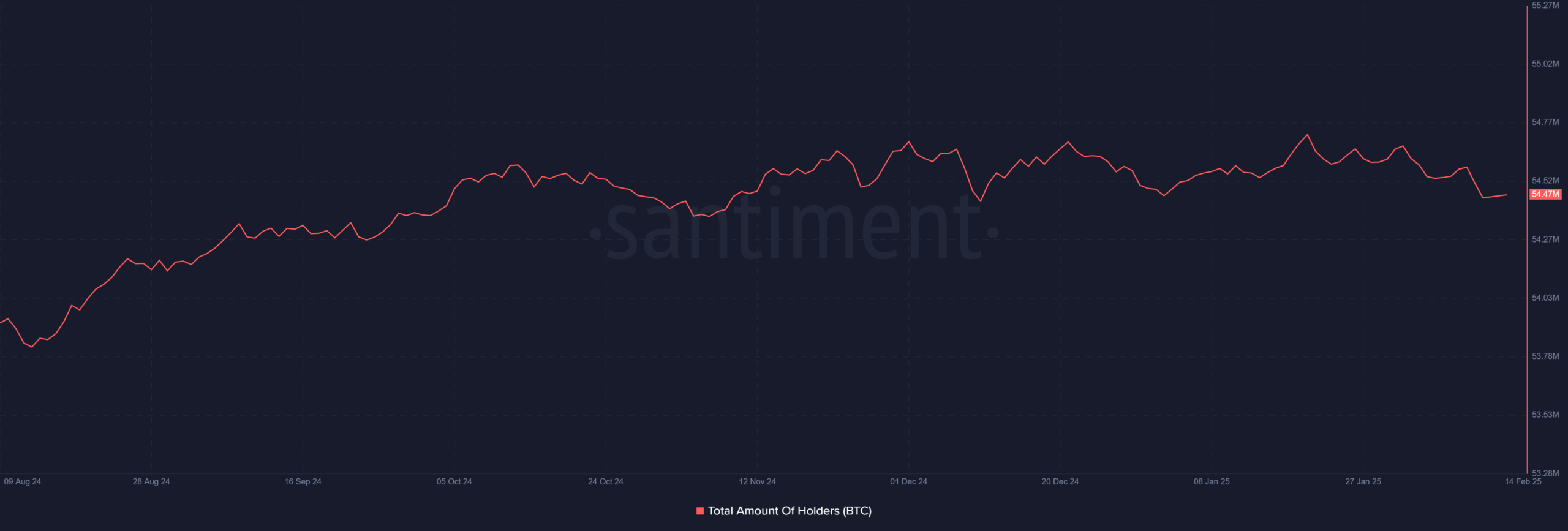

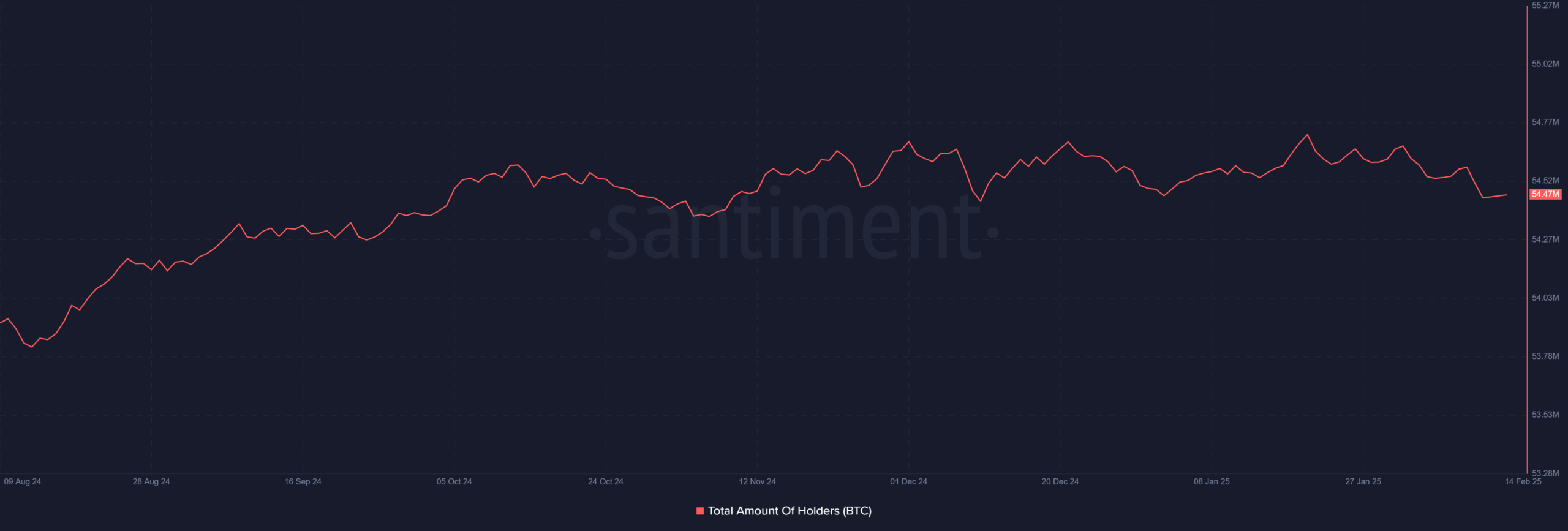

Bitcoin’s[BTC] network has witnessed a notable decline in the number of active wallets, hitting a five-month low of around 54 million non-empty wallets.

This drop signals increasing retail capitulation as smaller traders exit their positions, likely due to recent market uncertainty. The question now is whether whales are stepping in to absorb the selling pressure.

Retail exodus and its impact

Analysis of data from Santiment highlighted that the number of Bitcoin wallets holding a balance has steadily declined.

The decline marked the lowest level since the 10th of December. As of this writing, it was around 54.7 million.

Source: Santiment

Historically, such trends suggest that smaller investors are liquidating their holdings, possibly due to recent volatility.

Fear-driven selling often coincides with market bottoms, raising speculation about an impending price reversal.

Whale accumulation on the rise?

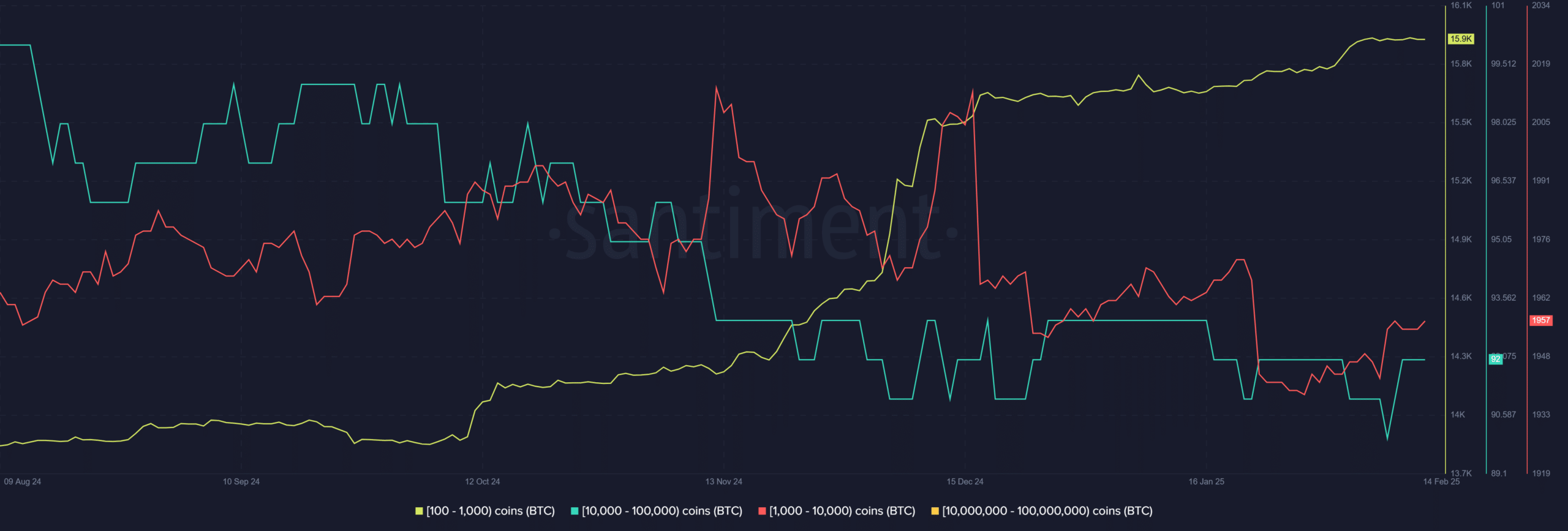

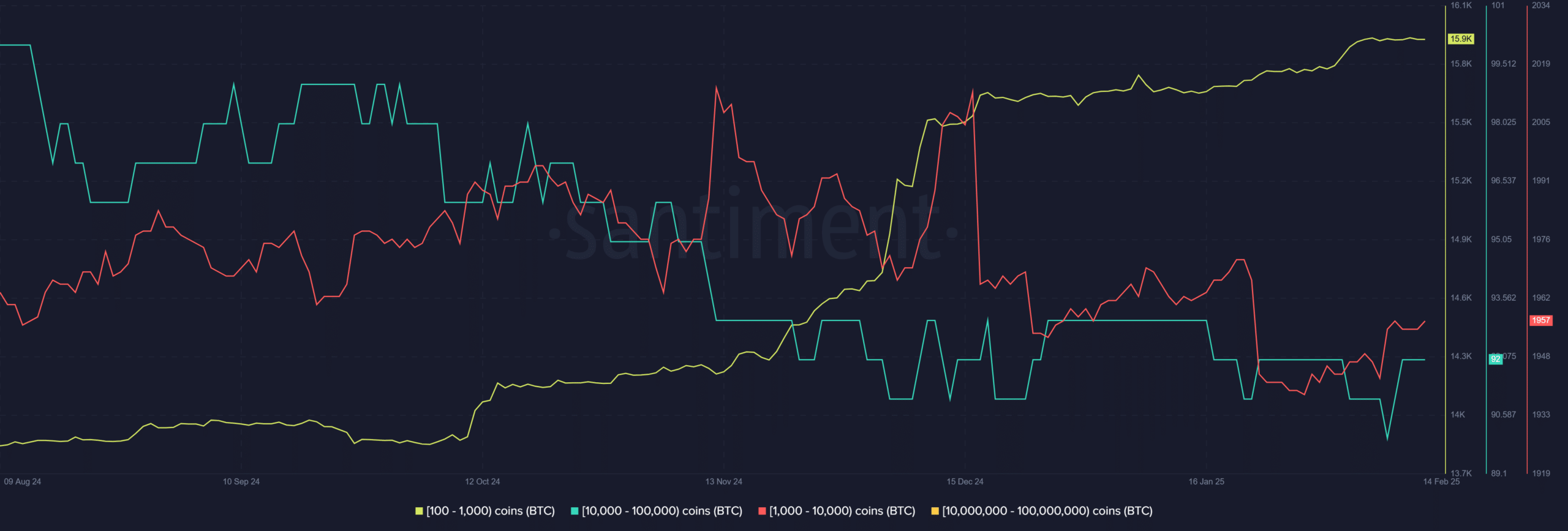

On-chain data from Santiment also showed that while smaller wallet counts are dropping, large Bitcoin holders—whales—are maintaining or even increasing their positions.

Specifically, addresses holding between 10,000 and 100,000 BTC have remained relatively stable, while those with 100-1,000 BTC have shown a slight increase.

Source: Santiment

This divergence suggests that institutional investors or high-net-worth individuals may take advantage of the dip to accumulate BTC at lower prices.

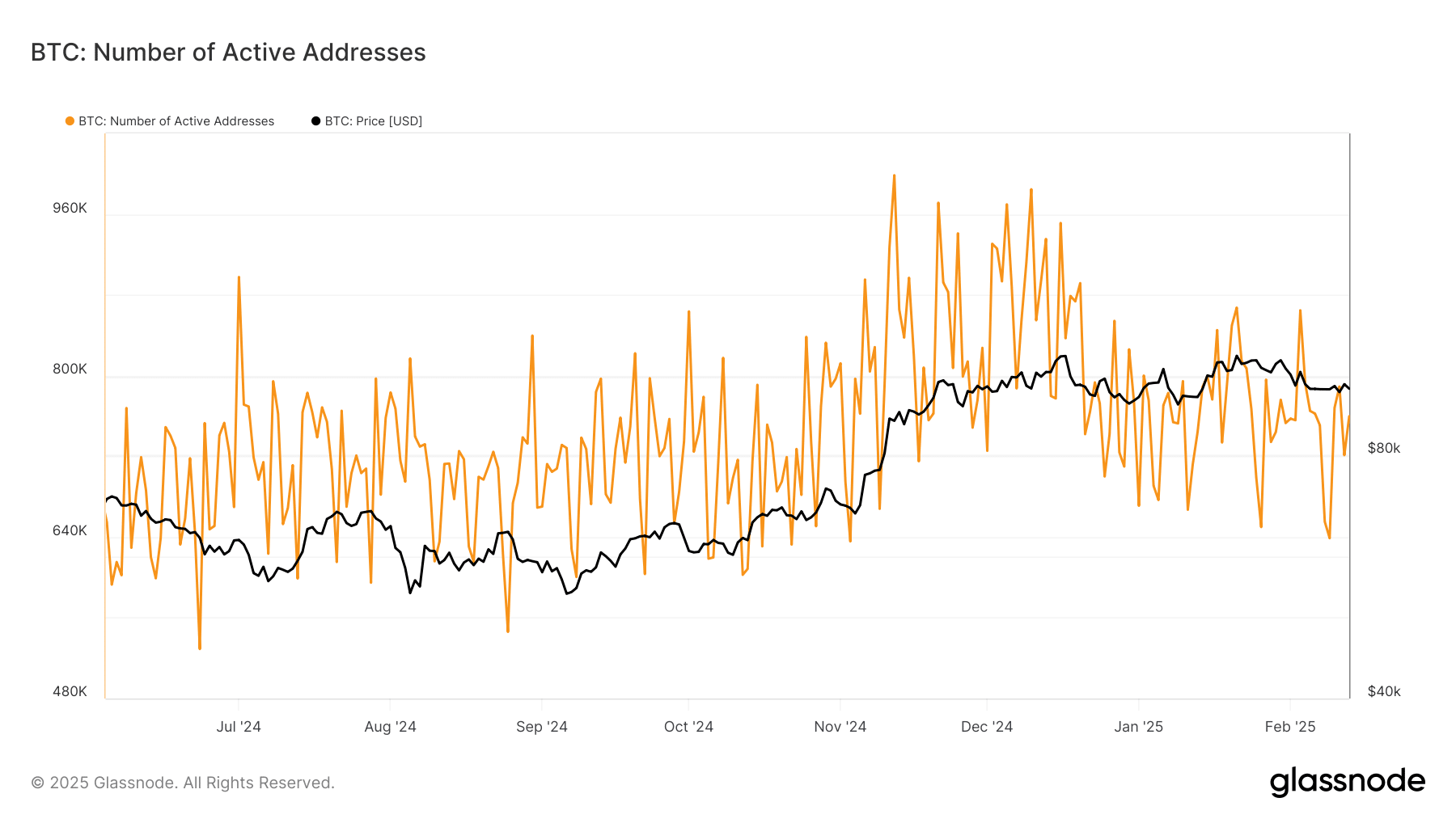

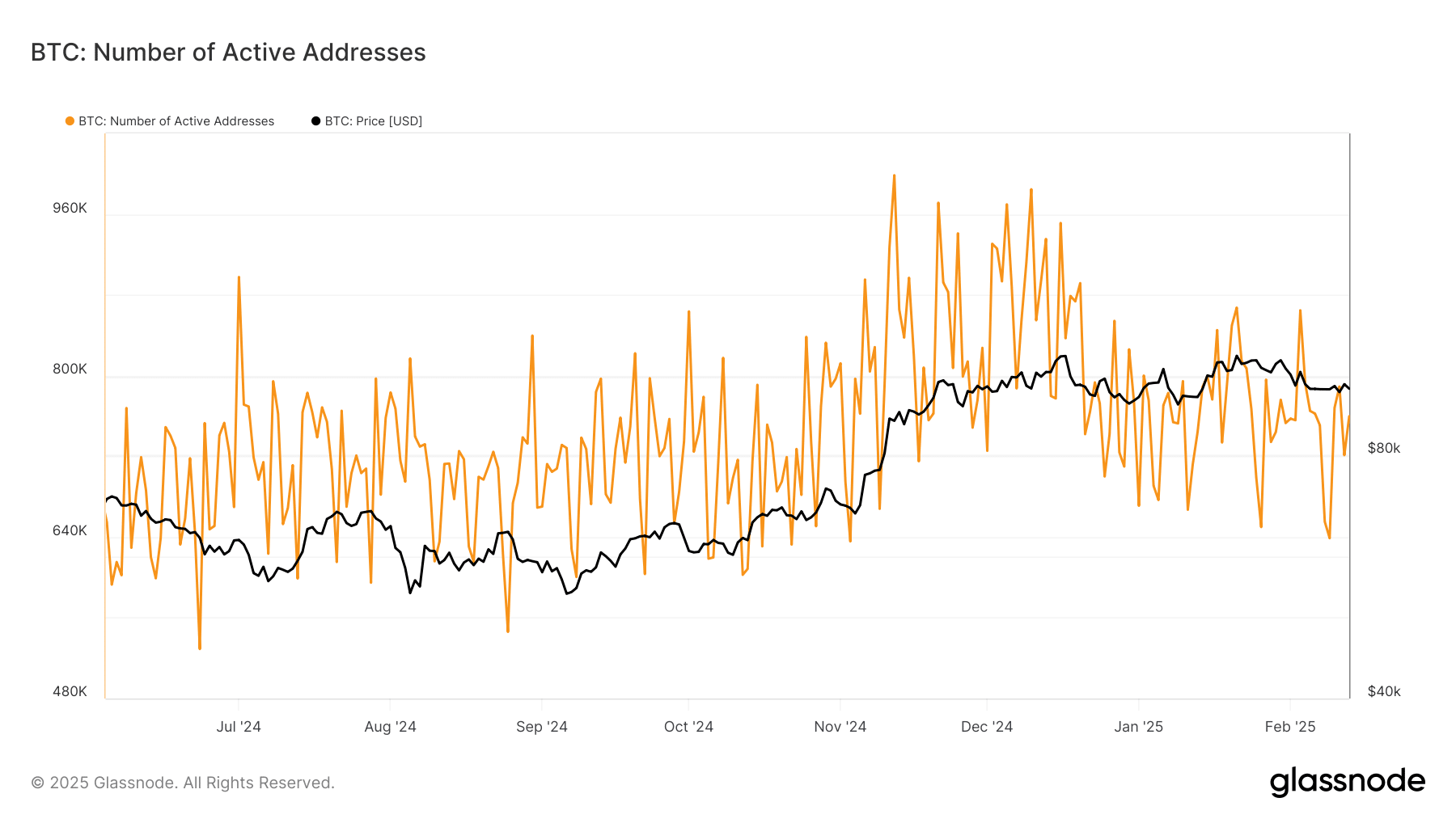

Network activity and market sentiment

Glassnode’s data analysis revealed that Bitcoin’s number of active addresses has also remained subdued. The subdued nature of the metric reflects lower participation from retail traders.

Source: Glassnode

This aligns with the trend of wallet depletion and reduced market enthusiasm among smaller investors.

However, similar patterns have historically preceded significant recoveries, especially when institutional accumulation picks up.

What’s next for Bitcoin?

If whales continue to accumulate and retail-driven selling slows down, Bitcoin could find a strong support base and set the stage for a rebound.

Traders should monitor signs of increasing whale holdings, stabilization in active wallets, and any resurgence in on-chain activity as key indicators of a potential trend reversal.

While short-term sentiment remains cautious, larger market players might be quietly positioning themselves for the next leg up.